21st Austria weekly - Rosenbauer (05/04/2019)

07.04.2019, 1644 Zeichen

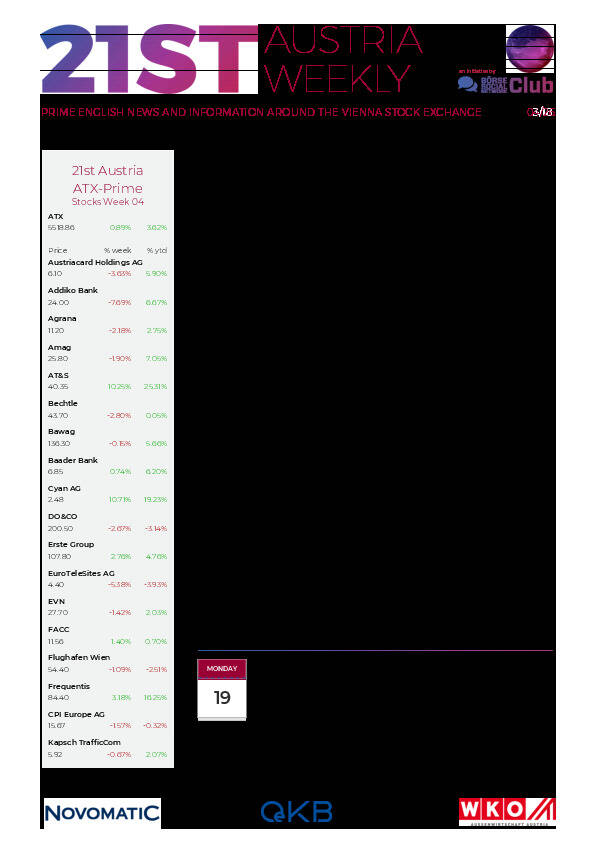

>> Öffnen auf photaq.com Rosenbauer:The Rosenbauer Group, world’s leading manufacturer of systems for firefighting and disasterprotection, closed the 2018 financial year with some all-time highs, as revenues of Euro 909.4 mn (2017: Euro 847.6 mn) and incoming orders of Euro 1,107.7 min (2017: Euro 970 mn) both marked new records. At the same time, the last three months of the financial year also represented the strongest quarter in the company’s history, with revenues of Euro 357.4 mn. The business growth was particularly attributable to Western Europe and the Middle East, with Stationary Fire Protection, Germany and Austria also posting increases. Profitability improved, as targeted, with EBIT of Euro 48.8 mn (2017: Euro 21.1 mn) and an EBIT margin of 5.4%.Incoming orders reached another all-time high of Euro 1,107.7 mn in 2018 (2017: Euro 970 mn). The biggest contribution to this growth came from the MENA area, which won a tender by the General Department of Civil Defense in Kuwait. This major order with a volume of around Euro 35 mn comprises 55 vehicles, including seven aerial ladders and five Panter 6x6. There were also substantial increases in incoming orders in the APAC area and in Stationary Fire Protection. As of December 31, 2018, the order backlog amounted to Euro 1,052.3 mn, up 19% on the previous year’s figure (2017: Euro 882.6 mn). The Executive Board and the Supervisory Board will propose a dividend of Euro 1.25 (2017: Euro 1.00) per share at the Annual General Meeting to validate the investors’ trust.Rosenbauer: weekly performance: 5.32%(From the 21st Austria weekly https://www.boerse-social.com/21staustria (05/04/2019)

Wiener Börse Party #1079: Kleine ATX-Korrektur am Ende einer weiteren Rekordwoche, Erste 2x über 100, Porr und AT&S vor den Vorhang

Bildnachweis

Aktien auf dem Radar:EuroTeleSites AG, RHI Magnesita, Flughafen Wien, Austriacard Holdings AG, Addiko Bank, Zumtobel, FACC, Pierer Mobility, Andritz, CA Immo, Lenzing, Mayr-Melnhof, OMV, UBM, SBO, Wiener Privatbank, Frequentis, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, Amag, EVN, CPI Europe AG, Österreichische Post, Telekom Austria, Verbund, adidas, Fresenius Medical Care, Volkswagen Vz., Siemens Energy, Hannover Rück.

Random Partner

REPLOID Group AG

Die 2020 gegründete REPLOID Group AG stellt hochwertige Proteine und Fette sowie biologischen Dünger aus der Aufzucht von Larven der Schwarzen Soldatenfliege her. In den für ihre Kunden errichteten Mastanlagen – den REPLOID ReFarmUnits – erhalten vom Unternehmen gelieferte Junglarven eine auf den jeweiligen Standort abgestimmte Futtermischung aus Reststoffen der regionalen Lebensmittel-Wertschöpfungskette. Nach erfolgter Mast übernimmt REPLOID die Larven zur zentralen Vermarktung.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten