21st Austria weekly - Strabag, Raiffeisen Bank International, Andritz, Mayr-Melnhof (12/11/2020)

15.11.2020, 3348 Zeichen

Strabag: In the first three quarters of 2020, construction group Strabag generated an output volume of Euro 11,099.85 mn, 9 % less than in the same period of the previous year. The order backlog as per 30 September 2020 amounted to Euro 19.0 bn, up 7 % on the same date in the previous year. The execution of large orders in the Americas, Hungary and Poland, among other places, was contrasted by new large orders and contract extensions in tunnelling in the United Kingdom and a significant increase in the order backlog in Germany. The Management Board confirms its outlook for the 2020 financial year as updated in August and anticipates a decrease in the output volume to approx. Euro 15.0 bn (-10 %). At the same time, it should still be possible to attain an EBIT margin of at least 3.5 % as had been previously expected.

Strabag: weekly performance:

Andritz: International technology group Andritz has received an order from Toyo Engineering Corporation, Japan, to deliver a PowerFluid circulating fluidized bed boiler with a flue gas cleaning system. The boiler will be part of a new biomass power plant to be built in Ichihara, Chiba Prefecture, some 30 km southeast of Tokyo. Commercial operations are scheduled to begin in late 2023, Andritz announced.

Andritz: weekly performance:

Mayr-Melnhof: Mayr-Melnhof, Europe's largest cartonboard producer and leading producer of folding cartons in Europe, reported consolidated sales of Euro 1,903.5 mn in the first three quarters (1-3Q 2019: Euro 1,924.3 mn). The operating profit of Euro 169.3 million was 13.4 % below last year's figure (1-3Q 2019: Euro 195.6 mn). This includes one-off expenses of Euro 57.5 mn from necessary market and structural adjustments as well as the termination agreement with the former CEO. Profit for the period declined from Euro 146.3 mn to Euro 116.3 mn. Cost optimization and deeper market penetration are the focus of the Mayr-Melnhof Group with the aim of sustainably combining growth and profitability in a highly competitive market environment. The related investment, innovation and acquisition activities will be intensified, the company stated. As already indicated, the annual result is expected to be lower than in the previous year due to one-off effects.

Mayr-Melnhof: weekly performance:

Raiffeisen Bank International: In the first three quarters of 2020, Raiffeisen Bank International (RBI) generated a consolidated profit of Euro 599 mn (-31,5 %). The negative impact on RBI from the recession caused by the COVID-19 pandemic is primarily reflected in impairment losses on financial assets in the amount of Euro 497 mn (an increase of Euro 417 mn). “We can be satisfied with the results for the first nine months considering the very difficult conditions,” said CEO Johann Strobl. “The interest rate cuts as well as the sharp decline in economic activity during the lockdown phases and, in particular, the depreciation of several CEE currencies weigh on our earnings. Strict cost discipline and the consistent implementation of our digitization strategy therefore have top priority.” He added: “We will close this financial year with a profit and generate a consolidated return on equity in the mid-single digit range".

RBI: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (12/11/2020)

Wiener Börse Party #1080: ATX nahe Rekorden, Warimpex-Day bzw. vor spannendem Bookbuildung bei Asta Energy

Bildnachweis

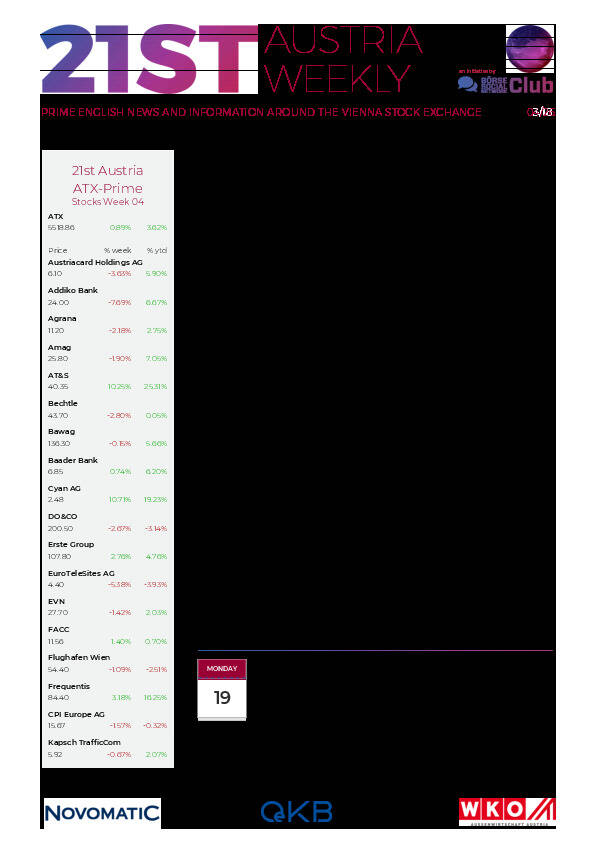

Aktien auf dem Radar:EuroTeleSites AG, Porr, RHI Magnesita, Austriacard Holdings AG, Zumtobel, Addiko Bank, FACC, Andritz, CA Immo, Lenzing, Polytec Group, Amag, Pierer Mobility, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, EVN, CPI Europe AG, OMV, Österreichische Post, Telekom Austria, Verbund.

Random Partner

wienerberger

wienerberger ist einer der führenden Anbieter von innovativen, ökologischen Lösungen für die gesamte Gebäudehülle in den Bereichen Neubau und Renovierung sowie für Infrastruktur im Wasser- und Energiemanagement.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten