21st Austria weekly - Mayr-Melnhof, Polytec, Austrian Post, Semperit, DO&CO, Wienerberger (10/08/2023)

13.08.2023, 6793 Zeichen

Mayr-Melnhof: Cartonboard and packaging group Mayr-Melnhof reportes half-year results for 2023. The Group's consolidated sales of EUR 2,181.4 million were slightly below the previous year's figure (1st half of 2022: EUR 2,218.5 million). A primarily volume-related decline in the division MM Board & Paper was offset by an acquisition- and price-related increase in the division MM Packaging. Operating profit decreased by EUR 181.0 million from EUR 285.0 million to EUR 104.0 million. This decline primarily results from extensive market- and capex-related downtime at MM Board & Paper. The Group’s operating margin was therefore at 4.8 % (1st half of 2022: 12.8 %). Peter Oswald, MM CEO, comments: “The development of the MM Group in the 1st half-year reflects the continuing weak demand in the cartonboard and paper sector after the record year 2022. As already communicated in mid-June, the significant decline in results is mainly attributable to the weak volume development in the division MM Board & Paper. In contrast, the division MM Pack- aging was able to record an overall positive performance with the successful integration of last year's acquisitions in the resilient pharmaceutical packaging sector and factoring in one-off restruc- turing costs.”

Mayr-Melnhof: weekly performance:

Polytec: The Polytec Group, developer and manufacturer of high-quality plastic components, reported consolidated sales revenues in the first half-year of 2023 of EUR 339.6 million, 19.2% higher than in the same period of the previous year (H1 2022: EUR 285.0 million). Over the course of 2023, customer call-offs have improved significantly. The market recovery and several new product launches led to considerably higher sales figures compared to the previous year. EBITDA amounted to EUR 17.0 million in the first half of 2023 (H1 2022: EUR 17.7 million). Delivery delays for urgently needed new production facilities, which were either delayed or not yet delivered, affected internal production processes, and continued to have a significant impact on the Group's earnings situation in the second quarter of 2023. Selective plant bottlenecks and a high density of new project launches led to additional shifts and an increased number of employees.

Polytec Group: weekly performance:

Austrian Post: Economic developments and the ongoing high inflation rate continue to impact Austrian Post’s business model. Group revenue totalled EUR 1,284.8m in the first half of 2023, implying a rise of 6.0 %. “Our performance in the first half year is in line with our expectations,” says CEO Georg Pölzl. “However, we succeeded in growing revenue as well as earnings thanks to the necessary cost and price discipline,” he added. EBITDA increased by 5.3 % to EUR 189.0m and earnings before interest and taxes (EBIT) rose 4.6 % from EUR 91.0m to EUR 95.2m.

Österreichische Post: weekly performance:

Semperit: In the first half of 2023, the Semperit Group, a group that develops and manufactures products made of rubber, generated revenue of EUR 374.2 million and EBITDA of EUR 43.7 million with its continued operations. As expected, this is below the comparable figures for the previous year (–5.2% in revenue and –18.9% for EBITDA) but represents a thoroughly solid performance in a challenging market environment. In the Industrial Sector, for example, the EBITDA margin was kept almost stable at 18% despite a 4.5% drop in revenue. It should also be noted that the result for the first half of 2023 includes negative non-recurring effects of around EUR 4.1 million from the acquisition of the Rico Group and as a result of changes on the Executive Board. Overall, the Semperit Group’s earnings after tax for the first half of 2023 were positive at EUR 3.9 million, compared to EUR 34.7 million in the same period of 2022, primarily due to the end of the pandemic-related special boom in the glove sector.

Semperit: weekly performance:

DO & CO: Hospitality group DO & CO benefited from increased demand in all its divisions (Airline catering, Event caterign, Restaurant & Hotels) and, with sales of € 400.88m (PY: € 288.31m) DO & CO is reporting the strongest quarter in terms of revenue in the Company’s history. The EBITDA of the DO & CO Group was € 43.26m (PY: € 29.16m) in the first quarter of the business year 2023/2024. The EBITDA margin was 10.8% (PY: 10.1%). All DO & CO divisions are in high demand. "The strong relationships with regular customers built over the years, some of them even spanning decades, as well as the ongoing expansion of the customer base continues to drive the ongoing growth of the DO & CO Group in the future", the company emphasized. With its focus on strong innovative power, the best product quality and exceptional services, DO & CO will be able to rise even higher above its competitors in the future and to continuously improve its margins as a result.

DO&CO: weekly performance:

Wienerberger: In the first half of 2023, persistently high inflation, rising interest rates and significantly reduced affordability led to declining demand in all relevant end markets. Nevertheless, the Wienerberger Group was able to successfully maintain its position in this challenging macroeconomic environment, even compared to the record year of 2022 and generated consolidated revenues of € 2,203 million (H1 2022: € 2,572 million). Commenting on this result, Heimo Scheuch, Chairman of the Managing Board of Wienerberger AG, says, “Although operating in a difficult market environment, Wienerberger successfully held its ground in the first half of 2023. With our clear focus on innovation and proactive cost management, we succeeded in delivering a strong set of results. Especially in view of the slowdown in renovation and infrastructure as well as a significant downward trend in new construction in Central-East Europe, led by Poland and Hungary with declines of more than 40%, followed by Germany. Our North American business also performed extremely well in a declining market environment.” Faced with weakening demand, the company responded proactively already in the second half of 2022 with strict cost management to quickly increase flexibility in fixed costs, which already generated € 29 million in savings in the first half of 2023 and is currently being further intensified due to the weaker market development. Based on these measures, Wienerberger generated operating EBITDA of € 454 million in the first half of 2023 (H1 2022: € 545 million). Overall, Wienerberger thus succeeded in maintaining profitability at a high level due to a clear outperformance of the end markets and its strong solution business.

Wienerberger: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (10/08/2023)

Zertifikat des Tages #10: Entspanntes BNP Paribas Produkt für Martmeinung "Tesla fällt", gefunden bei Hot Bets / finanzen.net

Bildnachweis

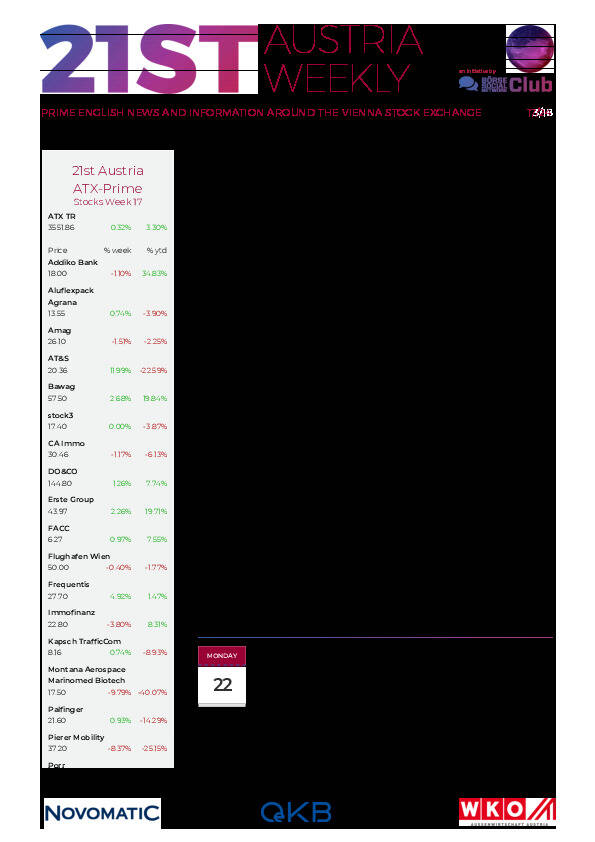

Aktien auf dem Radar:Polytec Group, Palfinger, Immofinanz, Warimpex, Flughafen Wien, Austriacard Holdings AG, Rosgix, Verbund, RBI, Porr, Frequentis, Addiko Bank, AT&S, Cleen Energy, Gurktaler AG Stamm, SBO, SW Umwelttechnik, Oberbank AG Stamm, Marinomed Biotech, Agrana, Amag, CA Immo, Erste Group, EVN, FACC, Kapsch TrafficCom, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG.

Random Partner

VAS AG

Die VAS AG ist ein Komplettanbieter für feststoffbefeuerte Anlagen zur Erzeugung von Wärme und Strom mit über 30-jähriger Erfahrung. Wir planen, bauen und warten Anlagen im Bereich von 2 bis 30 MW für private, industrielle und öffentliche Kunden in ganz Europa. Wir entwickeln maßgefertigte Projekte ganz nach den Bedürfnissen unserer Kunden durch innovative Lösungen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten