13.11.2017, 5466 Zeichen

- NBR keeps monetary policy rate unchanged at 1.75 % but narrows the interest rate corridor

- September inflation is driven by volatile food prices, the monetary policy relevant core inflation increased only moderately.

- Strong economic growth and tight labor market conditions will require the NBR to act soon.

The National Bank of Romania (NBR) has kept its monetary policy rate unchanged at 1.75 %. By narrowing the corridor around the monetary policy rate from +/- 1.25 to +/- 1 %-points the NBR continued its gradual monetary policy normalization. The deposit facility rate was raised to 0.75 % while the lending facility rate was lowered to 2.75 %. The NBR’s interest rate corridor bounds overnight interbank rates, which are highly correlated with longer maturity interbank rates. The 3 months ROBOR, as the main reference interbank rate, increased by more than 80 basis points since mid-September, currently trading above 1.6 % (Figure 1).

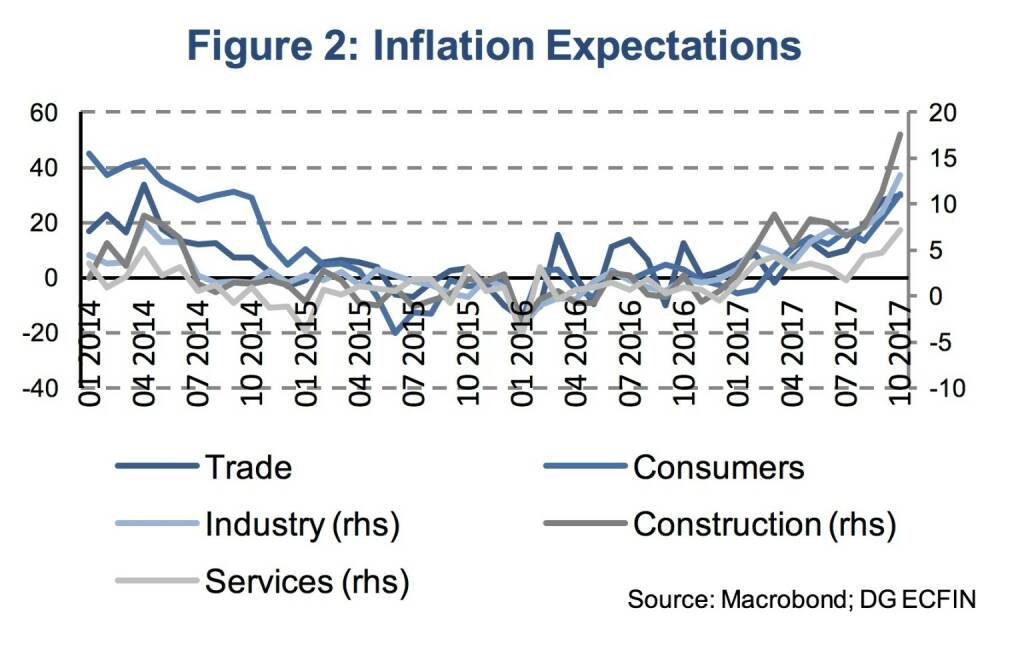

Since August 2005 the NBR is following an inflation targeting framework. Analyzing inflation and inflation expectations is, therefore, crucial to understand the NBR’s medium-term rate outlook. Inflation is still below the NBR’s target of 2.5 % but within its target band of +/- 1 %-point. Inflation based on the national CPI reached 1.77 % in September after 1.15 % in August. Based on the harmonized consumer price index (HICP, Eurostat), inflation is still below the NBR’s lower threshold, nevertheless, showing the same dynamic with a substantial increase from 0.62 % in August to 1.36 % in September. The rise in inflation was not driven by the monetary policy relevant core inflation, which is most reflective of the underlying macroeconomic development, but by a 3.6 % (y/y) rise in unprocessed food prices, which contributed 0.6 %-points to HICP headline inflation. HICP core inflation (HICP excluding unprocessed food and energy) accelerated moderately from 0.8 % in August to 1.0 % in September. The NBR’s monetary policy relevant core inflation measure, labelled CORE2, (CPI excluding administered prices, volatile prices, tobacco products and alcoholic beverages) shows a similar dynamic with an increase of 0.2 %-points reaching 1.8 % in September. Based on the latest NBR’s macroeconomic forecasts from November, inflation is projected to reach the NBR’s target as early as Q4 2017 (2.7 %) and increases further to 3.2 % by the end of 2018 and 3.1 % in Q3 2019. Accelerating inflation is also well in line with survey based inflation expectations which increased markedly in the last two months (Figure 2).

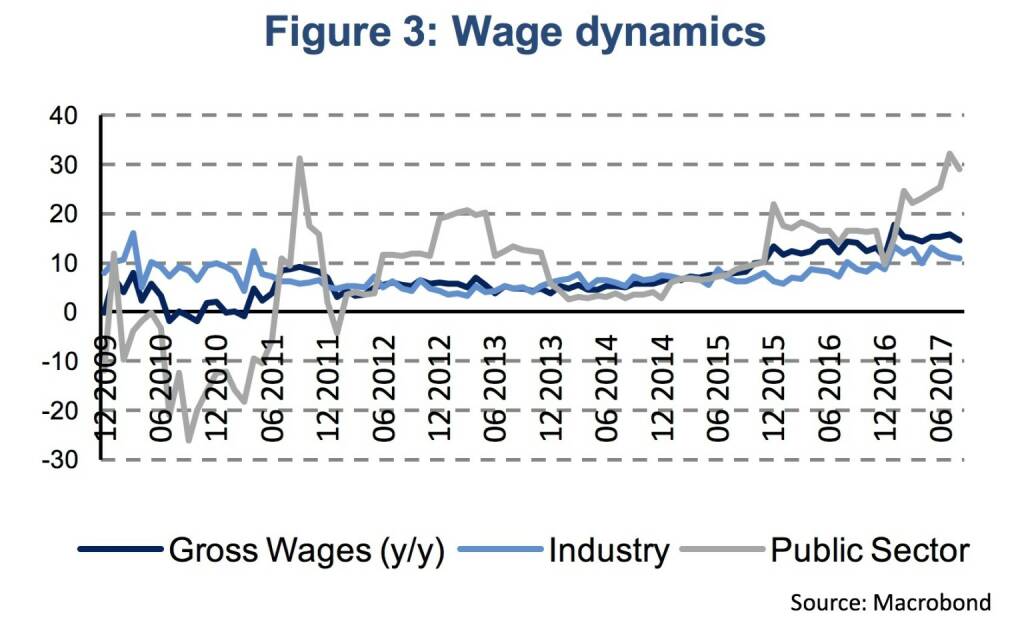

The Romanian economy is booming with real GDP growth at 5.9 % (y/y) in Q2 2017 and a low unemployment rate of 5 % in September. Evidence of a tightening labor market is further given by strong growth in gross wages of above 15 % (y/y, average January-September), even though wage growth in the public sector is stronger than in industry (Figure 3). This scenario poses inflationary pressure, mainly on core inflation, which is further supported by a positive output gap. Decomposing quarterly GDP into a trend and cyclical component by applying the Hodrick-Prescott filter results in a positive output gap of 2.1 % for the first two quarters of 2017. The NBR comes to an output gap estimate of 2.4 % (November Inflation Report). Moreover, they expect the output gap to grow further reaching 3.6 % in Q1 2018 and 3.8 % in Q1 2019. Based on coefficient estimates from a hybrid New-Keynesian Phillips Curve (NKPC) the NBR’s output gap projection would result in an additional increase in core inflation at constant taxes at 0.9 % (y/y) until Q1 2019. The uncertainty from the recent weakening of the relationship between the domestic output gap and core inflation (flattening of the NKPC) results in a range of the effect between 0.5 and 1.0 % (y/y) if the lowest and highest coefficient estimates are used. The NBR’s CORE2 inflation excluding the direct effects of VAT was 2.0 % (y/y) in September and 1.5 % (y/y) in Q2 2017. Hence, given the expanding output gap and the dynamics in core inflation further action by the NBR will be needed to achieve its inflation target over the medium term.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Disclaimer

This publication is neither a marketing document nor a financial analysis. It merely contains information on general economic data. Despite thorough research and the use of reliable data sources, we cannot be held responsible for the completeness, correctness, currentness or accuracy of the data provided in this publication.

Our analyses are based on public Information, which we consider to be reliable. However, we cannot provide a guarantee that the information is complete or accurate. We reserve the right to change our stated opinion at any time and without prior notice. The provided information in the present publication is not to be understood or used as a recommendation to purchase or sell a financial instrument or alternatively as an invitation to propose an offer. This publication should only be used for information purposes. It cannot replace a bespoke advisory service to an investor based on his / her individual circumstances such as risk appetite, knowledge and experience with financial instruments, investment targets and financial status. The present publication contains short-term market forecasts. Past performance is not a reliable indication for future performance.

SportWoche Podcast #105: Lisa Reichkendler, mit ihrem Food Marketing und Peast Performance ev. zu einem Sportgeschichte-Riegel

Bildnachweis

1.

NBR and interbank rates

2.

Inflation Expectations

3.

Wage dynamics

4.

Interest Rates

Aktien auf dem Radar:Palfinger, Amag, SBO, Flughafen Wien, AT&S, Frequentis, EVN, EuroTeleSites AG, CA Immo, Erste Group, Mayr-Melnhof, S Immo, Uniqa, Bawag, Pierer Mobility, ams-Osram, Addiko Bank, Wiener Privatbank, SW Umwelttechnik, Oberbank AG Stamm, Kapsch TrafficCom, Agrana, Immofinanz, OMV, Österreichische Post, Strabag, Telekom Austria, VIG, Wienerberger, Warimpex, American Express.

Random Partner

Do&Co

Als Österreichisches, börsennotiertes Unternehmen mit den drei Geschäftsbereichen Airline Catering, internationales Event Catering und Restaurants, Lounges & Hotel bieten wir Gourmet Entertainment auf der ganzen Welt. Wir betreiben 32 Locations in 12 Ländern auf 3 Kontinenten, um die höchsten Standards im Produkt- sowie Service-Bereich umsetzen zu können.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» SportWoche Podcast #105: Lisa Reichkendler, mit ihrem Food Marketing und...

» Börse-Inputs auf Spotify zu u.a. Beiersdorf, adidas, Netflix, Sartorius,...

» BSN Spitout Wiener Börse: Erste Group übernimmt year-to-date-Führung von...

» Österreich-Depots: Weekend-Bilanz (Depot Kommentar)

» Börsegeschichte 19.4.: Rosenbauer (Börse Geschichte) (BörseGeschichte)

» Aktienkäufe bei Porr und UBM, News von VIG-Tochter, Research zu Verbund,...

» Nachlese: Warum CA Immo, Immofinanz und RBI positiv bzw. voestalpine neg...

» Wiener Börse Party #633: Heute April Verfall, Ex-Marinomed-Investor in ...

» Wiener Börse zu Mittag schwächer: Frequentis, Immofinanz, Palfinger gesu...

» Börsenradio Live-Blick 19/4: DAX eröffnet zum April-Verfall deutlich sch...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2VYD6 | |

| AT0000A34CV6 | |

| AT0000A2QS86 |

- SportWoche Podcast #105: Lisa Reichkendler, mit i...

- Neue Bilder: Lisa Reichkendler Peast Performance ...

- wikifolio Champion per ..: Richard Dobetsberger m...

- ATX charttechnisch: Mittelfristiger Aufwärtstrend...

- Fazits zu Agrana, RBI, FACC, A1 Telekom Austria

- Börse-Inputs auf Spotify zu u.a. Beiersdorf, adid...

Featured Partner Video

Wiener Börse Party #617: Auflösung Addiko Bank Rätsel, AT&S KI, Karl-Heinz Strauss / Signa vs. AvW, Petrikovics, Meinl

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse....

Books josefchladek.com

Flughafen Berlin-Tegel

2023

Drittel Books

Limbo

2023

ediciones anómalas

erotiCANA

2023

in)(between gallery

Driftwood 15 | New York

2023

Self published

Dominic Turner

Dominic Turner Sebastián Bruno

Sebastián Bruno Ros Boisier

Ros Boisier Stefania Rössl & Massimo Sordi (eds.)

Stefania Rössl & Massimo Sordi (eds.) Adrianna Ault

Adrianna Ault