21st Austria weekly - Atrium, ams (19/03/2020)

22.03.2020, 2948 Zeichen

Atrium: Atrium European Real Estate Limited, owner, operator and redeveloper of shopping centres and retail real estate in Central Europe, makes the following statement to update shareholders on recent government announcements in response to the COVID-19 virus within the Company's operational jurisdictions. Over the last week, shopping centres within Poland, the Czech Republic and Slovakia have faced government imposed trading restrictions. In all three countries the restrictions exclude grocery stores/supermarkets, pharmacists/ drugstores and other necessity services. Also Russ announced its first internal restrictions in some cities which include banning all outdoor events and limiting indoor gatherings to 50 people. Atrium said it is continuing to monitor announcements by the authorities in allits areas of operation. At present, it is too early to ascertain the full impact these recent government orders, or the COVID-19 pandemic itself, will have on either the Company's business and financial position, or that of its tenants. The Company is also actively prioritising its capex programme to defer non-essential capital expenditure, and, in parallel, reducing its operational expenses in response to these new measures. With a strong balance sheet, a net LTV of 35% and access to credit facilities, the Company believes it has sufficient resources to manage its liquidity needs.

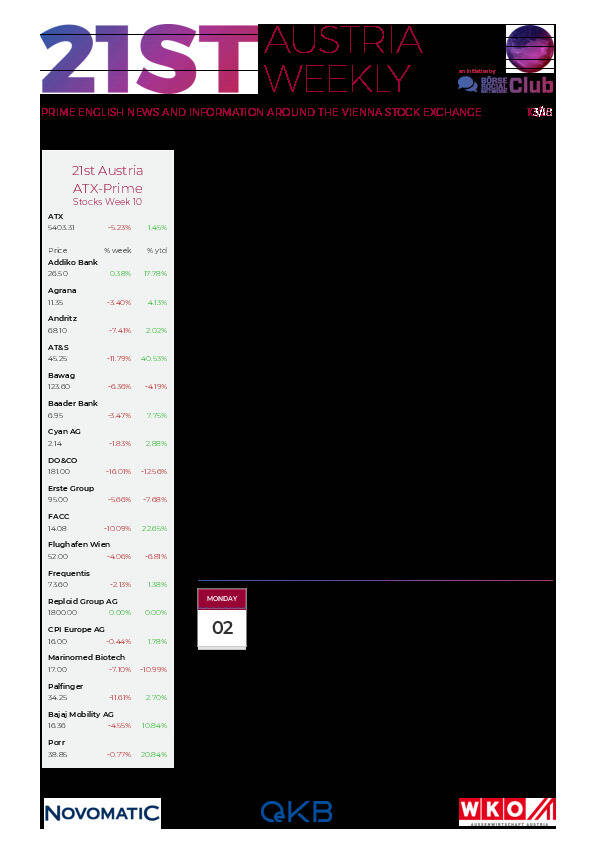

Atrium: weekly performance:

ams: ams, worldwide supplier of high performance sensor solutions, confirms that it expects the Public Offer to close in the second quarter 2020. The only remaining closing condition relates to the receipt of the required regulatory approvals. In the meantime, ams has increased its direct shareholding in Osram to 23.4% funded from existing cash resources, which further demonstrates the commitment to closing the Public Offer and realizing the combination of ams and Osram. "We are more convinced than ever of the compelling strategic logic and value creation potential of combining ams and Osram based on our ongoing interactions with OSRAM to prepare for post merger integration," says Alexander Everke, CEO of ams. "This logic is unaffected by the current capital market and end market environment attributable to Covid-19. We continue to receive positive feedback from our shareholders regarding the strategic rationale and the capital increase." The Rights Issue is proceeding pursuant to the terms set out in the prospectus and is fully underwritten by a syndicate consisting of the same banks that have also underwritten a fully committed acquisition bridge facility of up to Euro 4.4 bn; this syndicate comprises of UBS, HSBC, BofA Securities, Citigroup, Commerzbank, Deutsche Bank, Morgan Stanley and Erste Group. ams has thus secured all necessary funding for completing the Public Offer.

AMS: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (19/03/2020)

D&D Research Rendezvous #20: Gunter Deuber sieht Europas Sonderkonjunktur nun at risk - intensiver Blick auf die Aktienmärkte

Bildnachweis

Aktien auf dem Radar:FACC, RHI Magnesita, Amag, Agrana, Austriacard Holdings AG, Kapsch TrafficCom, Wolford, UBM, AT&S, DO&CO, Rath AG, RBI, Verbund, Wienerberger, Warimpex, Zumtobel, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Flughafen Wien, CA Immo, EuroTeleSites AG, CPI Europe AG, Österreichische Post, Telekom Austria, Infineon, Deutsche Boerse, Fresenius Medical Care, SAP, Scout24, Continental.

Random Partner

Novomatic

Der Novomatic AG-Konzern ist als Produzent und Betreiber einer der größten Gaming-Technologiekonzerne der Welt und beschäftigt mehr als 21.000 Mitarbeiter. Der Konzern verfügt über Standorte in mehr als 45 Ländern und exportiert innovatives Glücksspielequipment, Systemlösungen, Lotteriesystemlösungen und Dienstleistungen in mehr als 90 Staaten.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten