RHI AG / Preliminary results 2014

27.02.2015, 11887 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

annual result

Business Development The RHI Group's sales volume rose from roughly 1,768,000 tons in the previous year to roughly 1,868,000 tons in 2014. This is primarily attributable to increased sales activities of the Raw Materials Division. Revenues in the past financial year amounted to EUR 1,721.2 million, after EUR 1,754.7 million in the year 2013. While revenues in the Steel Division rose by 1.0%, the Industrial Division recorded a decline in revenues by 8.5% compared to the previous year as customers in the nonferrous metals business unit postponed major projects and due to weaker demand in the glass business.

The operating EBIT before impairment and restructuring costs increased from EUR 126.8 million in the previous year to EUR 141.9 million in the past financial year. While the Steel Division benefitted from an improved product mix and higher utilization of the production capacities as a result of the closure of the Duisburg plant, Germany, in early 2014, the operating EBIT of the Industrial Division decreased because of a decline in revenues and the related lack of coverage of fixed costs at the production facilities. The operating EBIT of the Raw Materials Division improved due to the progress made in optimizing the fused magnesia production at the site in Porsgrunn, Norway.

EBIT amounted to EUR 109.3 million in the past financial year and includes impairments on existing assets of the glass business unit amounting to roughly EUR 12 million and some EUR 7 million related to the fused magnesia production in Norway. In addition, EBIT of the year 2014 was affected by restructuring expenses resulting from the discontinuation of operations at the site in Kretz, Germany, in the course of optimizing raw material treatment in Europe, which amounted to roughly EUR 10 million, and from the closure of the plant in Duisburg, Germany, which amounted to roughly EUR 4 million. In the previous year EBIT was EUR 111.1 million and included, amongst other things, net income of roughly EUR 76 million from the termination of the US Chapter 11 proceedings, restructuring costs of roughly EUR 25 million for the closure of the plant in Duisburg, Germany, and an impairment of roughly EUR 65 million for the plant in Porsgrunn, Norway.

Profit after income tax thus totaled EUR 52.5 million in the financial year 2014 compared with EUR 63.4 million in the previous year. Earnings per share dropped from EUR 1.57 to EUR 1.28. The Management Board of RHI AG will propose a dividend of EUR 0.75 to the Annual General Meeting on May 8, 2015.

Financial and Assets Position Net cash flow from operating activities decreased from EUR 171.5 million in the previous year to EUR 72.4 million in the past financial year. While the prior- year figure was positively influenced by net cash inflows resulting from the termination of the US Chapter 11 proceedings totaling EUR 24.8 million, an increase in working capital by EUR 89.9 million had a negative impact in the year 2014. Net cash flow from investing activities included payouts related to the acquisition of the 69.9% share in the Indian company Orient Refractories Ltd. amounting to EUR 48.7 million in the previous year and declined from EUR (125.1) million in the year 2013 to EUR (61.1) million in the year 2014.

Working capital amounted to EUR 570.9 million at the end of the financial year, versus EUR 481.0 million in the previous year. The increase in inventories by some EUR 40 million is predominantly attributable to regions where RHI has no production capacities, for example North and South America, and is also influenced by exchange rate effects such as the strengthening of the US dollar against the euro. RHI currently works on new approaches to optimize the supply chain with the objective to reduce inventories by roughly EUR 100 million on a sustained basis. The higher receivables are due, amongst other things, to very strong monthly revenues in December 2014, which exceeded EUR 186 million.

The balance sheet total of the RHI Group increased by 7.9%, from EUR 1,724.0 million in the previous year to EUR 1,860.5 million in the year 2014, which was primarily due to an increase in working capital and higher non-current financial liabilities resulting from the issue of a Schuldscheindarlehen. The RHI Group's equity amounted to EUR 493.9 million at December 31, 2014 after EUR 485.5 million in the previous year. The consolidated statement of financial position as of December 31, 2014 shows net financial liabilities of EUR 466.9 million (previous year: EUR 422.9 million). That corresponds to 2.3 times the EBITDA of the year 2014.

Steel Division The Steel Division's revenues were up 1.0% from EUR 1,097.5 million to EUR 1,108.8 million. The sharp drop in revenues in South America due to a highly competitive situation resulting from the strong devaluation of local currencies was balanced out by growth in all other regions. The business development was particularly positive in India, Africa and the Middle East, where significant increases were recorded. The operating EBIT rose from EUR 64.4 million in the previous year to EUR 93.1 million in the past financial year due to improvements in the product mix and higher utilization of the production capacities resulting from the closure of the plant in Duisburg, Germany, at the beginning of the year.

Industrial Division The decline in revenues of the Industrial Division from EUR 619.0 million in the year 2013 to EUR 566.6 million in the year 2014 is primarily attributable to weaker demand in the nonferrous metals and glass business units. While falling metal prices caused customers of the former to postpone major repairs, worldwide excess capacity burdened the market environment for the latter. The operating EBIT decreased from EUR 70.2 million in the year 2013 to EUR 48.6 million in the past financial year as a result of lower revenues and the related lack of coverage of fixed costs at the production plants.

Raw Materials Division Revenues of the Raw Materials Division were up 10.5%, from EUR 274.4 million in the previous year to EUR 303.3 million in the past financial year. This is due to both an increase in internal demand and higher external revenues. The operating EBIT rose from EUR (7.8) million in the previous year to EUR 0.2 million in the past financial year. This development reflects the progress made in optimizing the production of fused magnesia at the site in Porsgrunn, Norway, and successes resulting from a continuous improvement program.

Outlook The outlook given in the ad hoc release of January 23, 2015 is confirmed. Due to the positive development of incoming orders in the past months and the measures taken by the management, RHI thus expects a year-on-year increase in revenues by roughly 3% and an operating EBIT margin of approximately 9% in the current economic environment. If the US dollar continues to strengthen against the euro, further positive effects on revenues and EBIT can be expected. In the year 2015, the RHI Group will make investments totaling roughly EUR 80 million.

Preliminary key figures (in EUR million) 2014 2013 Delta Balance sheet total 1,860.5 1,724.0 7.9% Equity 493.9 485.5 1.7% Equity ratio (in %) 26.5% 28.2% (1.7)pp Investments in PP&E and intangible assets 76.2 89.4 (14.8)% Net debt 466.9 422.9 10.4% Gearing ratio (in %) 94.5% 87.1% 7.4pp Net debt / EBITDA 2.3 1.6 0.7 Working capital 570.9 481.0 18.7% Working capital (in %) 33.2% 27.4% 5.8pp Capital employed 1,225.3 1,138.8 0.0% Return on average capital employed (in %) 6.5% 7.3% (0.8)pp Net cash flow from operating activities 72.4 171.5 (57.8)% Net cash flow from investing activities (61.1) (125.1) 51.2% Net cash flow from financing activities 24.6 (112.8) 121.8%

Preliminary key figures 2014

in EUR million 2014 2013 Delta 4Q/14 4Q/13 Delta Revenues 1,721.2 1,754.7 (1.9)% 466.5 456.6 2.2% Steel Division 1,108.8 1,097.5 1.0% 293.6 278.7 5.3% Industrial Division 566.6 619.0 (8.5)% 162.7 170.9 (4.8)% Raw Materials Division External revenues 45.8 38.2 19.9% 10.2 7.0 45.7% Internal revenues 257.5 236.2 9.0% 62.6 58.1 7.7% EBITDA 199.4 260.7 1) (23.5)% 51.8 42.9 1) 20.7% EBITDA margin 11.6% 14.9% (3.3)pp 11.1% 9.4% 1.7pp Operating EBIT 2) 141.9 126.8 11.9% 41.8 18.0 132.2% Steel Division 93.1 64.4 44.6% 27.9 7.1 293.0% Industrial Division 48.6 70.2 (30.8)% 18.2 19.7 (7.6)% Raw Materials Division 0.2 (7.8) 102.6% (4.3) (8.8) 51.1% Operating EBIT margin 8.2% 7.2% 1.0pp 9.0% 3.9% 5.1pp Steel Division 8.4% 5.9% 2.5pp 9.5% 2.5% 7.0pp Industrial Division 8.6% 11.3% (2.7)pp 11.2% 11.5% (0.3)pp Raw Materials Division 3) 0.1% (2.8)% 2.9pp (5.9)% (13.5)% 7.6pp EBIT 109.3 111.1 (1.6)% 11.9 (53.0) 122.5% Steel Division 91.4 97.3 (6.1)% 27.7 3.3 739.4% Industrial Division 34.9 86.8 (59.8)% 5.7 17.7 (67.8)% Raw Materials Division (17.0) (73.0) 76.7% (21.5) (74.0) 70.9% EBIT margin 6.4% 6.3% 0.1pp 2.6% (11.6)% 14.2pp Steel Division 8.2% 8.9% (0.7)pp 9.4% 1.2% 8.2pp Industrial Division 6.2% 14.0% (7.8)pp 3.5% 10.4% (6.9)pp Raw Materials Division 3) (5.6)% (26.6)% 21.0pp (29.5)% (113.7)% 84.2pp Net finance costs (32.7) (29.8) (9.7)% (10.3) (1.9) (442.1)% Share of profit of joint ventures 8.2 8.0 2.5% 2.5 2.8 (10.7)% Profit before income tax 84.8 89.3 (5.0)% 4.1 (52.1) 107.9% Income taxes (32.3) (26.6) (21.4)% (3.2) 13.6 (123.5)% Income taxes in % 38.1% 29.8% 8.3pp 78.0% 26.1% 51.9pp Profit from continued operations 52.5 62.7 (16.3)% 0.9 (38.5) 102.3% Profit from discontinued operations 0.0 0.7 (100.0)% 0.0 0.7 (100.0)% Profit for the year 52.5 63.4 (17.2)% 0.9 (37.8) 102.4%

Earnings per share in EUR 4) Continuing operations 1.28 1.55 0.01 (0.97) Discontinued operations 0.00 0.02 0.00 0.02

1) adjusted for income from the reversal of investment grants recognized as liabilities

2) EBIT before impairment losses, restructuring effects and result from the US Chapter 11 proceedings 3) based on internal and external revenues 4) basic and diluted Gearing ratio: net debt / equity Working Capital: Inventories + Trade receivables and receivables from long-term construction contracts - Trade payables - Prepayments received Capital Employed: Property, plant and equipment + Goodwill + Other intangible assets + Working Capital

Return on average capital employed: (EBIT - Taxes) / average Capital Employed

end of announcement euro adhoc

company: RHI AG Wienerbergstrasse 9 A-1100 Wien phone: +43 (0)50213-6676 FAX: +43 (0)50213-6130 mail: rhi@rhi-ag.com WWW: http://www.rhi-ag.com sector: Refractories ISIN: AT0000676903 indexes: ATX Prime, ATX

stockmarkets: official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/1644/aom

Börsepeople im Podcast S22/14: Franz Tretter

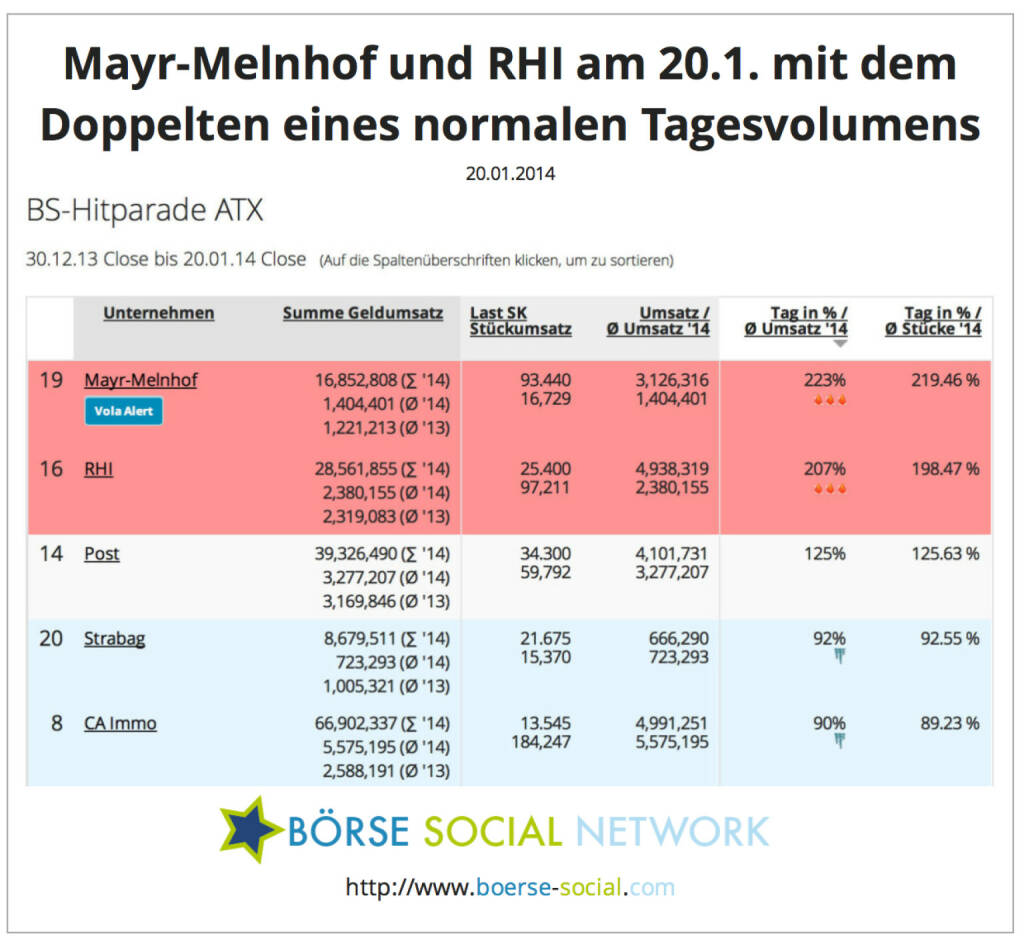

RHI Letzter SK: 0.00 ( 0.00%)

Bildnachweis

Aktien auf dem Radar:VIG, Austriacard Holdings AG, Amag, Pierer Mobility, EuroTeleSites AG, Addiko Bank, CPI Europe AG, Wienerberger, Zumtobel, BKS Bank Stamm, Oberbank AG Stamm, Kapsch TrafficCom, AT&S, EVN, Flughafen Wien, Österreichische Post, Semperit, Henkel, Münchener Rück, Fresenius Medical Care, E.ON , RWE, Zalando, Rheinmetall, Scout24.

Random Partner

UBS

UBS bietet weltweit finanzielle Beratung und Lösungen für private, institutionelle und Firmenkunden als auch für private Kundinnen und Kunden in der Schweiz. UBS mit dem Hauptsitz in Zürich hat eine weltweite Präsenz in allen wichtigen Finanzmärkten.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Analysten: "Flughafen Wien angemessen bewertet"

- Research-Fazits zu Beiersdorf, Nemetschek, BASF, ...

- Guten Morgen mit Galvion, Ceconomy, Weight Watche...

- Analysten zu Porr: "Jahr 2025 sehr gelungen"

- wikifolio whispers a.m. Evotec, PayPal, Rheinmeta...

- ATX-Trends: RBI, Bawag, wienerberger ....

Featured Partner Video

kapitalmarkt-stimme.at daily voice: Der ATX Five hinkt weiterhin brutal hinterher, hat aber - relativ zum ATX - auch kein Aufholpotenzial

kapitalmarkt-stimme.at daily voice auf audio-cd.at: Bis auf den ATX Five, der noch 20 Prozent von seinen Hochs entfernt ist, sind alle relevanten Austro-Indices auf High. Hat der ATX Five deshalb A...

Books josefchladek.com

Particles

2025

Origini edizioni

Beyond Caring

1986

Grey Editions

Im Flug nach Moskau

1959

Artia

Zur neuen Wohnform

1930

Bauwelt-Verlag

Claudia Andujar

Claudia Andujar Adriano Zanni

Adriano Zanni Adriano Zanni

Adriano Zanni Florian Rainer

Florian Rainer Paul Graham

Paul Graham Allied Forces

Allied Forces