26.11.2017, 6322 Zeichen

- Solid Q3 growth in Germany and around the Euro Area

German economic growth continued at a high rate in Q3 2017. The Federal Statistical Office (Destatis) reported last week that real quarterly GDP rose by 0.8 % (after 0.9 % in Q2). Positive contributions came from foreign trade, as the increase in exports was higher than that of imports, and from fixed investment. Especially, investment in machinery and equipment increased on the previous year, according to the Destatis release (GDP details are not yet available). In annual terms, GDP rose by 2.8 % and – assuming a rise of 0.6 % q/q in Q4 – it will have expanded by around 2.5 % (swda) over the total of 2017. Germany’s growth acceleration is in line with solid pan-Eurozone results (Figure 1).

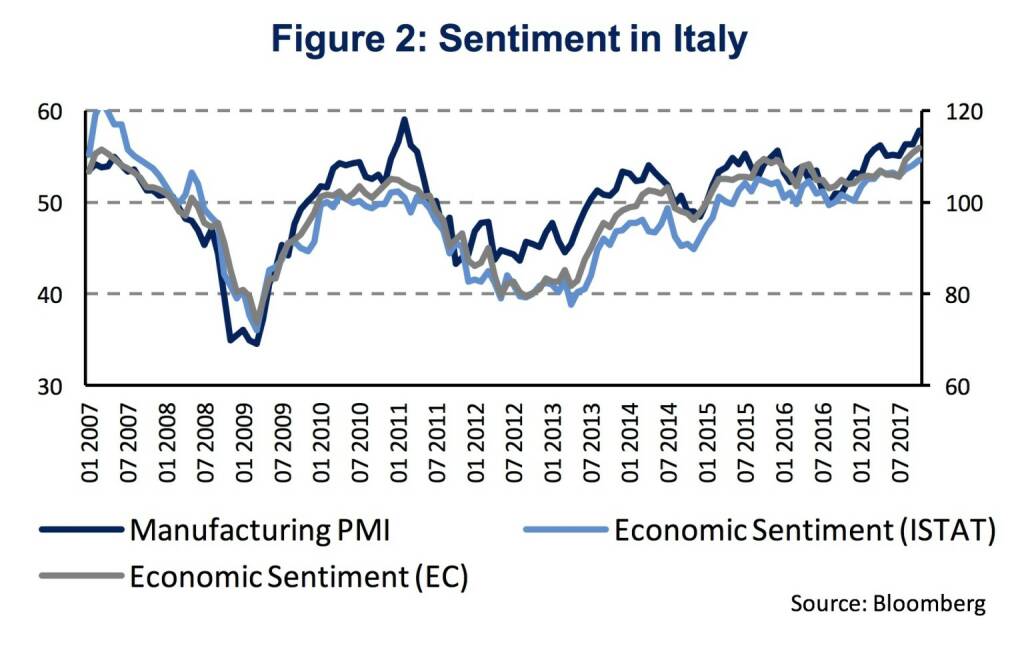

In Italy, GDP growth accelerated to 0.5 % quarterly and 1.8 % annually in Q3 (from 0.3 % and 1.5 % previously). Clearly, Italy has been one of the growth laggards across the Euro Area and has now reached the highest annual expansion since Q1 2011. In spite of upcoming elections in the first half of next year and the usual uncertainty around Italian politics, economic sentiment has reached a multi-year high (Figure 2).

Eurostat confirmed Q3 GDP growth at 0.6 % (q/q) and 2.5 % (y/y) for the total of the Eurozone. Our GDP tracking estimate (as of 3rd November), that is based on a dynamic factor model, signals a 0.6 % quarterly GDP increase for the final quarter, thereby taking annual 2017 growth to 2.3 % (after 1.8 % in 2016). The model is updated on a bi-monthly basis (Figure 3).

CEE

- Economic growth in the CEE region further accelerates.

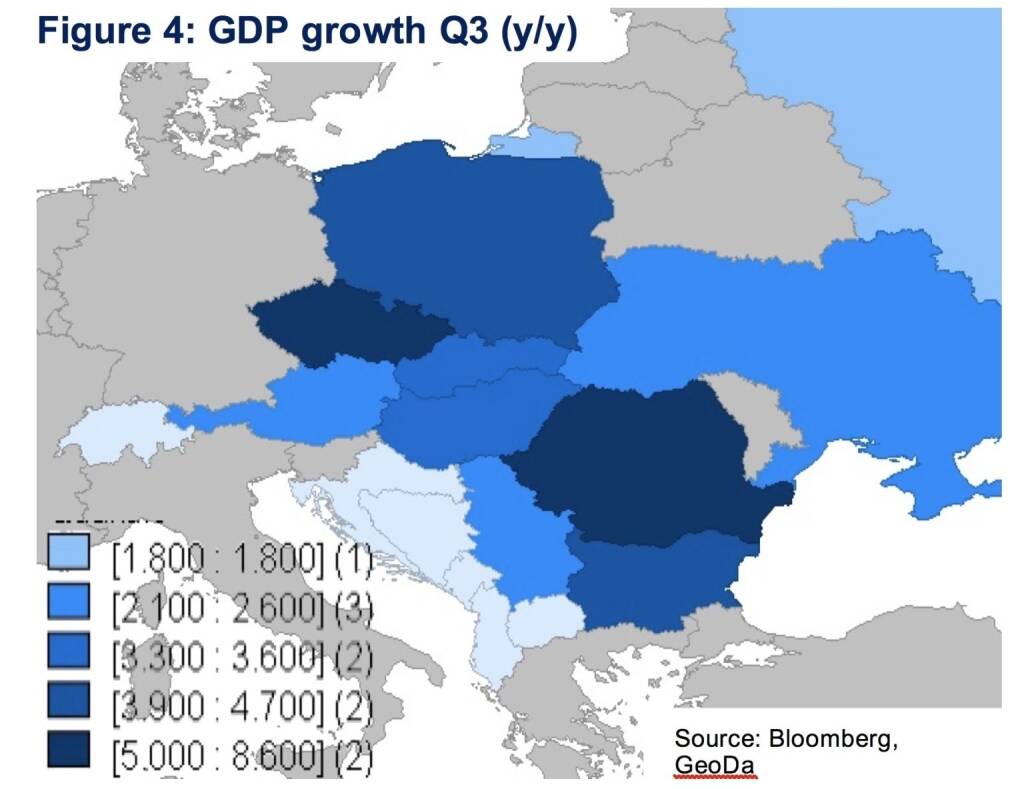

- Romania stands out with 8.6 % (y/y) GDP growth in Q3 followed by the Czech Republic and Poland.

- The medium-term growth pattern suggests growth to be driven by domestic demand.

Strong growth in the CEE region continues! GDP figures for Q3 2017, which have been released early last week, show average economic growth of 3.8 % across the region. Economic growth ranges between 8.6 % (y/y, sa) in Romania to 1.8 % (y/y, nsa) in Russia. Besides, exceptionally high growth in Romania, GDP growth also accelerated in the Czech Republic (5.0 %, y/y, sa) and Poland (4.7 %, y/y, nsa) as figure 4 shows. With 2.5 % (y/y, sa) growth in the Euro Area, the CEE region continues its catch-up.

It is too early to tell with certainty which factors drove GDP in Q3. However, the preceding quarters point towards prolonged support from domestic demand, particularly from household consumption. During the first two quarters of the year household consumption contributed substantially to GDP growth in Romania (4.6 %), Poland (3.9 %) and Bulgaria (2.7 %, y/y contribution). Its impact on GDP growth was slightly lower in Hungary (2 %), Slovakia (1.8 %) and the Czech Republic (1.7 %), nevertheless, being of economic significance. In Austria, which is among the fastest growing Euro Area economies, household consumption contributed by 0.7 %-points to GDP growth (Figure 5).

Investment (gross fixed capital formation) shows a much more diversified picture. Hungary had a strong rebound in investment growth at an average of 21 % during the first two quarters of 2017 contributing 3.9 %-points to economic growth. The only other CEE economy with a substantial growth contribution from investment is the Czech Republic where investment picked up during the second quarter reaching 7.9 % (y/y). As investment growth was negative during 2016 in all the economies which are shown in figure 5, a rebound in investment is an additional potential source of growth acceleration during the third quarter.

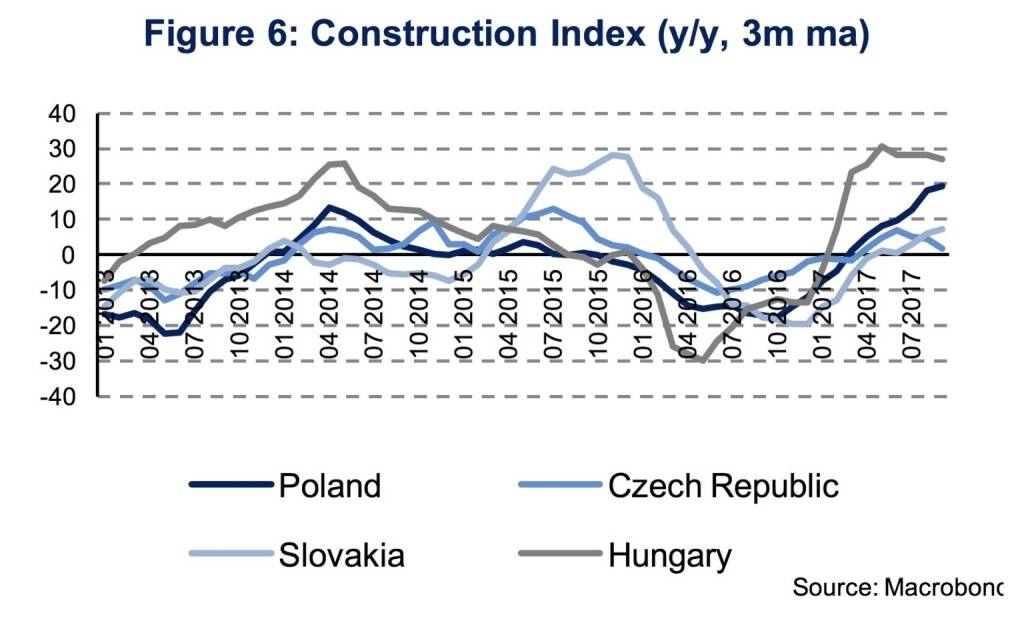

For Romania, which was the biggest surprise with GDP growth of 8.6 % (y/y, sa) in Q3, high frequency indicators support domestic demand as a driver. Retail sales expanded by 11.8 % (y/y) in Q3 after 7.3 % in Q1 and Q2. This is accompanied by extensive nominal wage growth of 14.8 % (y/y) during the third quarter. The average inflation rate between July and September was 1.4 %. Thus, wage growth implies a considerable improvement of the purchasing power of Romanian households. Retail sales were high in Q3, though more in line with the first half of the year, in Poland (7.8 %), Slovakia (6.2 %), Hungary (5.0 %), the Czech Republic (3.3 %) and Bulgaria (2.6 %). Other high frequency indicators, show evidence for increased investment activity. Construction activity accelerated in Poland with y/y growth of 19.3 % in Q3 after 9.7 % in Q2 and 1.3 % in Q1 (Figure 6). Moreover, investment in construction picked up in Slovakia at 7.1 % in Q3 after 0.4 % in Q2 and -5.8 % in Q1. Construction activity sustained its high growth rate in Hungary (Q3: 27.1 %). Interestingly, in Romania construction declined at 8 %, indicating the importance of consumption as a driver of growth.

Economic growth in the CEE region is mainly driven by domestic factors. However, the acceleration of economic growth in the Euro Area should support growth in the region over the medium-term. We should, therefore, see a continuation of convergence of the region.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Disclaimer

This publication is neither a marketing document nor a financial analysis. It merely contains information on general economic data. Despite thorough research and the use of reliable data sources, we cannot be held responsible for the completeness, correctness, currentness or accuracy of the data provided in this publication.

Our analyses are based on public Information, which we consider to be reliable. However, we cannot provide a guarantee that the information is complete or accurate. We reserve the right to change our stated opinion at any time and without prior notice. The provided information in the present publication is not to be understood or used as a recommendation to purchase or sell a financial instrument or alternatively as an invitation to propose an offer. This publication should only be used for information purposes. It cannot replace a bespoke advisory service to an investor based on his / her individual circumstances such as risk appetite, knowledge and experience with financial instruments, investment targets and financial status. The present publication contains short-term market forecasts. Past performance is not a reliable indication for future performance.

Wiener Börse Party #632: Warum CA Immo, Immofinanz und RBI positiv bzw. voestalpine negativ auffallen, morgen April-Verfall

Bildnachweis

1.

GDP Growth

2.

Sentiment in Italy

3.

UCM GDP Tracker; Euro Area

4.

GDP Growth Q3

5.

Drivers of GDP growth

6.

Construction Index

7.

Index Rates

Aktien auf dem Radar:Rosenbauer, SBO, Palfinger, Addiko Bank, Austriacard Holdings AG, Flughafen Wien, EVN, Immofinanz, AT&S, ams-Osram, Marinomed Biotech, Porr, Warimpex, SW Umwelttechnik, Oberbank AG Stamm, Pierer Mobility, Agrana, Amag, CA Immo, Erste Group, Kapsch TrafficCom, Österreichische Post, Strabag, Telekom Austria, Uniqa, VIG, Wienerberger, Continental, adidas, Travelers Companies, Fresenius.

Random Partner

Uniqa

Die Uniqa Group ist eine führende Versicherungsgruppe, die in Österreich und Zentral- und Osteuropa tätig ist. Die Gruppe ist mit ihren mehr als 20.000 Mitarbeitern und rund 40 Gesellschaften in 18 Ländern vor Ort und hat mehr als 10 Millionen Kunden.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Österreich-Depots unveändert (Depot Kommentar)

» Börsegeschichte 18.4.: Mayr-Melnhof (Börse Geschichte) (BörseGeschichte)

» SportWoche Party 2024 in the Making, 18. April (ein Freund, ein guter Fr...

» Reingehört bei A1 Telekom Austria (boersen radio.at)

» News von Verbund und VIG, Research zu Palfinger, A1 Telekom Austria, Ers...

» Nachlese: Matejka Poetry Slam, B&C, 10% auf Wienerberger (Christian Dras...

» Wiener Börse Party #631: XXS-Folge mit einer Facette, in der CA Immo, Im...

» Wiener Börse zu Mittag stärker: Strabag, Bawag, Verbund gesucht, DAX-Bli...

» Börsenradio Live-Blick 18/4: DAX okay, Sartorius-Crash, Munich Re mahnt ...

» Zertifikat des Tages #8: Was Zweistelliges zu Wienerberger im Investment...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A39UT1 | |

| AT0000A2C5J0 | |

| AT0000A2SUY6 |

- Österreich-Depots unveändert (Depot Kommentar)

- Börsegeschichte 18.4.: Mayr-Melnhof (Börse Geschi...

- Dow Jones-Mover: Johnson & Johnson, Travelers Com...

- Österreichische Post: Dividende wird am 2. Mai ge...

- #gabb Jobradar: Telekom Austria, Erste Group, CA ...

- Unser Volumensrobot sagt: Palfinger, Immofinanz, ...

Featured Partner Video

Wiener Börse Party #623: RBI zahlt und trifft sich in Tirol, CA Immo-Info über interessanten Aktionär bzw.Team Bulle vs. Team Bär

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse....

Books josefchladek.com

On the Verge

2023

Void

Spurensuche 2023

2023

Self published

I’ll Bet the Devil My Head

2023

Void

Ta-ra

2023

ediciones anómalas

Berlin. Symphonie einer Weltstadt

1959

Ernst Staneck Verlag

Stefania Rössl & Massimo Sordi (eds.)

Stefania Rössl & Massimo Sordi (eds.) Adrianna Ault

Adrianna Ault Andreas H. Bitesnich

Andreas H. Bitesnich Christian Reister

Christian Reister Ros Boisier

Ros Boisier