27.11.2017, 7570 Zeichen

CEE

- Divergence of monetary policy trajectories continues among CE central banks.

- The National Bank of Hungary introduces two unconventional instruments to flatten the yield curve (effective from January 2018) while other CE central banks start with monetary policy normalization.

- New instruments: interest rate swaps (maturities: 5Y and 10Y); purchasing programme of mortgage bonds (maturities: +3Y).

The divergence of monetary policy trajectories among the central banks of the Central European (CE) region continues. The most pronounced difference can be found between the Czech National Bank (CNB) and the National Bank of Hungary (NBH). While the former increased its monetary policy rate (2 week repo rate) by 25 basis points to reach 0.5 % earlier this month, the latter announced the introduction of new non-standard measures to further loosen monetary conditions last week. The National Bank of Poland (NBP) stands between these two by keeping monetary policy unchanged so far, with its governor Glapinski signaling no rate hike until the end of 2018.

According to the NBH’s press release of last week’s monetary council meeting, a further loosening of monetary policy is justified by a weak pass-through of lower short-term rates to longer maturities. Hence, the NBH perceives the yield curve as being too steep. Comparing 10-year government bond yields, as a proxy for the longer end of the yield curve, between selected CE countries shows that Hungarian yields have already declined substantially during recent months (Figure 1). The yield on 10-year Hungarian government bonds is only marginally above the Czech and already well below the Polish counterpart.

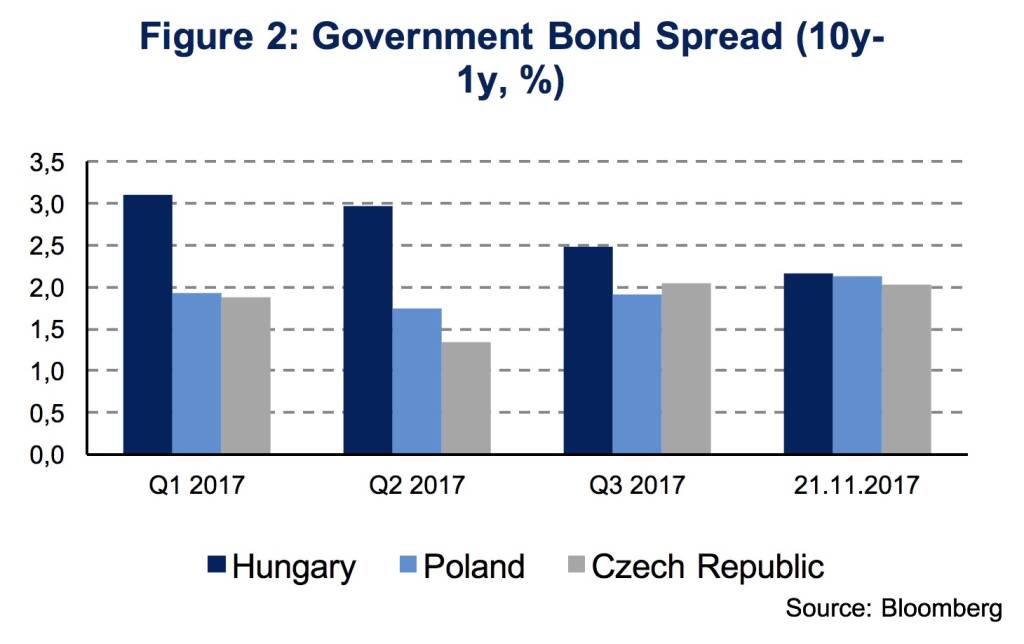

Investigating the steepness of the yield curve, by analyzing the spread between government bond yields with maturities of 10 years and 1 year, shows that the Hungarian yield curve was indeed steeper than the Polish or Czech curves for most of 2017. Especially, during the first half of the year the spread was substantially higher. Since the end of September, however, the spread has significantly narrowed showing very similar levels across all three economies (Figure 2). The NBH attributes “the reduction of the overnight deposit rate in September, the introduction of an upper limit on the stock of three-month deposits and central bank communication addressing longer-term yields” for the narrowing of the spread. That the yield curve is still steeper in international comparison can, however, not be supported, at least within the CE region.

Two unconventional instruments, which will become effective in January 2018, are introduced to achieve the objective of lower long-term rates. Their operational details will be released in December. Firstly, the NBH will use unconditional interest rate swap facilities with maturities of 5 and 10 years. The allocation amount has been set at HUF 300 billion for Q1 2018. The NBH was using interest rate swaps with a 10-year maturity during 2015 and 2016 when swaps were offered at an average discount of 44 bp to the market rate until the start of the silent exit period from February 2016. Secondly, a purchasing program targeting mortgage bonds with maturities of 3 years and more, target long term yields and increase the share of mortgage loans with long periods of interest rate fixation. In September the stock of outstanding debt securities issued by resident mortgage banks was 951.5 bn HUF. If the NBH buys 50 % of the outstanding stock, as it indicated, the central bank’s balance sheet will expand by about 475 bn HUF, or 1.3 % of GDP. Even if the NBH’s purchasing program spurs the supply of mortgage bonds, which is likely, the mortgage bond purchasing program cannot be seen as a Fed or ECB like quantitative easing program.

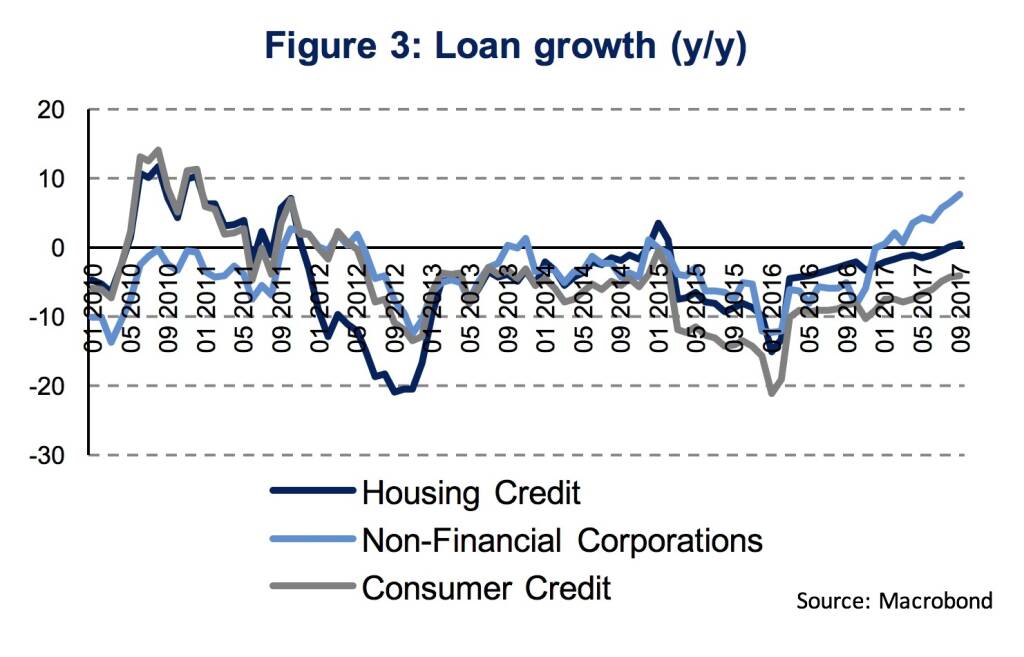

As figure 3 shows, the credit market has already improved with loans expanding mainly in the corporate sector. Nevertheless, the recovery on the credit market is not very advanced yet. Loans to non-financial corporations increased by 6.6 %(y/y) in Q3 2017 after 2.5 % (y/y) in H1 2017. Mortgage loans still stagnated in Q3 and declined by 1.5 % (y/y) during the first half of the year. Consumer loans declined by 4.4 % (y/y) in Q3. Hence, there is some indication that the credit market might depend on more accommodative monetary policy. However, it is worth noting that a decomposition of loans by maturity shows no tendencies that loans of longer maturity are disadvantaged. While mortgage loans at maturities over 5 years are stagnating, the growth of loans to non-financial corporations is driven by loans with maturities over 5 years. Loans to non-financial corporations at a maturity between 1 and 5 years are even still in decline which is questioning the steepness of the yield curve as the main driver for a slow recovery of the credit market.

This in mind it is worth noting that the Hungarian economy is developing dynamically. GDP growth was 3.6 % (y/y, sa) in Q3 2017. Both industrial production (8.1 %, y/y) and retail sales growth (5.9 %, y/y) accelerated in September. Gross wages in September were expanding at double digit rates (13.6 %, y/y) with substantial growth also in the manufacturing sector (11.8 %, y/y). At the same time the unemployment rate has reached a record low of 4.1 %. Nevertheless, the monetary council of the NBH states that “some degree of unused capacity has remained in the economy”. This is in stark contrast to the European Commission’s assessment, which predicts the output gap at 1.5 % of potential GDP in 2017 (AMECO).

Inflation is below the NBH’s 3 % target and even decreased to 2.2 % in October after 2.5 % in September, so did core inflation which declined to 2.7 % in October after 2.9 % in September. Base effects will further negatively influence inflation until the end of 2017. In 2018 it will be seen whether the NBH can still reliably anchor inflation expectations at the 3 % target while gradually reverting to monetary policy normalization. If not, they will have little choice other than to tighten earlier and from a lower level. Our inflation projection sees the 3 % target to be met by the mid of 2018. Forward rates of the 3 months BUBOR imply two 25 bp rate hikes over the next 9 months and three 25 bp rate hikes over the next 12 months.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Disclaimer

This publication is neither a marketing document nor a financial analysis. It merely contains information on general economic data. Despite thorough research and the use of reliable data sources, we cannot be held responsible for the completeness, correctness, currentness or accuracy of the data provided in this publication.

Our analyses are based on public Information, which we consider to be reliable. However, we cannot provide a guarantee that the information is complete or accurate. We reserve the right to change our stated opinion at any time and without prior notice. The provided information in the present publication is not to be understood or used as a recommendation to purchase or sell a financial instrument or alternatively as an invitation to propose an offer. This publication should only be used for information purposes. It cannot replace a bespoke advisory service to an investor based on his / her individual circumstances such as risk appetite, knowledge and experience with financial instruments, investment targets and financial status. The present publication contains short-term market forecasts. Past performance is not a reliable indication for future performance.

BörseGeschichte Podcast: Christian-Hendrik Knappe vor 10 Jahren zum ATX-25er

Bildnachweis

1.

Government Bond Yield

2.

Government Bond Spread

3.

Loan growth

4.

Interest Rates

Aktien auf dem Radar:DO&CO, Amag, AT&S, Austriacard Holdings AG, RHI Magnesita, SBO, Rosgix, Rosenbauer, FACC, Lenzing, OMV, Polytec Group, Zumtobel, Porr, Frequentis, Gurktaler AG Stamm, Wienerberger, Wolford, Wolftank-Adisa, Palfinger, Pierer Mobility, EuroTeleSites AG, Oberbank AG Stamm, BKS Bank Stamm, Marinomed Biotech, Österreichische Post, Verbund, GEA Group, Bayer, Fresenius Medical Care, Symrise.

Random Partner

VAS AG

Die VAS AG ist ein Komplettanbieter für feststoffbefeuerte Anlagen zur Erzeugung von Wärme und Strom mit über 30-jähriger Erfahrung. Wir planen, bauen und warten Anlagen im Bereich von 2 bis 30 MW für private, industrielle und öffentliche Kunden in ganz Europa. Wir entwickeln maßgefertigte Projekte ganz nach den Bedürfnissen unserer Kunden durch innovative Lösungen.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Börse-Inputs auf Spotify zu u.a. Max Otte, Christian-Hendrik Knappe, ETF...

» ATX-Trends: Bawag, Erste Group, Bajaj Mobility ...

» Österreich-Depots: Etwas schwächer (Depot Kommentar)

» Börsegeschichte 14.1.: Lenzing x2 (Börse Geschichte) (BörseGeschichte)

» Nachlese: Michael Mayer Nullzwo, Max Otte, ZFA-Jahresauftakt (audio cd.at)

» Wiener Börse Party #1072: ATX unverändert, Polytec erweitert Investments...

» PIR-News: In den News: Porr, VIG, Polytec, Bajaj Mobility, Bawag, Kapsch...

» Wiener Börse zu Mittag etwas fester: Austriacard, Polytec, Do&Co gesucht

» ATX-Trends: Agrana, Addiko, EVN ...

» Börse-Inputs auf Spotify zu u.a. Michael Mayer Nullzwo, Ruf Pull, Addiko...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- DAX-Frühmover: Fresenius, adidas, Deutsche Teleko...

- ATX TR-Frühmover: OMV, AT&S, Wienerberger, Lenzin...

- BayWa, Aixtron am besten (Peer Group Watch Deutsc...

- Asta Energy plant IPO in Frankfurt

- Börse-Inputs auf Spotify zu u.a. Max Otte, Christ...

- Warimpex startet Wohnungsverkauf in Krakau

Featured Partner Video

BörseGeschichte Podcast: Gerald Grohmann vor 10 Jahren zum ATX-25er

Der ATX wurde dieser Tage 35. Rund um "25 Jahre ATX" haben wir im Dezember 2015 und Jänner 2016 eine grossangelegte Audioproduktion mit dem Ziel einer Fest-CD gemacht, die auch auf Audible als Hörb...

Books josefchladek.com

Posedy / Hunting Stands

2025

PositiF

Im Flug nach Moskau

1959

Artia

Født af mørket

2025

Gyldendal

Dimma Brume Mist

2025

Void

Die Welt ist schön. Einhundert photographische Aufnahmen.

1931

Kurt Wolff

Niko Havranek

Niko Havranek Anna Fabricius

Anna Fabricius Sasha & Cami Stone

Sasha & Cami Stone Joselito Verschaeve

Joselito Verschaeve Thonet

Thonet