21st Austria weekly - Marinomed, SBO, UBM, Vienna Insurance Group (26/11/2020)

29.11.2020, 4729 Zeichen

Marinomed: Marinomed Biotech AG, a globally operating biopharmaceutical company, has benefited from the dynamic demand for Carragelose® products in the first 9 months of 2020. In these first three quarters, Marinomed increased revenues by 53% to a record Euro 5.1 mn (1-9/2019: Euro 3.3 mn). The earnings performance continued to be influenced by high investments in research and development. Nevertheless, the operating result (EBIT) improved to Euro -4.3 mn (1-9/2019: Euro -5.3 mn). As expected, the nine-month earnings were negative at a net loss of Euro -4.8 mn, compared to Euro -6.2 mn in the corresponding period of the previous year. “An increasing number of trials are demonstrating the high efficacy of Carragelose® against several types of respiratory virus. In-vitro studies have shown that Carragelose® also neutralizes the new SARS-CoV-2 virus and can protect cells from infection. We intend to confirm this in upcoming clinical trials, in order to provide a safe and cost-effective technology in the fight against this pandemic. Our record sales show that the knowledge of Carragelose® and its high efficacy is increasingly reaching the market,” explained Andreas Grassauer, CEO of Marinomed Biotech AG. “Thanks to forward-looking supply chain management, Marinomed is able to meet even short-term increases in demand ever faster and more efficiently. In addition, the positive data against SARS-CoV-2 have led to a greater interest from international companies to establish marketing partnerships.”

Marinomed Biotech: weekly performance:

UBM: UBM Development increased EBT by 10% to over Euro 50 mn in the first three quarters of 2020 despite the Corona-related declines in the hotel business and foreign currency losses. Cash reserves are even higher than before Corona at over Euro 230 mn, and equity has risen to a new high. The development pipeline, which has again grown to Euro 2.2 bn, now consists of 50% residential and 30% office, with only 15% in the hotel sector. UBM assumes the expected market environment will also lead to new opportunities. Real estate projects currently in realisation by competitors are likely to come under increasing pressure in the next six months due to the prevailing uncertainty, and a strong partner may be needed. These potential investments or acquisitions will, however, only have a positive influence on UBM’s earnings development beginning in 2022. Due to the limited project acquisition activity in 2020 and the further course of the COVID-19 pandemic, earnings in 2021 are expected to be lower than the previous year. UBM is optimistic concerning a successful return to the pre-corona development beginning in 2022 and expects to emerge stronger from these crisis years.

UBM: weekly performance:

SBO: Sales of Schoeller-Bleckmann Oilfield Equipment AG (SBO), leading supplier of products and solutions used by the oil and gas industry for directional drilling and well completion, in the first three quarters of 2020 amounted to Euro 236.4 mn (1-9/2019: Euro 345.9 mn, minus 31.6 %). Bookings dropped from the previous year and stood at Euro 184.0 mn (1-9/2019: Euro 376.5 mn, minus 51.1 %). The order backlog at the end of September 2020 was Euro 69.7 mn (31 December 2019: Euro 123.0 mn). Earnings before interest, taxes, depreciation, and amortization (EBITDA) for the first three quarters of 2020 were Euro 27.2 mn, compared to Euro 91.6 mn in 2019. “It seems that the bottom has been reached: The US rig count shows a slight increase and well completion activities are also picking up again. Recovery is expected to set in clearly in the second half of 2021, provided that the consequences of the coronavirus pandemic can be mitigated until then. Actively managing crises is one of our core competencies. While this is the focus of our attention, we do not lose sight of opportunities for the future because the next upturn is bound to come", says SBO CEO Gerald Grohmann.

SBO: weekly performance:

Vienna Insurance Group: Vienna Insurance Group reported a solid performance in the operative insurance business in the first three quarters of 2020. Premium income was up year-on-year to around Euro 8 bn. The combined ratio improved compared to the same period last year, reaching 96.1%. The ongoing COVID-19 pandemic had a significant impact on the financial result, which fell by 18% to Euro 513 mn. In addition, goodwill impairments of Euro 118 mn as of half-year 2020 weighed on pre-tax profit. Profit before taxes stood at Euro 266.3 mn in the first nine months of 2020, a decline of 29.2% compared to the same period last year.

VIG: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (26/11/2020)

Wiener Börse Party #645: ATX TR ärgert sich über fehlenden Applaus, ATX NTR noch nicht soweit, Porr & Strabag together

Bildnachweis

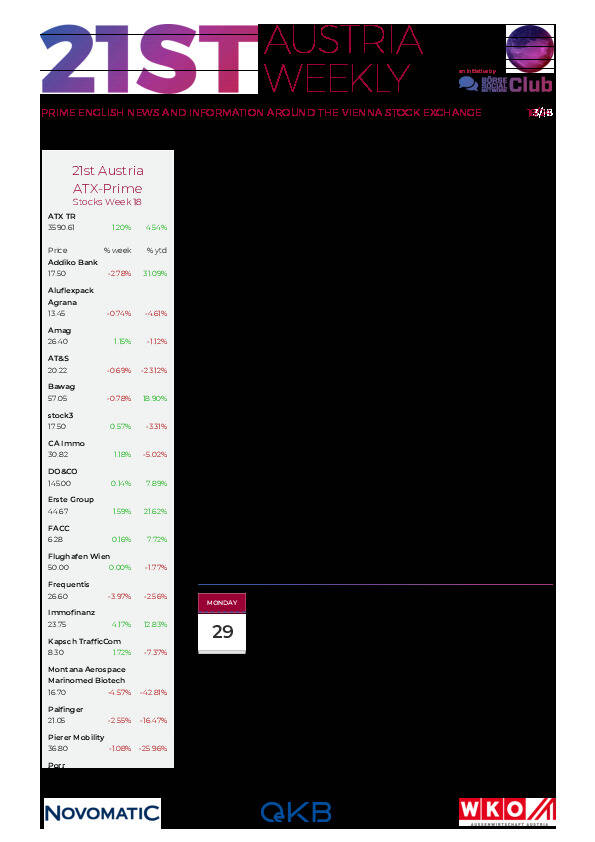

Aktien auf dem Radar:Österreichische Post, Palfinger, RHI Magnesita, Flughafen Wien, EuroTeleSites AG, Rosenbauer, Wienerberger, Andritz, VIG, Strabag, SBO, Porr, Addiko Bank, Lenzing, Pierer Mobility, Verbund, voestalpine, Wolford, Wiener Privatbank, SW Umwelttechnik, Oberbank AG Stamm, Agrana, Amag, CA Immo, Erste Group, EVN, FACC, Immofinanz, Kapsch TrafficCom, OMV, Telekom Austria.

Random Partner

CA Immo

CA Immo ist der Spezialist für Büroimmobilien in zentraleuropäischen Hauptstädten. Das Unternehmen deckt die gesamte Wertschöpfungskette im gewerblichen Immobilienbereich ab: Vermietung und Management sowie Projektentwicklung mit hoher in-house-Baukompetenz. Das 1987 gegründete Unternehmen notiert im ATX der Wiener Börse.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten