Lenzing AG / Lenzing solid in a very difficult market environment

06.11.2019, 10106 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Financial Figures/Balance Sheet/Quarterly Report/Company Information

-

Continued positive development of the specialty fiber business with a share in revenue of 49.8 percent\nFocus on expanding specialty fiber and dissolving wood pulp capacities in line with the sCore TEN strategy\nGrowing trade conflicts put the textile value chain under pressure - standard viscose prices at a historic low\nInvestments of EUR 100 mn to achieve ambitious climate targets\nLenzing - The Lenzing Group continued its solid business development in the third quarter of 2019 despite a significantly more challenging market environment. The consistent implementation of the sCore TEN strategy and the focus on specialty fibers again had a positive impact. As a result, the decline in revenue and earnings in the first three quarters of 2019 due to the historically low standard viscose prices was mitigated.

Revenue of the Lenzing Group developed at a similar level to the prior-year period and amounted to EUR 1.62 bn (minus 1.1 percent), despite the steep decline in prices for standard viscose. However, based on a further product mix optimization and higher prices for specialty fibers, the decrease in revenue was largely offset; the share of specialty fibers in revenue, at 49.8 percent, significantly exceeded the prior-year value of 44.1 percent. EBITDA (earnings before interest, tax, depreciation and amortization) dropped by 8.1 percent to EUR 266.9 mn, primarily due to the market environment for standard viscose, leading to a lower EBITDA margin of 16.5 percent compared with 17.8 percent in the first three quarters of the previous year. EBIT (earnings before interest and tax) fell by 19.3 percent to EUR 153.5 mn. The EBIT margin dropped to 9.5 percent (from 11.6 percent in the comparative period). Net profit decreased by 15.6 percent to EUR 112.9 mn. Earnings per share amounted to EUR 4.41 (01-09/ 2018: EUR 5.06).

"Lenzing is very well positioned due to its strategic orientation and its strong focus on specialty fibers. This is reflected, more than ever, in the current market environment, which is marked by trade conflicts and historically low prices for standard viscose. This uncertainty can be felt throughout the textile value chain and leads to significantly more sluggish demand. Thanks to the performance of our specialty fibers, we have nevertheless been able to achieve a solid result", says Stefan Doboczky, Chief Executive Officer of the Lenzing Group. "While the profit situation of many companies in the textile value chain is challenging, we are still optimistic thanks to our specialty strategy and expect a satisfactory result for the full year", Doboczky adds.

CAPEX (investments in intangible assets and property, plant and equipment) dropped by 8.3 percent to EUR 159.7 mn during the reporting period. This decline is primarily attributable to the completion of the expansion project in Heiligenkreuz in 2018 and the ongoing planning for major projects in Brazil and Thailand, which will only have an effect on the investment volume in the coming quarters. In the first three quarters of 2019, investment activities in the Lenzing Group focused on the expansion of the share of specialty fibers in line with the sCore TEN strategy.

Zwtl.: Expansion of specialty fiber capacities

Lenzing puts the focus on stable and profitable growth as well as an improvement of the ecological footprint of the textile and nonwovens industries by expanding the production of specialty fibers. The decision to build a state-of-the-art lyocell plant with a capacity of 100,000 tons in Prachinburi (Thailand) is the next logical step to achieve this goal. In the third quarter, Lenzing chose Wood Plc as a general contractor for detailed engineering, purchasing and construction management and supervision.

In addition, the conversion of the production capacities from standard viscose to LENZING(TM) ECOVERO(TM) branded specialty viscose fibers was also continued during the reporting period. Thanks to their excellent ecological footprint and their leading-edge identification technology, LENZING(TM) ECOVERO(TM) fibers have been very well received by the market.

Zwtl.: Expansion of pulp capacities

Increasing the self-supply with dissolving wood pulp is another key element of the sCore TEN strategy. Lenzing and the Brazilian company Duratex continue to advance the construction of a 450,000-ton dissolving wood pulp plant in the state of Minas Gerais (Brazil). The basic engineering, site grading and the applications for required permits are proceeding according to plan.

In addition, the expansion and modernization of the pulp plant in Lenzing were completed in the third quarter. Lenzing invested EUR 60 mn, increasing the production capacity for dissolving wood pulp to 320,000 tons per year.

Zwtl.: Transparency from wood to garment

Lenzing will use blockchain technology to support its TENCEL(TM) branded fiber business, ensuring complete transparency and traceability for brands and consumers of its fibers in the finished garment. In the second quarter Lenzing announced a cooperation with the technology company TextileGenesis(TM) to accomplish this ambition; in the third quarter, Lenzing presented its first pilot project at the Hong Kong Fashion Summit.

The TENCEL(TM) brand's visibility was further increased through co-branding during the reporting period. Compared to the same period of 2018, the number of end products labeled with the TENCEL(TM) brand increased from 41 mn to 102 mn. The digital marketing concept "Where to buy" was introduced on the product website www.tencel.com [http://www.tencel.com] in the first quarter of 2019. Based on this concept, products made from TENCEL(TM) fibers can be presented and linked in the online shops of more than 110 partners, including brands like H&M, Levi's, Allbirds, Victoria Secret, Esprit, Pottery Barn and Asos.

Zwtl.: Ambitious climate targets

Lenzing invests more than EUR 100 mn in energy-saving measures, the conversion to renewable energies and in new technologies, thus strengthening its position as a front runner in climate protection both in the production industry and in particular also in the fiber industry. In the second quarter Lenzing announced its ambitious climate strategy. The goal is to reduce net emissions of greenhouse gases to zero by 2050. An important milestone on the way to becoming climate-neutral is set for the year 2030. By then Lenzing has committed to reduce emissions per ton of fibers and pulp by 50 percent compared with 2017.

Zwtl.: Outlook

The International Monetary Fund expects a slowdown of global economic growth to 3 percent in 2019, mainly driven by increasing protectionist tendencies and growing geopolitical tensions. The currency environment in the regions relevant to Lenzing will remain volatile.

Global fiber demand has weakened. Trade conflicts have caused nervousness and declining demand throughout the textile value chain. According to preliminary calculations, cotton inventory levels will continue to increase in the 2019/20 season because a good harvest is expected. The price levels for cotton and polyester are expected to remain subdued. Capacity expansions for standard viscose, coupled with sluggish demand due to the trade conflicts, caused higher pressure on prices, which fell to a new historic low in the third quarter of 2019. In specialty fibers, the Lenzing Group expects a comparatively positive development of its business.

Driven by the challenging situation in standard viscose and low paper pulp prices, prices for dissolving wood pulp remain on a comparatively low level. Caustic soda prices in Asia have already declined significantly over the past months; this development is now also noticeable in Europe. The very challenging and volatile market environment in general, paired with erratic developments in the trade disputes between the major economic blocks plus the high level of uncertainty in the textile value chain, significantly impacts earnings visibility. Based on the above mentioned economic environment, the Lenzing Group expects the result for 2019 to be slightly below the level of 2018.

Above developments reassure the Lenzing Group in its chosen strategy sCore TEN. Lenzing is very well positioned in this market environment and will continue to focus growth with specialty fibers.

Key group indicators (IFRS) 01-09/2019 01-09/2018 (in EUR mn) Revenue 1,617.9 1,636.2 Earnings before interest, tax, depreciation and 266.9 290.6 amortization (EBITDA) EBITDA margin in % 16.5 17.8 Earnings before interest 153.5 190.3 and tax (EBIT) EBIT margin in % 9.5 11.6 Net profit for the period 112.9 133.8 CAPEX(1) 159.7 174.1

30.09.2019 31.12.2018 Adjusted equity ratio(2) 55.5 59.0 in % Number of employees 6,988 6,839

1) Capital expenditures: acquisition of intangible assets, property, plant and equipment as per statement of cash flows 2) Ratio of adjusted equity to total assets in percent

Photo download: https://mediadb.lenzing.com/pinaccess/showpin.do?pinCode=CxlVtMeD349T [https:// mediadb.lenzing.com/pinaccess/showpin.do?pinCode=CxlVtMeD349T] PIN: CxlVtMeD349T

end of announcement euro adhoc

issuer: Lenzing AG

A-4860 Lenzing phone: +43 7672-701-0 FAX: +43 7672-96301 mail: office@lenzing.com WWW: http://www.lenzing.com ISIN: AT0000644505 indexes: WBI, ATX stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/1597/aom

SportWoche Podcast #105: Lisa Reichkendler, mit ihrem Food Marketing und Peast Performance ev. zu einem Sportgeschichte-Riegel

Lenzing

Uhrzeit: 13:03:44

Veränderung zu letztem SK: 0.25%

Letzter SK: 29.60 ( -2.47%)

Bildnachweis

Aktien auf dem Radar:Palfinger, Amag, SBO, Flughafen Wien, AT&S, Frequentis, EVN, EuroTeleSites AG, CA Immo, Erste Group, Mayr-Melnhof, S Immo, Uniqa, Bawag, Pierer Mobility, ams-Osram, Addiko Bank, Wiener Privatbank, SW Umwelttechnik, Oberbank AG Stamm, Kapsch TrafficCom, Agrana, Immofinanz, OMV, Österreichische Post, Strabag, Telekom Austria, VIG, Wienerberger, Warimpex, American Express.

Random Partner

Agrana

Die Agrana Beteiligungs-AG ist ein Nahrungsmittel-Konzern mit Sitz in Wien. Agrana erzeugt Zucker, Stärke, sogenannte Fruchtzubereitungen und Fruchtsaftkonzentrate sowie Bioethanol. Das Unternehmen veredelt landwirtschaftliche Rohstoffe zu vielseitigen industriellen Produkten und beliefert sowohl lokale Produzenten als auch internationale Konzerne, speziell die Nahrungsmittelindustrie.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A39UT1 | |

| AT0000A2VYD6 | |

| AT0000A2QS86 |

- EVN und vs. Ballard Power Systems und SFC Energy...

- Suess Microtec und Stratec Biomedical vs. BayWa u...

- Snapchat und Fabasoft vs. Nvidia und GoPro – komm...

- Hochtief und Bilfinger vs. HeidelbergCement und S...

- American Express und Goldman Sachs vs. Sberbank u...

- Sixt und vs. Leoni und Tesla – kommentierter KW ...

Featured Partner Video

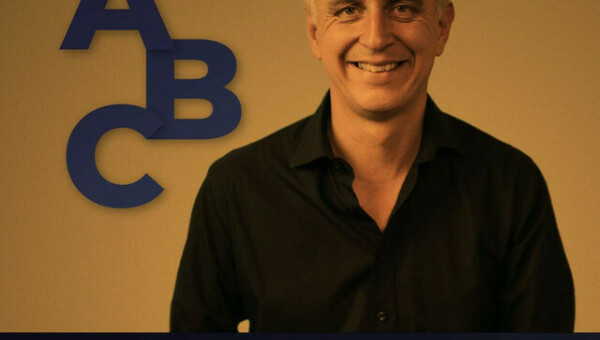

ABC Audio Business Chart #98: Rote Defizitlinien und EU-Grenzgänger (Josef Obergantschnig)

Die Finanzpolitik Europas steht zunehmend unter Druck. Die Folgen der Corona-Pandemie und der Teuerungskrise haben die Staatsschulden in die Höhe getrieben. Selbst in wirtschaftlich starken Jahren ...

Books josefchladek.com

操上 和美

2002

Switch Publishing Co Ltd

Nacht und Nebel

2023

Safelight

The Americans (fifth American edition)

1978

Aperture

Bonifica

2024

Self published

La Scène de la Locomotive à Vapeur

1975

Yomiuri Shimbun

Christian Reister

Christian Reister Valie Export

Valie Export Sergio Castañeira

Sergio Castañeira Futures

Futures Sebastián Bruno

Sebastián Bruno