21st Austria weekly - Immofinanz, Fabasoft, Porr (29/08/2019)

01.09.2019, 2695 Zeichen

Immofinanz: The strong earnings development recorded by real estate company Immofinanz continued during the first half of 2019. Rental income rose by 10.8% (including the effects from the initial application of IFRS 16) to Euro 131.8 mn. After an adjustment for the IFRS 16 effects, the increase equalled 4.2%. The results of asset management increased 6.6% to Euro 101.0 mn, the operating profit (EBIT) rose by 63.9% to Euro 203.4 min and sustainable FFO 1 (before tax) from the standing investment business improved by 22.0% to Euro 59.0 mn. Net profit more than doubled to Euro 185.3 mn. “This very good first half-year follows our strong performance in 2018. Against this backdrop, we are raising our outlook for pre-tax FFO 1 in 2019 and now expect more than Euro 115 mn. That means FFO 1 before tax of roughly Euro 128 mn together with our dividend from S Immo“, indicated Immofinanz CEO Oliver Schumy. “We have successfully returned to a growth course following the portfolio restructuring measures and efficiency improvements implemented in recent years. Together with our latest acquisitions in the office and retail areas, our property portfolio is approaching a value of roughly five billion Euros.“

Immofinanz: weekly performance:

Fabasoft: Fabasoft, a software product company and provider of cloud services in Europe for the digital control of documents as well as electronic document, process and records management, recored revenue of Euro 10.9 mn in the first quarter of the fiscal year 2019/2020 (8,8 mn in the corresponding period of the previous year). EBIT was Euro 2.082 mn (1,5 mn in the corresponding period of the previous year). The Fabasoft Group employed a workforce of 246 on the interim balance sheet date 30 June 2019 (212 employees on 30 June 2018).

Fabasoft: weekly performance:

Porr: Construction group Porr's record order backlog of Euro 7,600 mn in the first half of 2019 has secured full capacity utilisation for the future. The consolidation path led to a moderate increase in production output of 1.6% to Euro 2,497 mn. In addition, EBT climbed to Euro 8.2 mn in the first half of the year. “The construction sector is currently experiencing a historically unique situation. With a record cushion of orders at Porr as well as uninterrupted demand for our construction services, we nonetheless face a difficult market environment. That said, our markets offer long-term potential”, said Karl-Heinz Strauss, CEO of Porr. “With Porr 2025, we have introduced a transformation programme to exploit this opportunity as effectively as possible”.

Porr: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (29/08/2019)

Wiener Börse Party #1110: ATX mehr als 2 Prozent tiefer, Verbund gesucht, Andritz vielversprechend und Gabler statt Babler

Bildnachweis

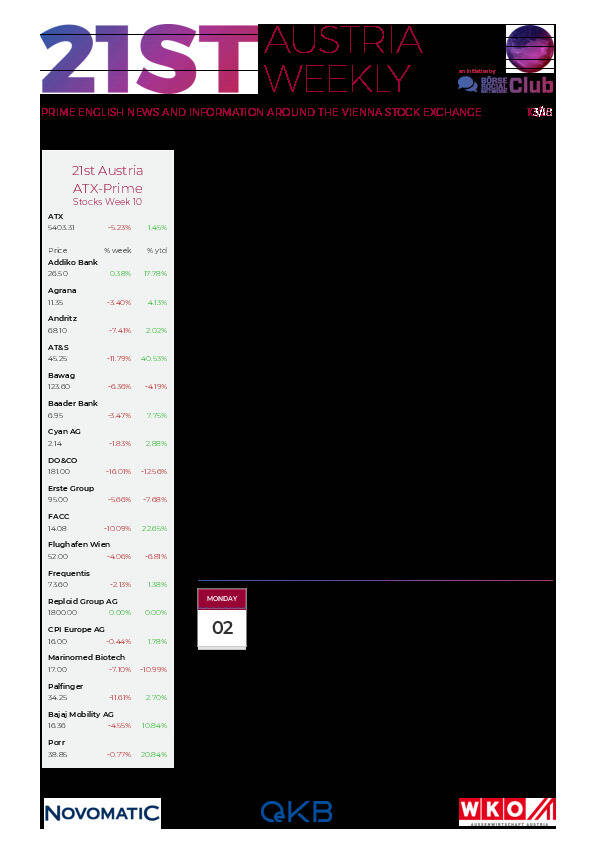

Aktien auf dem Radar:FACC, RHI Magnesita, Amag, Agrana, Austriacard Holdings AG, Kapsch TrafficCom, Wolford, UBM, AT&S, DO&CO, Rath AG, RBI, Verbund, Wienerberger, Warimpex, Zumtobel, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Flughafen Wien, CA Immo, EuroTeleSites AG, CPI Europe AG, Österreichische Post, Telekom Austria, Infineon, Deutsche Boerse, Fresenius Medical Care, SAP, Scout24, Continental.

Random Partner

3 Banken Generali

Die 3 Banken-Generali Investment-Gesellschaft m.b.H. ist die gemeinsame Fondstochter der 3 Banken Gruppe (Oberbank AG, Bank für Tirol und Vorarlberg Aktiengesellschaft, BKS Bank AG) und der Generali Holding Vienna AG. Die Fonds-Gesellschaft verwaltet aktuell 8,65 Mrd. Euro - verteilt auf etwa 50 Publikumsfonds und 130 Spezial- bzw. Großanlegerfonds (Stand 06/17)

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten