21st Austria weekly - Austrian Post, Mayr-Melnhof, Vienna Airport (Flughafen Wien), RBI, Do&Co (14/11/2019)

17.11.2019, 4547 Zeichen

Austrian Post: Austrian Post’s Group revenue amounted to Euro 1,462.2 mn in the first three quarters of the current financial year. This implies an increase of 3.2% from the prior-year level. Both the Parcel & Logistics Division (+11.3%) and the Mail & Branch Network Division (+0.6%) showed a positive development in the reporting period. From an earnings perspective, EBIT of the Austrian Post Group showed an upward operating trend in the first nine months of 2019, consistent with the previous two quarters. The reported EBIT of Euro 130.0m was down by 8.4% from the previous year due to the provision for data protection totalling Euro 19.8 mn, allocated in the third quarter of 2019. For the full-year 2019, Austrian Post expects an increase in revenue as in previous periods. Based on the good trends in the core business, a stable operating earnings (EBIT) is broadly being targeted, including various start-up costs for setting up the financial services business. This does not include the administrative fine by the Austrian Data Protection Authority. For 2020, Austrian Post also forecasts a stable to slightly higher revenue and plans further broad stability in operating earnings (EBIT).

Österreichische Post: weekly performance:

Mayr-Melnhof: The Mayr-Melnhof Group was able to maintain with a good third quarter the growth in sales and results in the first three quarters of 2019 despite slowed market dynamics. The consolidated sales of the Group totaled Euro 1,924.3 mn and were thus 9.1 % above the previous year’s value. This increase primarily resulted acquisition-related from the packaging division. At Euro 195.6 mn, an operating profit 13.5 % above the previous year’s value was achieved, with MM Packaging accounting for two thirds and MM Karton for one third of the increase. In the course of the initial consolidation of the Tann-Group one-off expenses from acquisition effects totaling Euro -4.8 mn were reported due to recognition of order backlog and inventory measurement. The operating margin amounted to 10.2 % (1-3Q 2018: 9.8 %). Based on the strong earnings development in the first nine months the positive prospects for the whole financial year 2019 remain however in place.

Mayr-Melnhof: weekly performance:

Vienna Airport (Flughafen Wien): Revenue generated by the Flughafen Wien Group in Q1-3/2019 improved by 7.8% to Euro 642.9 mn, and EBITDA improved by 10.2% to Euro 313.1 mn. EBIT in Q1-3/2019 increased by 12.9% to Euro 215.0 mn, and the net profit for the period before non-controlling interests climbed 14.4% in Q1-3/2019 to Euro 152.1 mn. Net profit for the period after minorities rose by 14.7% to Euro 138.7 mn. The Flughafen Wien Group including the foreign strategic investments in Malta Airport and Kosice Airport handled a total of 30.1 million passengers in the period January to September 2019, comprising a year-on-year rise of 16.6% from the prior-year level.

Flughafen Wien: weekly performance:

Raiffeisen Bank International: In the first three quarters of 2019, Raiffeisen Bank International (RBI) generated a consolidated profit of Euro 874 mn (vs 1,173 mn in 1-9 2018). The year-on-year decline must be seen in the light of the very good result of the comparative period, which had been supported by an exceptionally high net release under impairment losses on financial assets due to releases of loan loss provisions and gains from sales of non-performing loans, the bank stated. “We recorded very pleasing earnings growth during the first nine months of the year,” said CEO Johann Strobl. “Credit growth exceeded our expectations as well despite the economic slowdown,” Strobl continued. Adjusted for revenues from the Polish banking operations sold in 2018, net interest income and net fee and commission income increased significantly, with these core revenues up 8 per cent year-on-year.

RBI: weekly performance:

Do&Co: Catering company Do&Co recorded revenue of Euro 507.85 mn, representing an increase in revenue of 17.0%, in the first half of the business year 2019/2020. For the first half of the business year 2019/2020, the Group achieved a profit after income tax of Euro 22.04 mn, an increase of Euro 2.61 mn on the same period of the previous year. This means an increase of 13.4% of the profit after income tax on the previous year. The net profit attributable to the shareholders of Do&Co amounts to Euro 14.95 mn (PY: Euro 15.96 mn).

DO&CO: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (14/11/2019)

Börsepeople im Podcast S12/13: Carola Bendl-Tschiedel

Bildnachweis

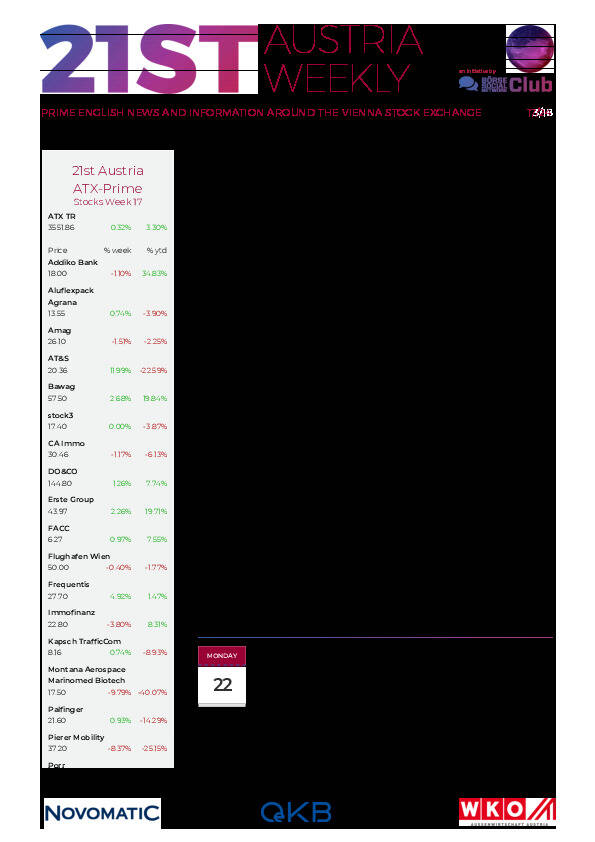

Aktien auf dem Radar:Polytec Group, Immofinanz, Palfinger, Warimpex, Flughafen Wien, Austriacard Holdings AG, EVN, Rosgix, S Immo, Erste Group, Österreichische Post, Cleen Energy, Marinomed Biotech, Pierer Mobility, RBI, Addiko Bank, SW Umwelttechnik, Oberbank AG Stamm, Agrana, Amag, CA Immo, Kapsch TrafficCom, OMV, Telekom Austria, Uniqa, VIG, Wienerberger, Mercedes-Benz Group, Siemens Energy, Deutsche Post, Allianz.

Random Partner

Wolftank-Adisa

Die Wolftank-Adisa Holding AG ist die Muttergesellschaft einer internationalen Unternehmensgruppe mit Fokus auf Sanierung und Überwachungen von (Groß–)Tankanlagen und Umweltschutz-Dienstleistungen bei verseuchten Böden und Einrichtungen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten