14.05.2018, 7439 Zeichen

- In Romania the National Bank has continued its rate hiking cycle to bring accelerated inflation under control.

- In the Czech Republic a koruna appreciation weighs on inflation which motivated the Czech National Bank to put its rate hiking cycle on pause.

- Q1 Growth accelerated in Serbia. While inflation lingers around historic lows, the central bank left the key policy rate unchanged at an all-time low.

Romania

The cyclical upswing has been very strong in Romania with economic growth at 6.8 % in 2017. GDP growth was primarily driven by domestic demand and particularly household consumption expenditure which has expanded by 9.9 % in 2017. The unemployment rate has decreased to its lowest level in March (4.5 %, sa, Eurostat) while the unmet labor demand has not yet accelerated further, as indicated by a constant job vacancy rate at 1 %. The labor market has, nevertheless, tightened and net wages have increased by 11.6 % (y/y) in Q1 2018 after 14.2 % in 2017. Rising wages are only partly offset by rising productivity resulting in double digit unit labor cost growth of 11.5 % in 2017. Hence, it should not come as a surprise that inflationary pressures are emerging rapidly in Romania.

Consumer price inflation has reached 5.0 % in March, after 1.3 % in 2017. Looking at HICP inflation the acceleration is less rapid (4.0 %, March) but still well above the National Bank of Romania’s inflation target at 2.5 % with a tolerance band of +/- 1 %-age points. It should also be noted that inflation was severely dampened by tax effects until the end of 2017. Looking at HICP at constant taxes it is evident that inflation was close to 2 % both in 2016 and 2017 (Figure 1).

In this environment, the National Bank of Romania (NBR) has already increased interest rates three times this year. In its last meeting on the 7th of May, the monetary policy rate was increased to 2.5 % from previously 2.25 %. The NBR’s Inflation Report from May expects inflation to remain elevated and return to within the inflation target band again in 2019. The current surge in inflation is explained by excess aggregate demand, rising production costs, exchange rate dynamics and higher inflation expectations. Upward risks to the inflation projection are seen from elevated levels of labor market tightness.

Czech Republic

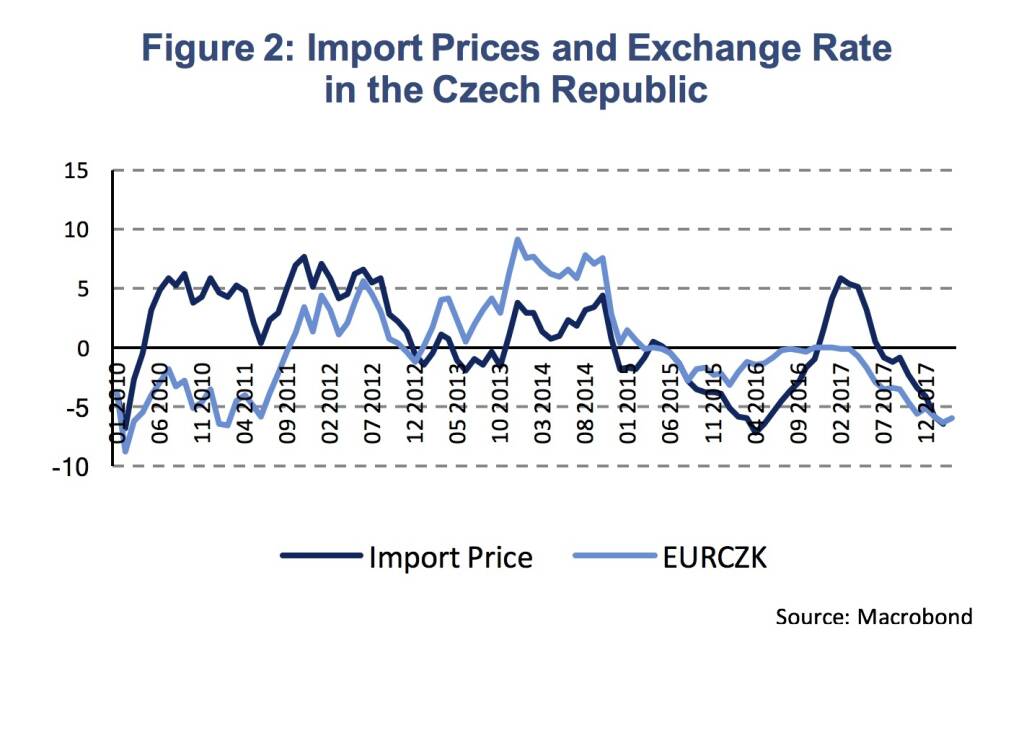

In contrast to the NBR, the Czech National Bank (CNB) has decided to keep interest rates unchanged at the meeting of the Bank Board in early May. The decision was based on new macroeconomic forecasts which are consistent with further growth in interest rates not before late 2018 / early 2019. The pause in the rate hiking cycle is justified by lower than expected inflation. CPI inflation was at 1.7 % in March 2018 following a continuous decline since a peak in October 2017 at 2.9 %. The lower than expected inflation is associated with a fall in import prices due to an appreciation of the koruna exchange rate. In March 2018, the koruna has appreciated by 5.9 % (y/y), compared to the Euro (Figure 2). In the first two months of the year, import prices have decreased by 6.1 % (y/y). A slower appreciation of the koruna and stable growth in foreign producer prices is expected to bring inflation close to the 2 % inflation target in 2019. In an interview with Bloomberg (21.3.2018), the CNB’s Deputy Governor Vladimir Tomsik stated that the koruna gains in combination with three rate increases delivered the equivalent of 2.25 %-age points in rate hikes, which implies a net currency effect of 1.55 %-age points.

The strengthening of the koruna is dampening inflationary pressure, nonetheless, domestic inflationary pressure remains strong. GDP growth was 5.5 % (y/y) in Q4 2017, the unemployment rate decreased even further to reach 2.2 % in March 2018 and gross wage growth accelerated throughout the year 2017 averaging 6.0 % (y/y). Hence, even though GDP growth will decelerate, which is likely, domestic inflationary pressure will remain strong for some time.

Serbia

Serbia’s Q1 GDP growth was released on 30th April and surprised on the upside (Figure 3). According to the first estimate, real GDP rose by 4.5 % compared to the corresponding quarter in 2017 equating a q/q-growth rate of 1.7 % in seasonally-adjusted terms (own calculation). This is a strong acceleration compared to quarterly growth in Q4 2017 (0.7 %), that was not expected by us as well as the median expectation among Bloomberg consensus forecasters (3.1 % y/y). GDP details will be released on 31st May by the Statistical Office of the Republic of Serbia.

Given the real activity data that was released so far for the first quarter, it is difficult to explain the strong GDP rise. Industrial production picked up in 2018. It spiked in January (10.6 % y/y) and rose by 6.0 % (y/y) on average during the first quarter (after 3.5 % y/y in Q4 2017). Retail sales increased on average by 3.3 % during Q1 driven by a large y/y-rise in January (7.1 %). This compares to an average monthly rise by 2.3 % (y/y) in Q4 2017.

The results from sentiment surveys for several sectors improved since early in the year (Figure 4). Consumer confidence has been gradually climbing up to peak in Q1. The confidence survey for the construction sector also rose significantly in the first quarter. This corresponds with an annual rise by 21 % in the construction index (Q4 2017) and rising building permits over the same period. Even so, it confirms the rise in construction activity that was visible in gross value added in Q4 2017 (+17.8 % y/y).

Trends in the labor market support private demand as both employment as well as real wages rose during the first quarter. In March, employment increased by 3.5 % (y/y), while in the total of last year increases in total employment averaged 2.6 % per month. Real wage growth picked up in January (1.6 %) and February (2.5 % y/y) after average monthly increases of 1.1 % in 2017. However, the unemployment rate was 15.3 at the end of last year and increased compared to the previous quarter (13.5 %) and the corresponding quarter in 2016 (13.6 %).

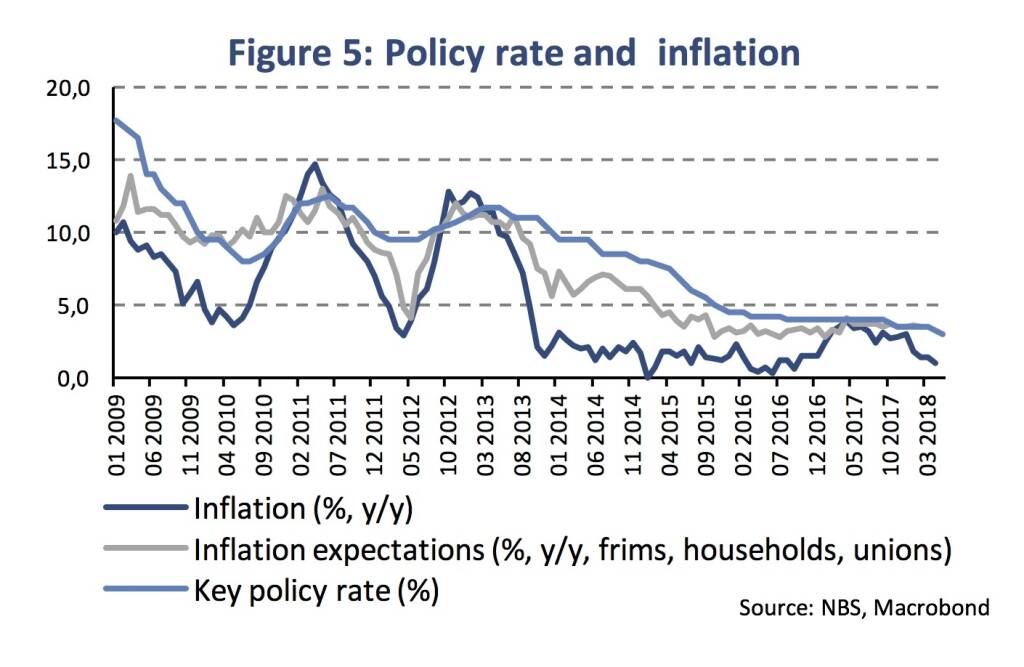

At the monetary policy meeting on 11th May, the National Bank of Serbia (NBS) kept the key policy rate unchanged at 3 % (Figure 5).

Previously this year, the NBS had lowered the key rate twice, in April and March, by 25 basis points. The bank board expects inflation to gradually approach the target (3 %), after reaching this year’s low in April. Inflation should remain close to the lower bound of the target tolerance band (+/- 1.5 %-age points) by the end of this year and should approach the target midpoint of 3.0 % in the second half of 2019; according to the NBS statement. In April, the inflation rate fell to 1.0 % (y/y) from 1.4 % previously in March. The core inflation rate was unchanged at 0.8 % in April, hence, it appears quite low compared to the inflation target of the NBS. In addition, survey-based inflation expectations in the private sector have touched all-time lows.

While it is difficult to trace back the 1st estimate GDP growth surprise, some high-frequency indicators suggest a solid development in economic activities during the first months of the year (sentiment, labor market, industry and construction). On the other side, inflationary pressures remain very low. The NBS expects it to converge towards the inflation target in the medium term.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

SportWoche Podcast #105: Lisa Reichkendler, mit ihrem Food Marketing und Peast Performance ev. zu einem Sportgeschichte-Riegel

Bildnachweis

1.

Impact of taxes on Inflation in Romania

2.

Import Prices and Exchange Rate in the Czech Republic

3.

Contribution to GDP growth

4.

Sentiment indicators (EC)

5.

Policy rate and inflation

6.

Interest Rates

Aktien auf dem Radar:Palfinger, Amag, SBO, Flughafen Wien, AT&S, Frequentis, EVN, EuroTeleSites AG, CA Immo, Erste Group, Mayr-Melnhof, S Immo, Uniqa, Bawag, Pierer Mobility, ams-Osram, Addiko Bank, Wiener Privatbank, SW Umwelttechnik, Oberbank AG Stamm, Kapsch TrafficCom, Agrana, Immofinanz, OMV, Österreichische Post, Strabag, Telekom Austria, VIG, Wienerberger, Warimpex, American Express.

Random Partner

S Immo

Die S Immo AG ist eine Immobilien-Investmentgesellschaft, die seit 1987 an der Wiener Börse notiert. Die Gesellschaft investiert zu 100 Prozent in der Europäischen Union und setzt den Fokus dabei auf Hauptstädte in Österreich, Deutschland und CEE. Das Portfolio besteht aus Büros, Einkaufszentren, Hotels sowie aus Wohnimmobilien.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» SportWoche Podcast #105: Lisa Reichkendler, mit ihrem Food Marketing und...

» Börse-Inputs auf Spotify zu u.a. Beiersdorf, adidas, Netflix, Sartorius,...

» BSN Spitout Wiener Börse: Erste Group übernimmt year-to-date-Führung von...

» Österreich-Depots: Weekend-Bilanz (Depot Kommentar)

» Börsegeschichte 19.4.: Rosenbauer (Börse Geschichte) (BörseGeschichte)

» Aktienkäufe bei Porr und UBM, News von VIG-Tochter, Research zu Verbund,...

» Nachlese: Warum CA Immo, Immofinanz und RBI positiv bzw. voestalpine neg...

» Wiener Börse Party #633: Heute April Verfall, Ex-Marinomed-Investor in ...

» Wiener Börse zu Mittag schwächer: Frequentis, Immofinanz, Palfinger gesu...

» Börsenradio Live-Blick 19/4: DAX eröffnet zum April-Verfall deutlich sch...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2QS86 | |

| AT0000A2VYD6 | |

| AT0000A34CV6 |

- SportWoche Podcast #105: Lisa Reichkendler, mit i...

- Neue Bilder: Lisa Reichkendler Peast Performance ...

- wikifolio Champion per ..: Richard Dobetsberger m...

- ATX charttechnisch: Mittelfristiger Aufwärtstrend...

- Fazits zu Agrana, RBI, FACC, A1 Telekom Austria

- Börse-Inputs auf Spotify zu u.a. Beiersdorf, adid...

Featured Partner Video

D-Roadshow Österreich: Porr als Star der Woche 12, Rekorde bei DAX und Gold, immerhin Jahreshoch beim ATX, Live-Blick heute

Seit Jänner gibt es einen täglichen Live-Blick in den aktuellen Handelstag der Börsen Frankfurt und Wien, dies von Audio-CD-Macher Christian Drastil im deutschen Börsenradio 2 G...

Books josefchladek.com

Bolnichka (Владислава Краснощока

2023

Moksop

Ta-ra

2023

ediciones anómalas

François Jonquet

François Jonquet Kazumi Kurigami

Kazumi Kurigami Igor Chekachkov

Igor Chekachkov Sebastián Bruno

Sebastián Bruno Helen Levitt

Helen Levitt Adrianna Ault

Adrianna Ault Christian Reister

Christian Reister Tommaso Protti

Tommaso Protti