07.12.2017, 5181 Zeichen

The Rise of Debt in China

- Stylized facts document the astonishing rise of corporate debt in China.

- The Great Recession stopped the rise of private debt in advanced economies, while governments bear a larger part of the debt burden.

Since 2002, the total world debt as a percentage of global output increased by 44.6 %-age points according to the Bank for International Settlements (BIS). In 2017, the total private and public debt as a percentage of world GDP was 238.4 %.

The Great Recession did not stop the trend: In 2017, total global debt to GDP was again 33.8 %-age points above the level immediately after the crisis in 2008. The surge in debt was more pronounced in the emerging world (EM) than in the advanced economies (DM). Emerging markets debt rose by 50.1 %-age points since 2010, while debt in the industrialized countries rose by mere 9.1 % in the same period (Figure 1). As part of the rise took place in 2009, the development of total debt to GDP in advanced economies has been fairly stable since then.

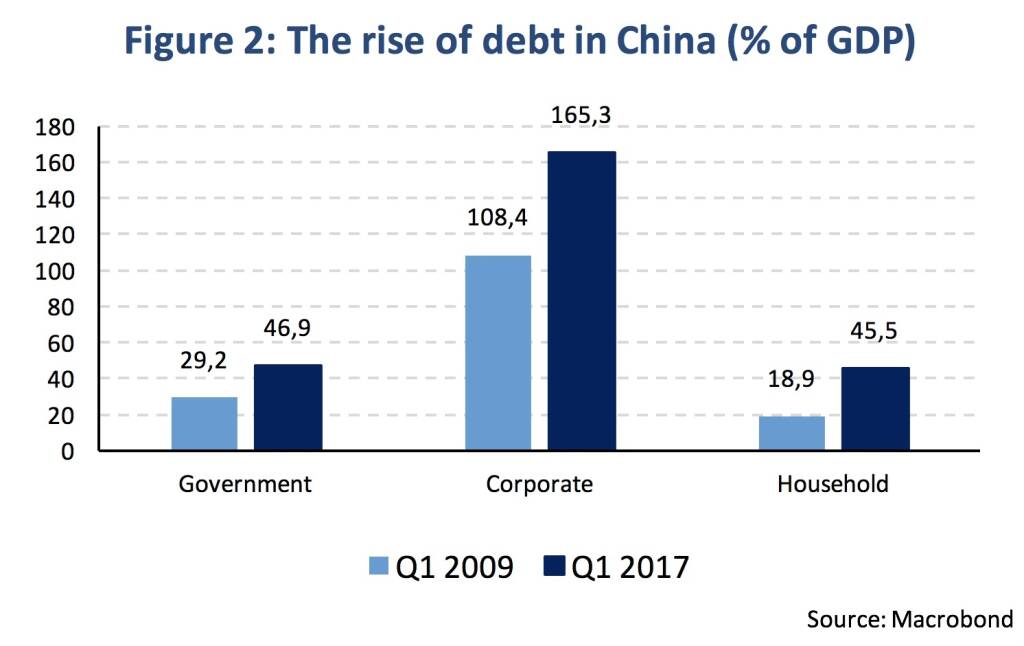

The astonishing rise of debt among emerging countries has been driven by China’s evolution. Since 2009, total debt increased by more than 100 %-age points from 156.6 % to 257.8 %. Hence, China’s economy is about to reach the debt stock of advanced economies (267.9 %). The debt rise is uniform across the private and public sector. The largest increase since 2009 took place for non-financial corporates for which debt/GDP rose by 56.9 %-age points to 165.3 % in 2017 (Figure 2). It is one of the largest corporate indebtedness’s among emerging and even advanced economies (in the BIS database that covers 43 countries). In the group of EM countries (besides China), only Chile (100.5 %) surpasses the 100 %-level for corporate debt to GDP and in the group of DM, only Belgium (157.8 %), Ireland (226.5 %), Hong Kong (242.7 %) and Luxembourg (345.3 %) outstrip China’s corporate debt burden. On the other side, China’s government and household debt rose (less) by 17.7 % and 26.6 % since 2009 (to levels of 46.9 % and 45.5 % of GDP).

While the development of total debt was quite stable since the aftermath of the Great Recession in advanced economies, the sectoral composition of debt shares has changed (remaining more stable in emerging economies). The share of government debt (of total debt) rose from around 30 % in the beginning of 2008 to 40 % in 2017 (Figure 3), while non-financial corporate and household debt shares both decreased by around 5 %. The shift occurred attributable to fiscal expansion and public banking sector bailout in the wake of the Great Recession (2008/09) and the Euro crisis (2011/12).

Accordingly, private debt service ratios (DSRs) in the advanced economies have eased since 2009. The metric gives a better indication of financial stress in the private sector as it relates to the share of income used to service debt. Since 2009, the ratios declined in the non-core Euro Area countries Spain (-9.0 to 14.7), Italy (-2.4 to 11) and Portugal (-5.4 to 16.7). DSRs also improved in Central and Eastern European countries including Hungary (-11.4 to 8), Poland (-0.8 to 7.6) and the Czech Republic (-0.2 to 7.3) reflecting the private deleveraging since the crisis, that initially had left region heavily overindebted.

On the other side, in China the DSR reached a level usually observed in advanced economies (rising by 7.0 to 20.1). Wealthier nations have higher debt as shown in the scatter plots below. China’s GDP per capita (in US dollar based on purchasing power parities from the IMF) is 16.624 USD in 2017 and remains below the average (23.899 USD) of emerging countries in the sub-sample. However, total debt to GDP in China has reached the average level (287 % of GDP) of the Western nations. If the next financial crisis happens to be a debt crisis, there exists some chance that China will be patient zero.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Disclaimer

This publication is neither a marketing document nor a financial analysis. It merely contains information on general economic data. Despite thorough research and the use of reliable data sources, we cannot be held responsible for the completeness, correctness, currentness or accuracy of the data provided in this publication.

Our analyses are based on public Information, which we consider to be reliable. However, we cannot provide a guarantee that the information is complete or accurate. We reserve the right to change our stated opinion at any time and without prior notice. The provided information in the present publication is not to be understood or used as a recommendation to purchase or sell a financial instrument or alternatively as an invitation to propose an offer. This publication should only be used for information purposes. It cannot replace a bespoke advisory service to an investor based on his / her individual circumstances such as risk appetite, knowledge and experience with financial instruments, investment targets and financial status. The present publication contains short-term market forecasts. Past performance is not a reliable indication for future performance.

Wiener Börse Party #632: Warum CA Immo, Immofinanz und RBI positiv bzw. voestalpine negativ auffallen, morgen April-Verfall

Bildnachweis

1.

World debt

2.

Rise of debt in China

3.

Sectoral share of total debt to GDP

4.

Debt and GDP per capita

5.

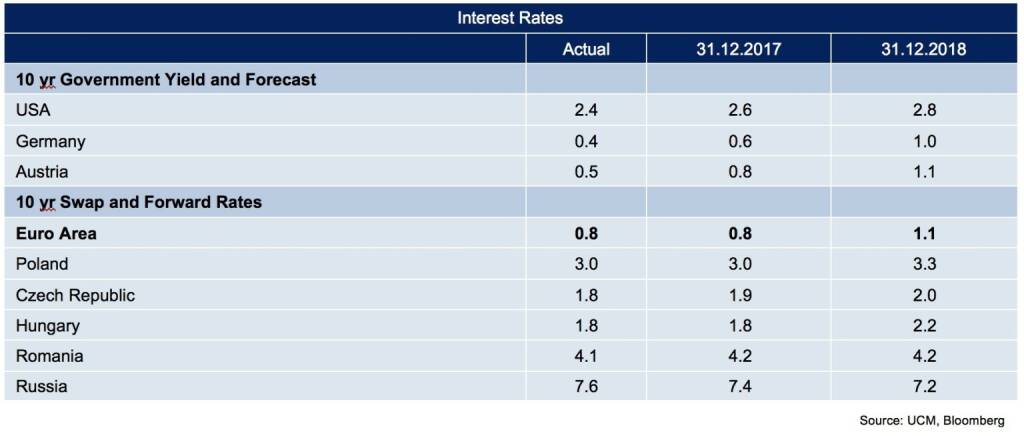

Interest Rates

Aktien auf dem Radar:Amag, Palfinger, SBO, Addiko Bank, Flughafen Wien, Austriacard Holdings AG, EVN, EuroTeleSites AG, Pierer Mobility, Semperit, Bawag, Kostad, Wolford, Oberbank AG Stamm, Polytec Group, ams-Osram, Agrana, CA Immo, Erste Group, Immofinanz, Kapsch TrafficCom, Mayr-Melnhof, OMV, Österreichische Post, Strabag, Telekom Austria, Uniqa, VIG, Wienerberger.

Random Partner

Kostad Steuerungsbau

Kostad ist ein österreichisches Familienunternehmen, das sich auf maßgeschneiderte Elektromobilitätslösungen spezialisiert hat. Das Unternehmen bietet Produkte und Dienstleistungen rund um die Elektromobilität in den Bereichen Schaltschrankbau, Automatisierungstechnik, Kabelkonfektionierung, Elektroprojektierung und Software an. Kostad hat in mehreren Ländern der Welt Schnell-Ladestationen für Elektrofahrzeuge errichtet.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» BSN Spitout Wiener Börse: Wienerberger zurück in den Top5 year-to-date

» SportWoche Party 2024 in the Making, 14. April (2nd Screens)

» SportWoche Party 2024 in the Making, 15. April (SportWoche-Riegel)

» Österreich-Depots unveändert (Depot Kommentar)

» Börsegeschichte 18.4.: Mayr-Melnhof (Börse Geschichte) (BörseGeschichte)

» SportWoche Party 2024 in the Making, 18. April (ein Freund, ein guter Fr...

» Reingehört bei A1 Telekom Austria (boersen radio.at)

» News von Verbund und VIG, Research zu Palfinger, A1 Telekom Austria, Ers...

» Nachlese: Matejka Poetry Slam, B&C, 10% auf Wienerberger (Christian Dras...

» Wiener Börse Party #631: XXS-Folge mit einer Facette, in der CA Immo, Im...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2SUY6 | |

| AT0000A2U2W8 | |

| AT0000A2C5J0 |

- BSN Spitout Wiener Börse: Wienerberger zurück in ...

- Wiener Börse: ATX am Donnerstag fester, Bawag mit...

- Wiener Börse Nebenwerte-Blick: Kostad mit Kursver...

- Wie Kostad, Wolford, ams-Osram, BTV AG, Addiko Ba...

- Wie Bawag, Lenzing, EVN, SBO, Immofinanz und OMV ...

- Österreich-Depots unveändert (Depot Kommentar)

Featured Partner Video

Börsenradio Live-Blick, Do. 18.4.24: DAX okay, Sartorius-Crash, Munich Re mahnt Turnaround ein; VIG, Immofinanz, Porr stark

Christian Drastil mit dem Live-Blick aus dem Studio des Börsenradio-Partners audio-cd.at in Wien wieder intraday mit Kurslisten, Statistiken und News aus Frankfurt und Wien. Es ist der Podcast, der...

Books josefchladek.com

India

2019

teNeues Verlag GmbH

Liebe in Saint Germain des Pres

1956

Rowohlt

A Way of Seeing

1965

The Viking Press

Inside

2024

Muga / Ediciones Posibles

La Scène de la Locomotive à Vapeur

1975

Yomiuri Shimbun

Christian Reister

Christian Reister Igor Chekachkov

Igor Chekachkov Kristina Syrchikova

Kristina Syrchikova Horst Pannwitz

Horst Pannwitz