11.12.2017, 7486 Zeichen

- The National Bank of Poland has kept its monetary policy rate unchanged at 1.5 %.

- The minutes of the November meeting show a lively discourse within the Monetary Policy Council.

- Headline inflation has reached the 2.5 % inflation target but core inflation remains low.

- Wage pressure on inflation remains limited, so far, as unit labor costs remain stable.

- Strong growth in construction activity points towards a recovery in investment.

Two weeks after our analysis of the introduction of new unconventional monetary policy instruments in Hungary, we take a look at the National Bank of Poland (NBP). The NBP shows the most stable interest rate outlook among the Central European central banks, with its governor Glapinski signaling no rate hike until the end of 2018. At its two-day Monetary Policy Meeting, last Monday/Tuesday, the NBP has kept its key interest rate unchanged at 1.5 %. The minutes of last month’s MPC’s decision-making meeting, however, reveal a lively debate about the medium-term interest rate path.

There is uncertainty about the intensification of domestic inflationary pressure. The latest inflation projection from the November inflation report shows inflation at 1.9 % in 2017, 2.3 % in 2018 and 2.7 % in 2019. In November inflation increased to 2.5 % after 2.1 % in October. While the majority of council members interpreted the inflation projections as “remaining close to the target”, some Council members highlighted the fact that the projection for 2019 is already above the NBP’s 2.5 % inflation target. The next inflation report will be published in March 2018, which according to the MPC’s minutes will “be an important prerequisite for an assessment of [the monetary policy] prospects.”[1]

Analyzing the drivers of inflation, based on Eurostat’s Harmonized Index of Consumer Prices (HICP), shows that price increases were mainly driven by the food and energy components of HICP. Services and non-energy industrial goods, which can be controlled more directly by monetary policy, have only played a secondary role in explaining recent inflation dynamics (Figure 1).

Without a visible acceleration of core inflation, the majority of the NBP’s Monetary Policy Council members will hesitate to suggest increasing interest rates. Core inflation was at 0.8 % in October. With core inflation substantially below the 2.5 % inflation target there is still scope for inflationary pressure to emerge.

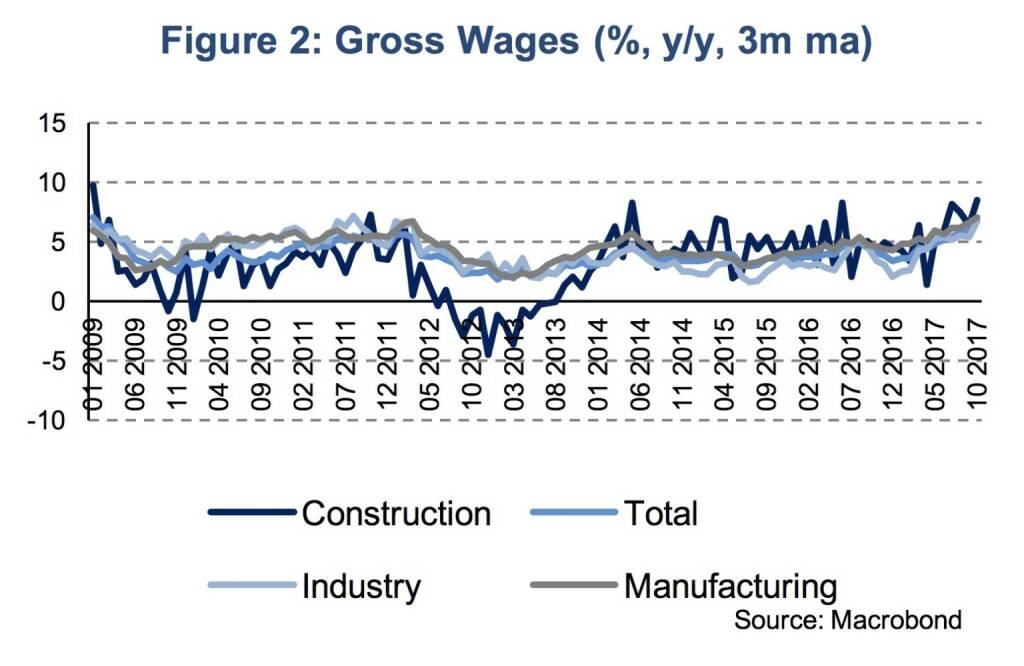

The labor market shows first signs of inflationary pressure. Figure 2 displays the development of gross wages in various sectors of the economy. In October gross wages increased by 7.4 % (y/y) after 6 % in September. Wage pressure is supported by a record low unemployment rate of 6.6 in October and steady employment growth of above 4 % since the beginning of the year. This is in spite of a positive labor supply shock of immigrations from Ukraine. According to estimates from the NBP there will be 1.2 million immigrants from Ukraine in 2017, or 4 % of the Polish labor force.

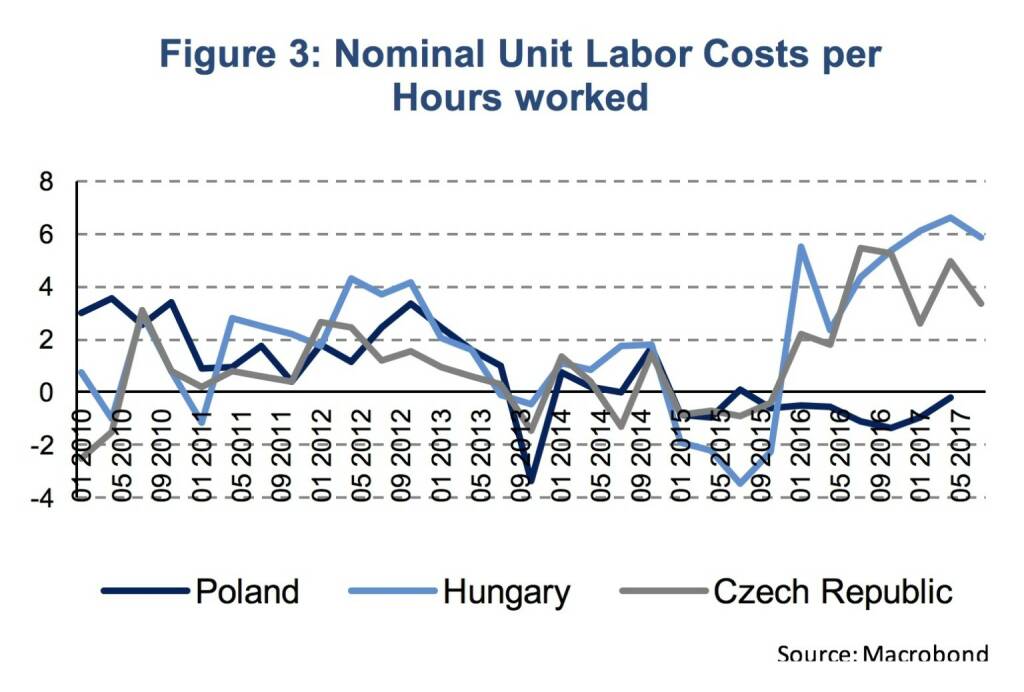

To what extent rising wages result in rising costs of production depend, upon other factors, on the productivity performance of Polish firms. If wage growth is accompanied by an equivalent increase in labor productivity, there should be no inflationary pressure from increasing labor input costs. Interestingly, nominal unit labor costs, which is the ratio of compensation per employee and labor productivity, is in moderate decline. In Q2 2017 nominal unit labor costs per hours worked

declined by 0.4 % (y/y) after a decline of 0.7 % in Q1 2017 (Figure 3). It will be interesting to see whether the acceleration of wage growth in Q3 will result in rising unit labor costs. As long as, we do not see a marked increase in unit labor costs, the inflationary pressure from wages should be limited. Comparing the development of nominal unit labor costs across the Central European region shows that the economic situation in Poland differs from those in Hungary and the Czech Republic. The development of unit labor costs clearly shows why the NBP has not started an interest rate hiking cycle yet, while its counterpart in the Czech Republic did. The introduction of additional measures to further loosen monetary conditions in Hungary remains to be puzzling from a wage pressure

perspective.

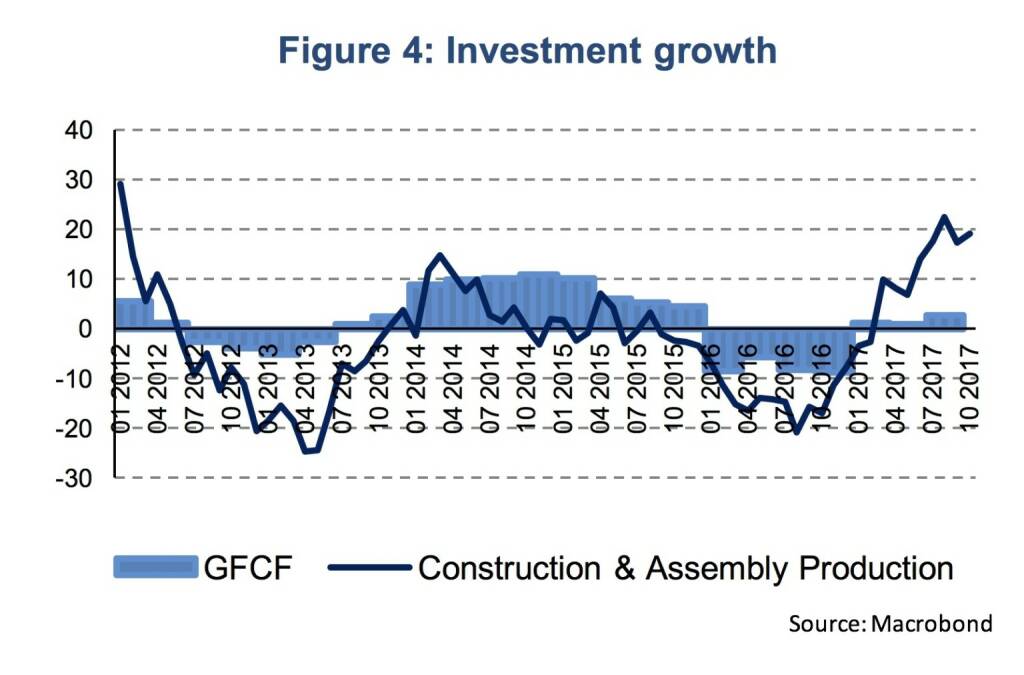

Apart from the dynamics of inflation and wages, the Monetary Policy Council of the NBP has discussed the development of investment activity. During the first two quarters of the year investment, which is measured as gross fixed capital formation, has not contributed to the expansion of the Polish economy. The acceleration of GDP growth to 5.2 % (y/y, sa) in Q3 after 4.3 % in Q2 2017, was, however, at least partly due to stronger investment growth. Gross fixed capital formation increased by 2.7 % (y/y, sa) during the third quarter. Construction and assembly production increased by 19 % in Q3 as well as October 2017 after 1.3 % in Q1 and 9.7 % in Q2 (Figure 4). However, uncertainty about the pace and duration of the recovery of investment poses a negative risk to the NBP’s GDP growth projection of 3.6 % for the year 2018. In the November projection, the NBP assumes gross fixed capital formation growth of 7.6 % (y/y) in 2018. The development of investment is relevant for the Monetary Policy Council which expressed the view that a “stabilization of interest rates would support the expected recovery in investment”.

The minutes of the MPC’s November meeting show a variety of opinions regarding the medium-term interest rate outlook. The next inflation report in March will be of upmost importance. Furthermore, the development of core inflation, wages and unit labor costs should be monitored very closely over the next months. If core inflation accelerates faster than anticipated or higher than expected wage growth leads to rising unit labor costs the majority within the NBP may shift, resulting in a first interest rate hike already before the end of 2018. At the moment, forward rates imply a first rate hike in Q4 2018.

Authors

Martin Ertl, Franz Zobl

Disclaimer

This publication is neither a marketing document nor a financial analysis. It merely contains information on general economic data. Despite thorough research and the use of reliable data sources, we cannot be held responsible for the completeness, correctness, currentness or accuracy of the data provided in this publication.

Our analyses are based on public Information, which we consider to be reliable. However, we cannot provide a guarantee that the information is complete or accurate. We reserve the right to change our stated opinion at any time and without prior notice. The provided information in the present publication is not to be understood or used as a recommendation to purchase or sell a financial instrument or alternatively as an invitation to propose an offer. This publication should only be used for information purposes. It cannot replace a bespoke advisory service to an investor based on his / her individual circumstances such as risk appetite, knowledge and experience with financial instruments, investment targets and financial status. The present publication contains short-term market forecasts. Past performance is not a reliable indication for future performance.

[1] “If incoming data and forecasts during the following quarters suggest a more marked intensification of inflationary pressure, it might be justified to consider an increase in the NBP interest rates in the quarters to come.”

Börsepeople im Podcast S23/11: Daniela Herneth

Bildnachweis

1.

Contribution to HICP growth

2.

Gross Wages

3.

Nominal Unit Labor Costs

4.

Investment growth

5.

Interest Rates

Aktien auf dem Radar:AT&S, OMV, Lenzing, Amag, EuroTeleSites AG, Zumtobel, Österreichische Post, DO&CO, Josef Manner & Comp. AG, Rath AG, RBI, Semperit, Warimpex, Telekom Austria, BKS Bank Stamm, Oberbank AG Stamm, Austriacard Holdings AG, Agrana, CA Immo, EVN, Flughafen Wien, Frequentis, CPI Europe AG, Verbund.

Random Partner

Hypo Oberösterreich

Sicherheit, Nachhaltigkeit und Kundenorientierung sind im Bankgeschäft Grundvoraussetzungen für den geschäftlichen Erfolg. Die HYPO Oberösterreich ist sicherer Partner für mehr als 100.000 Kunden und Kundinnen. Die Bank steht zu 50,57 Prozent im Eigentum des Landes Oberösterreich. 48,59 Prozent der Aktien hält die HYPO Holding GmbH. An der HYPO Holding GmbH sind die Raiffeisenlandesbank Oberösterreich AG, die Oberösterreichische Versicherung AG sowie die Generali AG beteiligt.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Österreich-Depots: Rekord (Depot Kommentar)

» Börsegeschichte 5.2.: Wolfgang Eder, Polytec (Börse Geschichte) (BörseGe...

» Nachlese: Wolfgang Matejka (audio cd.at)

» Wiener Börse Party #1088: ATX heute schwächer, Addiko Bank gesucht, Edi ...

» PIR-News: Research zu Semperit, Post eröffnet in Linz, Erste Group finan...

» Schnellster Runder-Marken-Sprung im ATX TR finished (Christian Drastil)

» Wiener Börse zu Mittag leichter: Addiko Bank und FACC gesucht

» Börse-Inputs auf Spotify zu u.a. ATX TR 14.000, BASF, Brenntag, Wolfgang...

» ATX-Trends: AT&S, Erste Group, OMV, Lenzing ...

» Österreich-Depots: Wieder Rekord (Depot Kommentar)

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wiener Börse: ATX gibt am Donnerstag 1,93 Prozent ab

- Wiener Börse Nebenwerte-Blick: Semperit steigt 3,...

- Wie Rath AG, Semperit, Josef Manner & Comp. AG, W...

- Wie RBI, Verbund, Bawag, voestalpine, SBO und Len...

- Strabag erhält Straßenbau-Aufträge in Polen im We...

- Österreich-Depots: Rekord (Depot Kommentar)

Featured Partner Video

Wiener Börse Party #1070: ATX etwas schwächer, AT&S gesucht, Marinomed-Manager wechselt zu Reploid, Viktoria Gass Opening Bell

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse. Inh...

Books josefchladek.com

Home is where work is

2024

Self published

Ctonio

2024

Studiofaganel

Someday Somewhere (Aru hi aru tokoro, 石元泰博 ある日ある所)

1958

Geibi Shuppan

It’s hard to stop rebels that time travel

2025

Void

Claudia Andujar

Claudia Andujar Tehching Hsieh

Tehching Hsieh Livio Piatti

Livio Piatti Pia Paulina Guilmoth & Jesse Bull Saffire

Pia Paulina Guilmoth & Jesse Bull Saffire Sasha & Cami Stone

Sasha & Cami Stone