02.10.2018, 14577 Zeichen

- Monetary policy is becoming less accommodative as U. S. growth remains strong, inflation near the target rate and unemployment very low.

- The large Fed balance sheet will shrink steadily coinciding with a normalization in longer-term U. S. interest rates.

In the meeting of the Federal Open Market Committee (FOMC) last week, the Fed decided to raise the target range of the federal funds rate by 25 basis points to 2-2.25 %. It was the 3rd increase this year and the 8th hike since the Fed embarked on an interest rate hiking cycle in 2015.

The FOMC statement remained mostly unchanged compared to the June statement. It says that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong and the unemployment rate has stayed low (3.9 % in August). The personal consumption expenditure inflation (2.2 % in August) and the core inflation rate (2 %) remained near the inflation target. A sentence stating that “the stance of monetary policy remains accommodative” was removed from the statement. The real natural rate of interest, which is an important measure of the real interest rate, at which monetary policy is neither restrictive nor accommodative, has increased to 0.6 % in the latest update in Q2. The real federal funds rate (subtracting inflation from the federal funds) can be compared to the real natural interest rate to judge whether monetary policy is accommodative, tight or roughly neutral (Figure 1). [1] The path of the measure for monetary policy tightness (real fed funds rate minus real natural rate), which is approaching zero from below, indicates that monetary is about to become neutral.

The updated Summery of Economic Projections (SEP) contained little new information which could alter the expectations about the future path of U.S. interest rates. Projections for real GDP growth were upgraded to 3.1 % and 2.5 % for 2018 and 2019 (2.8 % and 2.4 % previously) and GDP growth is assumed to converge to 1.8 % in the longer run. The unemployment rate is forecast to fall further (3.5 % in 2019 and 2020) and the inflation rate will remain near 2 % over the projection horizon. Finally, the medians of the forecasts for the federal funds rate are unchanged at 2.4 % for 2018, 3.1 % for 2019 and 3.4 % for 2019 and 2020. The expected level of the longer run federal funds rate has increased from 2.9 % to 3.0 % in the September SEP. The projections imply one further hike of the key policy rate this year (likely in December), 2-3 hikes next year and 1-2 hikes in 2020. Hence, the Fed is continuing its rate hiking cycle broadly as expected.

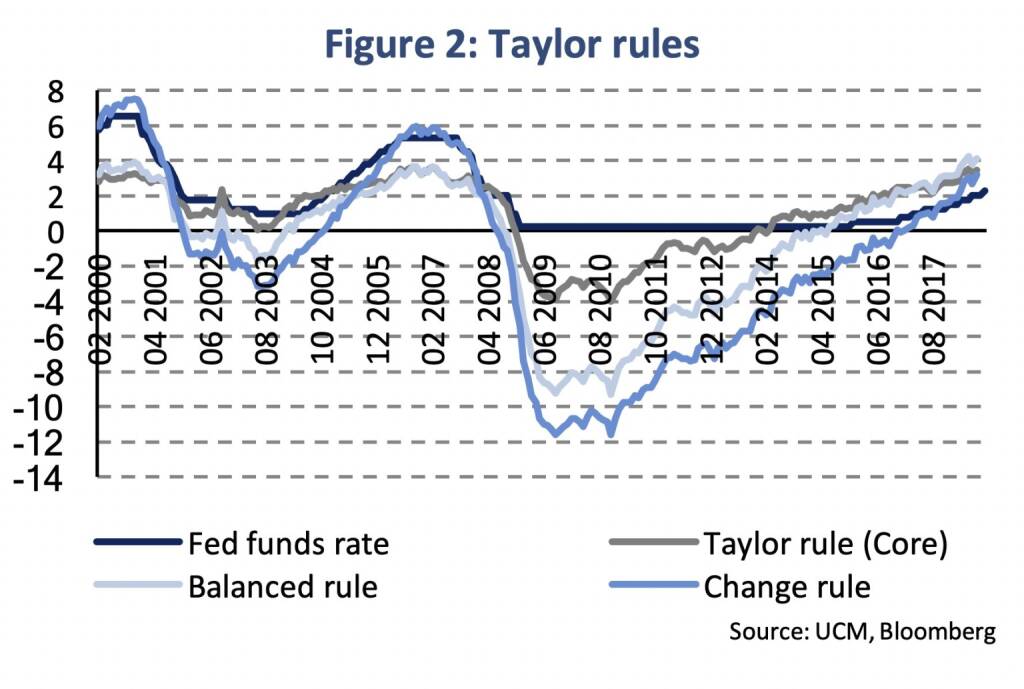

Taylor rules are usually employed as central bank response functions or monetary policy rules for key policy rates. A number of different Taylor rules suggest that, basically, the Fed has been raising the federal funds rate in line with these rules (Figure 2).

Two out of three rules in the graph (Core Taylor rule, Balanced rule) suggest that the level of the federal funds rate was accommodative (below the level implied by the rules) recently. From that perspective, a more neutral monetary policy stance would imply a convergence between these rules and the fed funds rate.

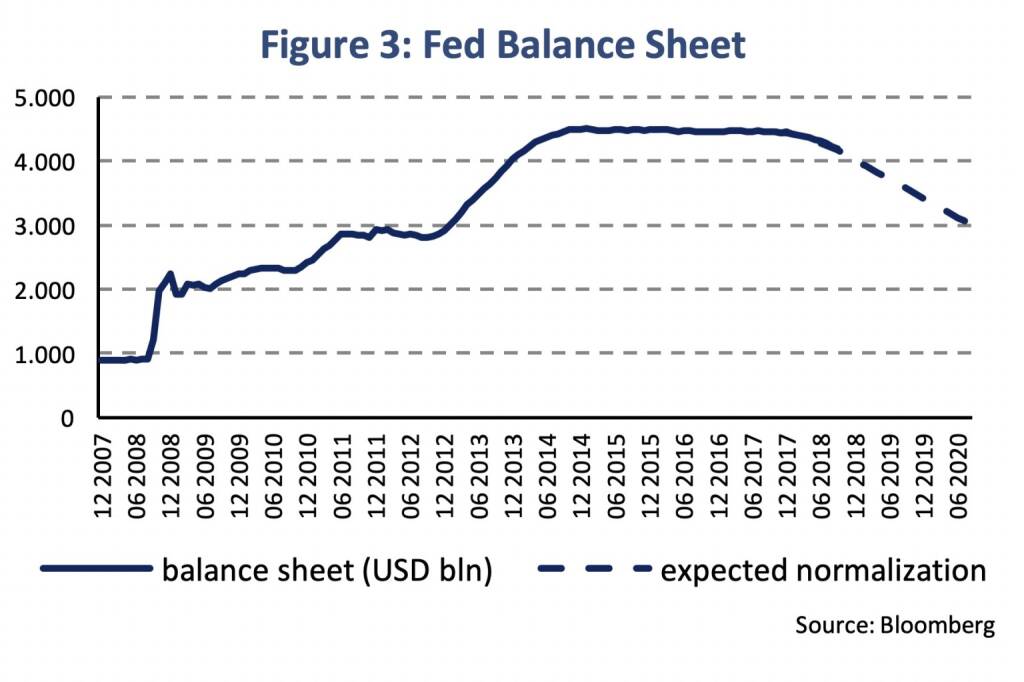

The Fed initiated the balance sheet normalization program in October 2017. Securities holdings are reduced gradually by decreasing the reinvestment of principal payments it receives from securities held in the System Open Market Account (SOMA). For principal payments from maturing treasury securities the cap was initially set at 6 bn USD per month and increased in steps of 6 bn at 3-months intervals over 12 months until reaching 30 bn per month. For principal payments from agency debt and mortgage-backed securities, the cap was initially set at 4 bn USD per month and increased in steps of 4 bn at 3-months intervals over 12 months until it reaches 20 bn per month. Between last October and September, the Fed balance sheet shrank from 4,461 bn to 4,192 bn USD which is approximately as anticipated by following the normalization principles (Figure 3).

The cumulative effect of the Fed’s asset purchases resulted in an estimated reduction of the 10-year Treasury yield term premium of about 100 basis points (Figure 4). [2]

By the end of 2017, the term premium was held down by around 89 basis points. As shown in Figure 4, the effect on the 10-year term premium will fade over the course of the next years coinciding with the normalization of the balance sheet.

In turn, the term premium which is the difference between the 10-year treasury market yield and an equivalent risk-neutral 10-year investment (rolling for example a 3-months investment over 10 years), is set to normalize to past levels. Recently, the term premium has been negative (Figure 5).

The Fed is continuing its interest rate hiking cycle leading to a higher short-term U. S. interest rates. Monetary policy is becoming less supportive (accommodative) while economic growth is projected to remain solid. The trajectory of the main policy interest rate is broadly consistent with different commonly used monetary policy rules (Taylor rules). When the huge balance sheet of the central bank decreases steadily over the next years, the effect on interest rates for longer maturities (term premium effect) will dissipate. Hence, U. S. treasury interest rates will keep rising gradually over the medium-term.

Hungary: reshaping unconventional monetary policy

- National Bank of Hungary prepares for a gradual and cautious normalization of monetary policy.

- Unconventional instruments will be simplified but remain part of the monetary policy toolkit.

- Foreign exchange swap instruments and measures affecting the interest rate corridor will continue to play a role in the future.

- 3-months deposits will phase out by year-end and the required reserve ratio will remain at 1 %.

Monetary policy normalization is already under way across the world’s leading central banks. The Fed increased its key policy interest rate for the third time this year and the ECB added a forward guidance on interest rates to its monetary policy decision statement. Moreover, regarding non-standard, or unconventional monetary policy measures the ECB anticipates ending net asset purchases under its asset purchase program by year-end while the Fed is already reducing the stock of assets accumulated under quantitative easing (QE). Among central banks in the CEE region, monetary policy has differed quite substantially so far, most prominently between the Czech National Bank (CNB) and the National Bank of Hungary (MNB). During last week’s meeting of the CNB’s board, the key policy rate was increased to 1.5 %. This is the sixth rise of interest rates since mid-2017 when the low at 0.05 % was abandoned. The MNB has been the most dovish central bank of the region with further loosening monetary policy in 2017 when the Hungarian economy was growing at a rate of 4 % and gross wage growth accelerated rapidly to reach double digit rates. However, the National Bank of Hungary is preparing to change course, even if the exact date is still unknown.

The last meeting of the MNB’s monetary council has brought substantial changes to the outlook of monetary policy in Hungary. Even if key interest rates have been left unchanged with the central bank base rate at 0.9 %, both forward guidance and unconventional monetary policy instruments have been altered. The MNB shifted to a more balanced forward guidance with highlighting the necessity of loose monetary conditions but, at the same time, preparing for a gradual and cautious normalization of monetary policy. Unconventional monetary policy instruments affecting short-term yields will be simplified and those affecting long-term yields will be fine-tuned.

The MNB differentiates between conventional and unconventional measures, regarding the base rate and forward guidance as conventional instruments. Once, the base rate neared the zero-lower bound and forward guidance was set to indicate the long-term maintenance of loose monetary conditions, unconventional instruments were added to the monetary policy toolkit. The National Bank of Hungary was quite creative and introduced six unconventional monetary policy measures targeting short-term yields.

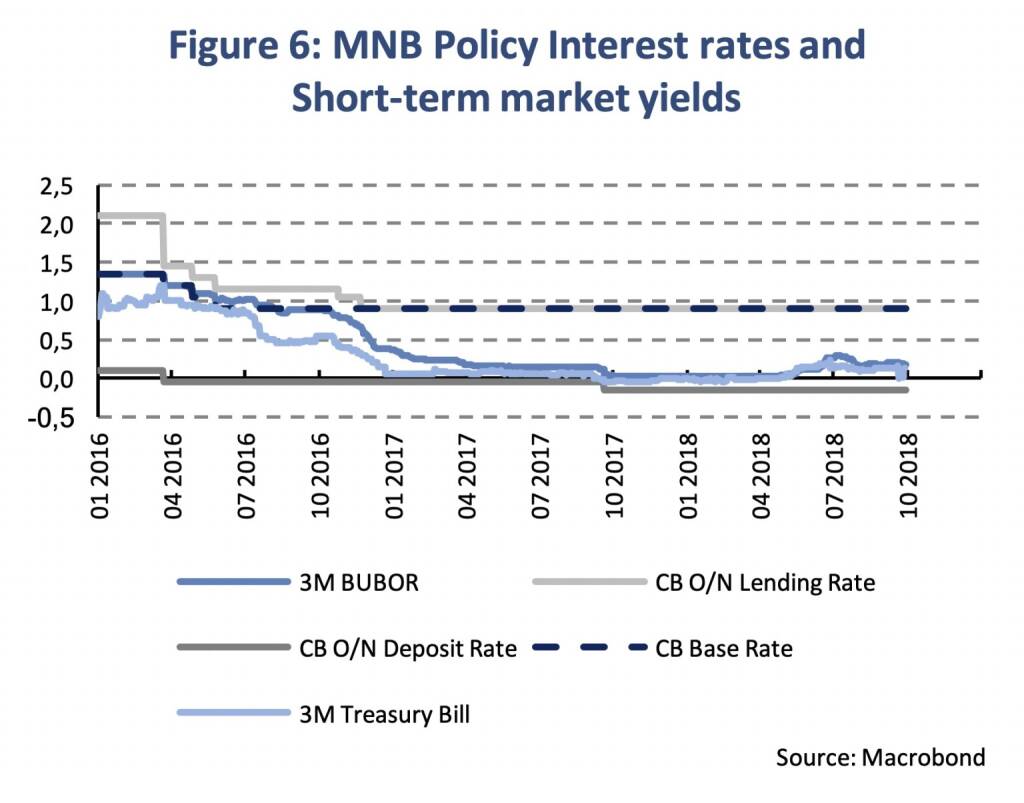

Looking at short-term market yields, such as the 3 months Budapest Interbank Offered Rate (BUBOR) and government debt securities with a maturity of 3 months, shows that the combination of measures has fulfilled their purpose. Short-term market yields had declined to the bottom of the interest rate corridor by year-end 2016 and have stayed there since then (Figure 6). Hence, without reducing the base rate further, the National Bank of Hungary managed to loosen monetary conditions by applying a set of unconventional monetary policy instruments. The MNB introduced the following six unconventional monetary policy instruments affecting short-term yields.

First, the interest rate corridor was made narrower and asymmetric. The interest rate corridor consists of interest rates paid on overnight central bank deposits and to be paid on overnight collateralized loans. These unlimited overnight standing facilities act as a ceiling and floor of short-term interbank interest rates. By setting the overnight lending facility at the base rate and the overnight deposit rate at -0.15 %, interbank interest rates were forced to fall below the base rate.

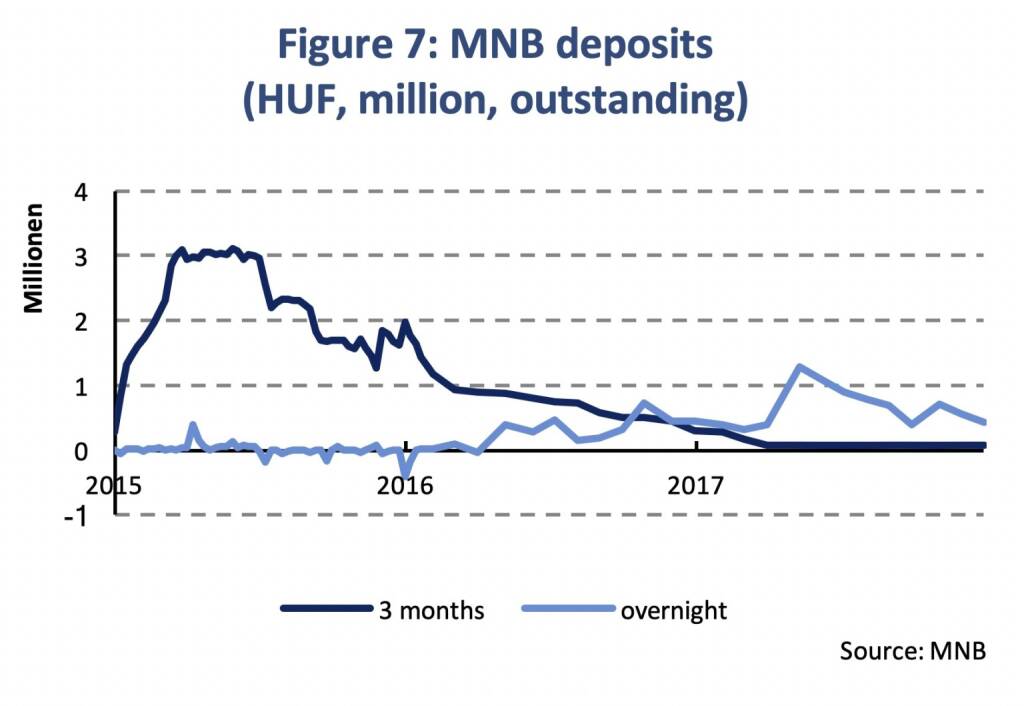

Second, banks’ access to a 3 months deposit facility, on which banks earn the base rate, has been limited and less frequently offered. The volume of outstanding deposits was limited to HUF 75 billion by the end of 2017. As part of simplifying unconventional instruments affecting short-term yields this instrument will gradually phase out from October 2018 with the last 3 months tender having been on the 19th September. As figure 7 indicates quantitative restrictions to the 3 months deposits have crowded out liquidity to the overnight deposits. The phasing out of the 3 months deposits is, however, not intended to reduce the volume of outstanding assets bearing interest at the base rate but to simplify the set of instruments and enhance transparency. Apart from 3 months deposits the MNB’s preferential deposit scheme (ca. 500 bn. HUF) as well as required reserves (ca. 220 bn. HUF) continue to bear interest at the base rate.

Third, in December 2016 the required reserve ratio was reduced to 1 % from previously 2 %, which has decreased minimum reserves held at the central bank to HUF 174 bn. (Dec. 2016) from HUF 344 bn. the month before. Changing the reserve ratio is not intended to be used in the future as an unconventional monetary policy instrument. A required reserve ratio of 1 % also complies with the ECB’s practice.

Fourth, a preferential deposit facility scheme was introduced to enable banks placing part of their excess liquidity to the MNB at the central bank’s base rate. Access to preferential deposits is, however, linked to the Market-based Lending Scheme (MLS). The MLS is a program with the intention to stimulate lending to SMEs by managing banks’ interest rate risks through providing interest rate swaps. During August 2018 banks deposited HUF 480 bn., on average, at the MNB under the preferential deposit facility, hence, exceeding required reserves. The preferential deposit facility will be prolonged as part of the Funding for Growth Fix (FSG Fix) program which will be launched in 2019. As the MLS expires, the FSG Fix program will continue to facilitate lending to SMEs by providing credit institutions with refinancing funds at an interest rate at 0 % which they lend further to SMEs to finance new investment in forint at a maximum margin of 2.5 % [3]. The total amount of the new program is HUF 1,000 bn. In contrast to previous programs the minimum maturity of loans eligible is set at 3 years and loans may only be granted for new investment purposes. The preferential deposit facility serves the purpose to sterilizing excess liquidity and, thus, ensuring the FGS Fix program to be liquidity neutral. The relevant terms & conditions, however, have not been formalized yet.

Fifth, foreign exchange (FX) swaps were introduced to provide Forint liquidity. FX swaps are seen as a strategic element of unconventional monetary policy instruments affecting short-term yields and will, therefore, remain part of the MNB’s toolkit. At the moment, Forint liquidity providing 1 week, 1 month, 3 months, 6 months and 12 months EUR/HUF FX swaps are being offered. And sixth, the BUBOR market has been reformed to better fulfil its role as a reference rate.

Looking ahead, the MNB will continue to use two unconventional monetary policy instruments. The FX swap instruments and the interest rate corridor. The 3-month deposit facility will phase out in Q4 2018 as part of simplifying central bank instruments and the preferential deposit scheme is prolonged only to neutralize liquidity provided through the new FSG Fix program. In addition to simplifying unconventional instruments affecting short-term yields, those instruments affecting long-term yields, which have only been put in place in January 2018, will phase out by year-end. On the one hand, the 5 and 10 years monetary policy interest rate swap tenders will end in December 2018. On the other hand, the mortgage bond program will end buying at the primary market by year-end. Overall, the National Bank of Hungary has acquired a large set of unconventional monetary policy instruments over the past few years. As part of a gradual and cautious normalization of monetary policy, it has now outlined to substantially simplify unconventional measures and, by doing so, make monetary policy more transparent.

[1]The real policy rate is defined as the upper band of the fed funds target range minus the PCE core inflation (PCE excluding food & energy prices). The natural rate is the Holston-Laubach-Williams (2017) natural rate of interest (Federal Reserve Bank of San Francisco). Projections are based on the median estimates of the September FOMC Summary of Economic Projections. Recessions are identified by using the NBER Business Cycle Reference Dates.

[1]Bonis, B., Ihrig, J. and M. Wei (2017): Projected Evolution of the SOMA Portfolio and the 10-year Treasury Term Premium Effect, FEDS Notes (September 22, 2017)

[1]Magyar Nemzeti Bank, (18.9.2018), Considerations behind the launch of the Funding for Growth Scheme Fix (FGS Fix) and main features of the programme.

Authors

Martin Ertl Franz Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Wiener Börse Party #1059: ATX über 5200, Erste Group-Aktie mit Windenergie erstmals in der Dreistelligkeit, Opening Bell läutet Andrea Maier

Bildnachweis

1.

Monetary Policy Tightness

2.

Taylor rules

3.

Fed Balance Sheet

4.

Term premium effect (%)

5.

10-yr term premium

6.

MNB Policy Interest rates and Short-term market yields

7.

MNB deposits (HUF, million, outstanding)

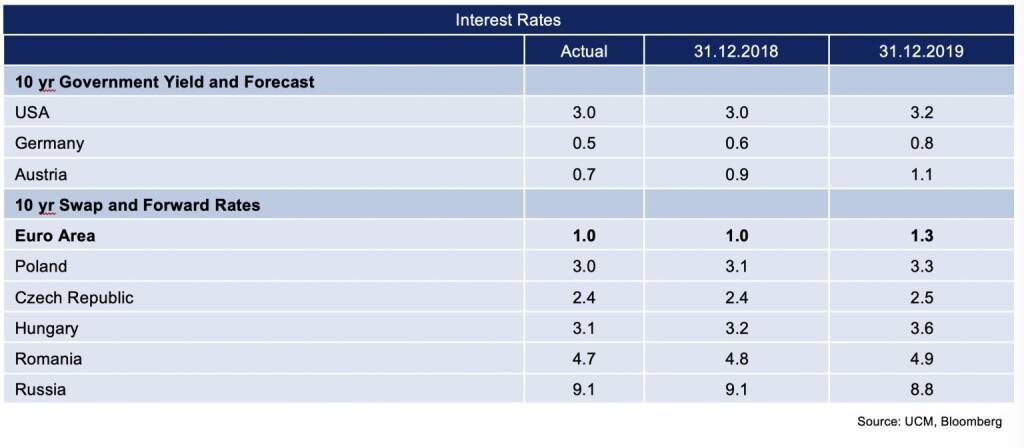

8.

Interest rates

Aktien auf dem Radar:VIG, Austriacard Holdings AG, Amag, Pierer Mobility, EuroTeleSites AG, Addiko Bank, ATX, ATX Prime, ATX TR, ATX NTR, DO&CO, Erste Group, Rosgix, EVN, voestalpine, Agrana, FACC, Frequentis, Kapsch TrafficCom, Palfinger, Semperit, BKS Bank Stamm, Oberbank AG Stamm, Mayr-Melnhof, AT&S, CPI Europe AG, Österreichische Post, RHI Magnesita, Telekom Austria, Hannover Rück, Nike.

Random Partner

FACC

Die FACC ist führend in der Entwicklung und Produktion von Komponenten und Systemen aus Composite-Materialien. Die FACC Leichtbaulösungen sorgen in Verkehrs-, Fracht-, Businessflugzeugen und Hubschraubern für Sicherheit und Gewichtsersparnis, aber auch Schallreduktion. Zu den Kunden zählen u.a. wichtige Flugzeug- und Triebwerkshersteller.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Österreich-Depots: Wochenend-Bilanz (Depot Kommentar)

» Börsegeschichte 19.12.: Kapsch TrafficCo, S Immo, UBM (Börse Geschichte)...

» Nachlese: Peter Bösenberg, credi2, Andreas Babler vs. Javier Milei (audi...

» PIR-News: Erste Group, RBI, EVN (Christine Petzwinkler)

» Wiener Börse Party #1059: ATX über 5200, Erste Group-Aktie mit Windenerg...

» Wiener Börse zu Mittag fester: RBI, Frequentis, Verbund gesucht

» Börsepeople im Podcast S22/15: Peter Bösenberg

» Börse-Inputs auf Spotify zu u.a. Andreas Babler vs. Javier Milei, Gunter...

» ATX-Trends: Erste Group, RBI, EVN, VIG, AT&S ...

» Österreich-Depots: Immer wieder am All-time-High gescheitert (Depot Komm...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Andritz und Mayr-Melnhof vs. Palfinger und RHI – ...

- VIG und Generali Assicuraz. vs. Münchener Rück un...

- Drillisch und Vodafone vs. Tele Columbus und AT&T...

- ArcelorMittal und ThyssenKrupp vs. voestalpine un...

- Callaway Golf und Puma vs. Nike und World Wrestli...

- Silver Standard Resources und Royal Dutch Shell v...

Featured Partner Video

kapitalmarkt-stimme.at daily voice: Sonderdividende oder Übergewinnsteuer, da nehmen wir zur Not allemal Marterbauers erste Wahl

kapitalmarkt-stimme.at daily voice auf audio-cd.at. Sonderdividende oder Übergewinnsteuer, da nehmen wir zur Not allemal Marterbauers erste Wahl.

Unser Ziel: Kapitalmarkt is coming home....

Books josefchladek.com

Født af mørket

2025

Gyldendal

Heustock

2025

Verlag der Buchhandlung Walther König

The waning season

2025

Nearest Truth

Il senso della presenza

2025

Self published

Sasha & Cami Stone

Sasha & Cami Stone Adriano Zanni

Adriano Zanni Regina Anzenberger

Regina Anzenberger Robert Frank

Robert Frank Niko Havranek

Niko Havranek