21st Austria weekly - Österreichische Post, Addiko Bank, CA Immo (10/03/2021)

14.03.2021, 2499 Zeichen

Austrian Post: Österreichische Post AG (Austrian Post), the postal service provider for Austria, has selected The Mobility House to support its rapidly-growing electric vehicle fleet with intelligent charging. As the Austrian Post works toward its goal of eliminating delivery emissions within the decade, they will deploy The Mobility House's ChargePilot Charging and Energy Management solution across more than 2,400 AC and DC charging stations in over 130 depot locations.

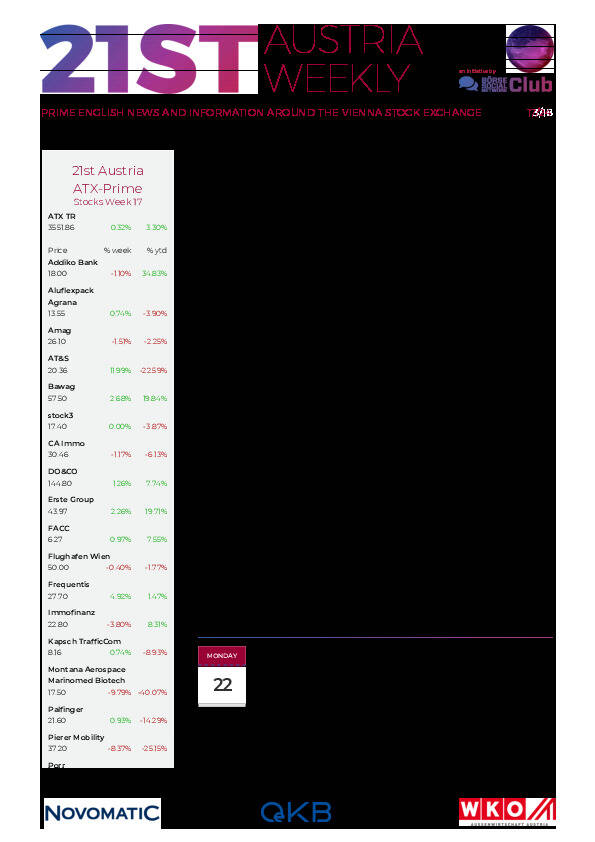

Österreichische Post: weekly performance:

Addiko Bank: Addiko Bank, a Consumer and SME specialist bank headquartered in Austria, reported a net profit of Euro 1.4 mn in 2020. The overall result was significantly impacted by a considerable increase in risk provisioning, predominantly driven by macroeconomic and portfolio behaviour expectations due to Covid-19. "The net profit of Euro 1.4 mn is a respectable achievement after reporting a loss of Euro 12.2mn for the first six months of the year 2020. This was a result of the slight economic recovery and the ramp-up of new business activities during the second half of the year while we continued to tightly manage operating costs", comments Csongor Németh, CEO of Addiko Bank AG. The outlook for 2021 and a return to a pre-crisis operating environment will largely depend on the evolution of the pandemic. "Our strategy and our digital & operational platform position us favourably to continue supporting customers and delivering value for our shareholders. It was and will remain to be of highest priority for us to ensure the safety and well-being of our customers and our staff while we continue with our efforts to gain a level playing field for our capital requirements”, hes adds. The CET1 ratio further improved to 20.3% on a transitional basis. Credit loss expenses increased to Euro -48.4 mn (YE19: +2.9 mn).

Addiko Bank: weekly performance:

CA Immo: Austrian real estate company CA Immo has signed a long-term lease agreement with Deutsche Kreditbank AG (DKB) for 34,850 sqm of rental space in the landmark office development Upbeat in Berlin’s Europacity. Upbeat is being developed as a premium, innovative, green, healthy, safe office building with cutting edge levels of technological sophistication and sustainable operations, and targeted to have at least DGNB (Gold), WiredScore (Platin), and WELL (Gold) certifications.

CA Immo: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (10/03/2021)

Zertifikat des Tages #10: Entspanntes BNP Paribas Produkt für Martmeinung "Tesla fällt", gefunden bei Hot Bets / finanzen.net

Bildnachweis

Aktien auf dem Radar:Polytec Group, Palfinger, Immofinanz, Warimpex, Flughafen Wien, Austriacard Holdings AG, Rosgix, Verbund, RBI, Porr, Frequentis, Addiko Bank, AT&S, Cleen Energy, Gurktaler AG Stamm, SBO, SW Umwelttechnik, Oberbank AG Stamm, Marinomed Biotech, Agrana, Amag, CA Immo, Erste Group, EVN, FACC, Kapsch TrafficCom, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG.

Random Partner

Fabasoft

Fabasoft ist ein europäischer Softwarehersteller und Cloud-Anbieter. Das Unternehmen digitalisiert und beschleunigt Geschäftsprozesse, sowohl im Wege informeller Zusammenarbeit als auch durch strukturierte Workflows und über Organisations- und Ländergrenzen hinweg. Der Konzern ist mit Gesellschaften in Deutschland, Österreich, der Schweiz, Großbritannien und den USA vertreten.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten