21st Austria weekly - Wienerberger, UBM, VIG (12/03/2024)

17.03.2024, 2775 Zeichen

Wienerberger: The achievements of wienerberger’s continuous sustainability efforts in 2023 have been acknowledged by global leading ESG rating agencies. For its further progress in environmental as well as social areas, wienerberger once again received top scores. The Carbon Disclosure Project (CDP) confirmed that wienerberger is taking coordinated action on climate issues, awarding it a “B” rating and placing it in the second-highest tier of all rated companies. Other scores regarding wienerberger’s sustainability efforts in 2023 include the “AAA” from MSCI, the agency’s highest ESG-rating, which wienerberger received for the eighth year in a row. With the "Prime" ESG rating from Institutional Shareholder Services (ISS ESG), wienerberger is in the top decile of rated companies in the building materials industry, a status that the company had received from ISS ESG for the first time in 2013. In addition, the sustainability rating agency EcoVadis ranked wienerberger in the top 1% of all rated companies in the industry sector, awarding it a Platinum medal. The firm Sustainalytics, specialized in assessing companies’ exposure to the risk of material financial impacts from ESG factors, rated wienerberger as “Low Risk”.

Wienerberger: weekly performance:

UBM: Real estate developer UBM is expecting negative EBT of an anticipated €39 million on the basis of the current figures for the 2023 financial year. This has been mainly caused by project and real estate revaluations totalling approx. €70 million during the past financial year, and also the continuing difficult situation on the transaction market. However, in the fourth quarter UBM succeeded in selling its 33.57% share of Palais Hansen to Wiener Städtische. At the same time, UBM invested in a 25% share of the project “Central Hub” in TwentyOne by Bondi Consult. “Despite all the current limitations, this shows our ability to act and safeguards our future for the time when the real estate crisis is over,” says Thomas G. Winkler, CEO of UBM Development AG.

UBM: weekly performance:

VIG: With double-digit premium growth and a strong increase in profit, Vienna Insurance Group (VIG) presented a successful financial year 2023. At EUR 13.8 billion, the premium volume is up 10% on the previous year's figure. The increase in gross written premiums results from all segments and lines of business. Profit before taxes increased to EUR 772.7 million. The 31.9% increase was attributable primarily to positive developments in the Austria, Extended CEE and Group Functions segments. The net result after taxes and non-controlling interests rose by 18.3% to EUR 559 million.

VIG: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (12/03/2024)

SportWoche Podcast #106: Persönliches Fail-Fazit VCM und Staatsmeisterin Carola Bendl-Tschiedel über Rekordlerin Julia Mayer

Bildnachweis

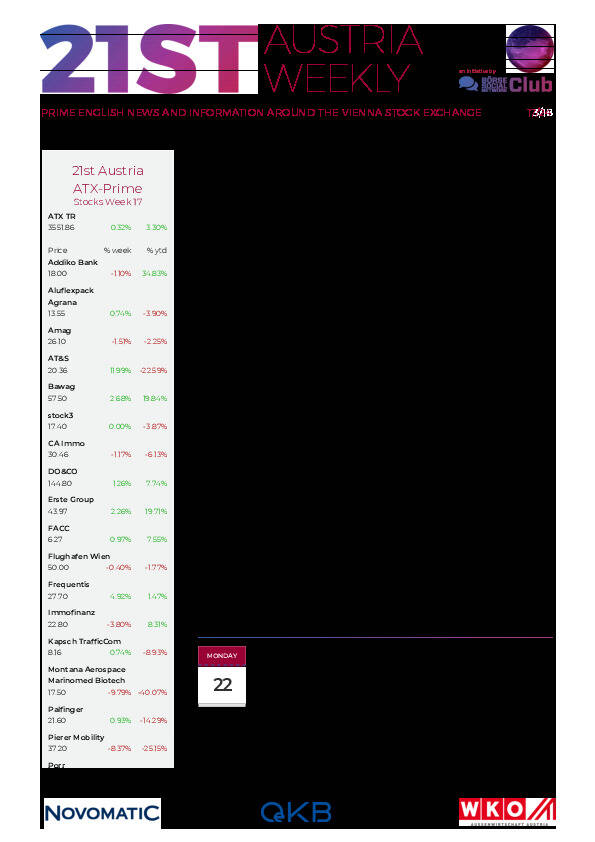

Aktien auf dem Radar:Immofinanz, Polytec Group, Marinomed Biotech, Flughafen Wien, Warimpex, Lenzing, AT&S, Strabag, Uniqa, Wienerberger, Pierer Mobility, ATX, ATX TR, VIG, Andritz, Erste Group, Semperit, Cleen Energy, Österreichische Post, Stadlauer Malzfabrik AG, Addiko Bank, Oberbank AG Stamm, Agrana, Amag, CA Immo, EVN, Kapsch TrafficCom, OMV, Telekom Austria, Siemens Energy, Intel.

Random Partner

VAS AG

Die VAS AG ist ein Komplettanbieter für feststoffbefeuerte Anlagen zur Erzeugung von Wärme und Strom mit über 30-jähriger Erfahrung. Wir planen, bauen und warten Anlagen im Bereich von 2 bis 30 MW für private, industrielle und öffentliche Kunden in ganz Europa. Wir entwickeln maßgefertigte Projekte ganz nach den Bedürfnissen unserer Kunden durch innovative Lösungen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten