21st Austria weekly - Agrana (11/05/2021)

16.05.2021, 1592 Zeichen

Agrana: In the 2020|21 financial year, fruit-, starch- and sugar company Agrana Beteiligungs-AG achieved a slight increase in Group revenue to Euro 2,547.0 mn. Operating profit (EBIT), at Euro 78.7 mn, rose 17.6% from the prior year. In the year under review, the Covid-19 pandemic was the defining factor for all business segments. In the Fruit segment, earnings of the fruit preparations business were up from a year ago despite one-off effects. In the fruit juice concentrate business, by contrast, poor apple harvests coincided with pandemic-related weak demand, especially in the food service and tourism sectors, which led to a significantly reduced earnings performance. In the Starch segment, reduced starch volumes sold to the graphic paper industry (the print sector) were offset by increased sales to corrugated cardboard manufacturers (packaging). Starch margins on balance were lower for demand reasons and the segment's operating performance was thus down from the prior year. In the Sugar segment, higher sugar prices and volumes contributed to a significant year-on-year improvement in the - albeit still negative - bottom line. "Despite the extraordinary conditions created by the Covid-19 pandemic, we delivered solid results in the last financial year. Overall, what is once again clear is that our stable business performance is due in large part to the diversification of our business segments," says Agrana Chief Executive Officer Johann Marihart.

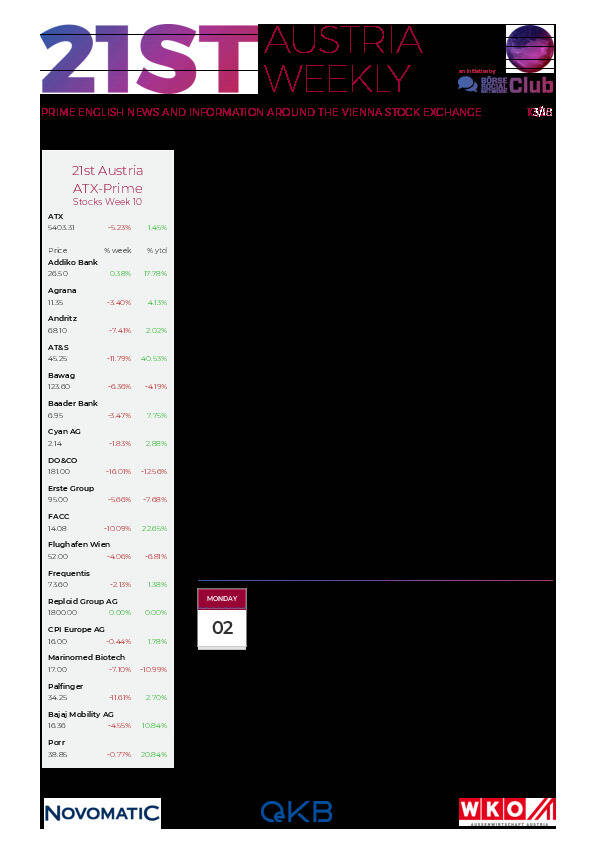

Agrana: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (11/05/2021)

Wiener Börse Party #1113: ATX spürbar schwächer, ytd wieder nur noch knapp im Plus, gute Sager von Christoph Boschan und Walter Oblin

Bildnachweis

Aktien auf dem Radar:CPI Europe AG, Wienerberger, RHI Magnesita, EuroTeleSites AG, Agrana, Telekom Austria, Austriacard Holdings AG, Gurktaler AG VZ, Hutter & Schrantz Stahlbau, Hutter & Schrantz, Linz Textil Holding, Josef Manner & Comp. AG, Stadlauer Malzfabrik AG, BKS Bank Stamm, Oberbank AG Stamm, Kapsch TrafficCom, DO&CO, FACC, Polytec Group, SBO, Verbund, voestalpine, Amag, CA Immo, Flughafen Wien, Österreichische Post, Rheinmetall, Vonovia SE, Fresenius Medical Care, Bayer, Siemens Healthineers.

Random Partner

gettex

gettex ist ein Börsenplatz der Bayerischen Börse AG für alle Investorentypen – vom Retail-Anleger bis zum Vermögensverwalter und institutionellen Anleger. Auf gettex fallen grundsätzlich weder Maklercourtage noch Börsenentgelt an.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten