21st Austria weekly - KTM, RHI Magnesita, Andritz (05/05/2020)

10.05.2020, 4375 Zeichen

KTM: KTM terminates short-time work for all 3,800 employees. Europe's largest motorcycle manufacturer reacted proactively to the COVID 19 crisis in March and stopped production as part of the short-time work model due to the interruption of the supply chain from Italy. Due to the resumption of production by the Italian supplier companies in the last week, motorcycle production now starts on Monday May 11, 2020 in several steps until full operation on May 18, 2020. The sales figures from Scandinavia and those regions such as Austria, Germany and China, where the dealers have already opened, give a positive outlook. In addition, due to the COVID 19-related measures, KTM anticipates that the two-wheeler will become increasingly important for private transport.

Pierer Mobility AG: weekly performance: 19.35%

RHI Magnesita: RHI Magnesita, global supplier of refractory products, systems and solutions, provides an update on measures being taken in response to the Covid-19 pandemic and trading for the three months to 31 March 2020. As outlined in the Company's 2019 full year results on 1 April 2020, the difficult market environment of the second half of 2019 continued into the first quarter of 2020, with limited impact from COVID-19. Trading activity in the Steel Division remained weak in Europe and South America, largely offset by a robust performance in North America. The Industrial Division continued to perform well, particularly in Cement. Overall, demand levels were similar to the final quarter of 2019 with EBITA slightly ahead, in line with management expectations. Raw material prices have fallen further in 2020, given the reduction in overall demand and uninterrupted supply from China, which has had a consequential impact on the pricing of some of the Group's products. The trading environment has become increasingly challenging in Q2 as a result of COVID-19, with a significant slowdown in customer activity and fall in order book levels, as expected. In the Steel Division, customer production has reduced in response to the economic slowdown caused by the COVID-19 crisis. To date, the Industrial Division has remained more resilient, particularly in areas where maintenance work has been accelerated during shutdowns, although there have been some project postponements. The business has increased the focus on cost management which includes the temporary closure of three plants in Europe and one plant in Mexico; the introduction of short time working arrangements; the deferral of at least Euro 45 mn of capital expenditure in 2020; no final 2019 dividend proposal; and fixed cost reduction actions, such as a hiring freeze on all non-critical roles and restricting discretionary expenditure. In recognition of these steps, the Board and the Executive Management Team have elected to reduce their fees and salary for at least the next three months. The Group's previously announced Production Optimisation Programme remains on track, expecting to deliver benefits of Euro 40 mn improvement in EBITA by 2022, with an additional benefit of Euro 15 mn in 2020 from the turnaround of the previously identified operational issues. The Group has a strong liquidity position, which increased to Euro 1.2 bn in Q1 2020. The overall impact of COVID-19 and, in particular, the extent and the duration of its effects on the global economy and our business, and the speed of economic recovery remain very uncertain. Whilst the impact will be material in the short term, the business is taking appropriate actions and has sufficient liquidity to withstand an extended period of uncertainty. Longer term, the Group is well positioned to take advantage of growth opportunities when markets improve and is focused on ensuring that it can exit this period of disruption with positive strategic momentum.

RHI Magnesita: weekly performance: -3.87%

Andritz: International technology group Andritz has signed a contract with Companhia Hidrelétrica do São Francisco (CHESF) to perform complete modernization and digitalization of the Sobradinho hydropower plant located on the São Francisco river, Bahia state, in the northeastern region of Brazil. The order value is more than 40 million euros, and the project is expected to be completed in 2025.

Andritz: weekly performance: 2.87%

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (05/05/2020)

D&D Research Rendezvous #20: Gunter Deuber sieht Europas Sonderkonjunktur nun at risk - intensiver Blick auf die Aktienmärkte

Bildnachweis

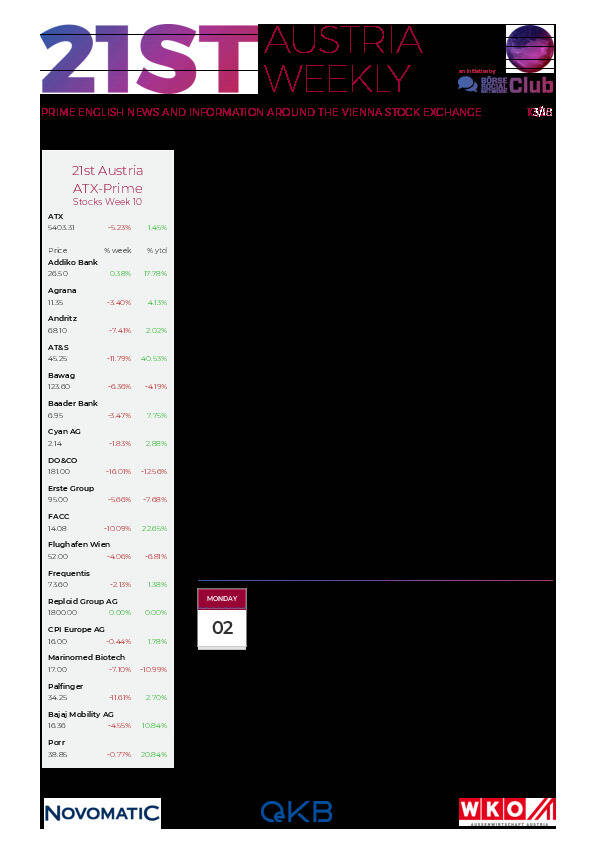

Aktien auf dem Radar:FACC, RHI Magnesita, Amag, Agrana, Austriacard Holdings AG, Kapsch TrafficCom, Wolford, UBM, AT&S, DO&CO, Rath AG, RBI, Verbund, Wienerberger, Warimpex, Zumtobel, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Flughafen Wien, CA Immo, EuroTeleSites AG, CPI Europe AG, Österreichische Post, Telekom Austria, Infineon, Deutsche Boerse, Fresenius Medical Care, SAP, Scout24, Continental.

Random Partner

Agrana

Die Agrana Beteiligungs-AG ist ein Nahrungsmittel-Konzern mit Sitz in Wien. Agrana erzeugt Zucker, Stärke, sogenannte Fruchtzubereitungen und Fruchtsaftkonzentrate sowie Bioethanol. Das Unternehmen veredelt landwirtschaftliche Rohstoffe zu vielseitigen industriellen Produkten und beliefert sowohl lokale Produzenten als auch internationale Konzerne, speziell die Nahrungsmittelindustrie.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten