21st Austria weekly - Valneva, Andritz, Amag, Austrian Post (19/07/2021)

25.07.2021, 4142 Zeichen

Valneva: Austrian/French Valneva, a specialty vaccine company focused on the development and commercialization of prophylactic vaccines for infectious diseases with significant unmet medical need, and Pfizer announced that they have completed recruitment for the Phase 2 trial, VLA15-221, of Lyme disease vaccine candidate, VLA15. The trial builds on previous positive Phase 2 trials and includes both adult and pediatric participants with the aim to support acceleration of the vaccine candidate’s pediatric program. A total of 625 participants, 5 to 65 years of age, have been randomized in the Phase 2 trial to receive VLA15 at Month 0-2-6 or Month 0-6 (200 volunteers each) or placebo at Month 0-2-6 (200 volunteers). The main safety and immunogenicity readout will be performed approximately one month after completion of the primary vaccination schedule (i.e. at Month 7). The objective of the trial is to show safety and immunogenicity down to 5 years of age and to evaluate the optimal vaccination schedule for use in Phase 3. Juan Carlos Jaramillo M.D., Chief Medical Officer of Valneva, said, “This recruitment completion represents another important milestone in the development of VLA15. If successful, this trial could enable the inclusion of a pediatric population in the Phase 3 trial. Lyme disease continues to be a major concern and is prevalent in children, it is therefore extremely important for us to potentially offer a vaccine that could protect both adults and children as rapidly as we can. We’d like to thank everyone involved in the trials for their contributions to keep the development moving forward and on track.”

Valneva: weekly performance:

Andritz: International technology Group Andritz has received an order from Shandong Huatai Paper Industry Shareholding to upgrade an existing BCTMP (bleached chemi-thermo-mechanical pulp) plant to become the world’s largest mechanical pulping line for P&W (Printing & Writing) paper production at the mill in Dongying, Shandong province, China. Start-up is scheduled for the fourth quarter of 2022. The existing BCTMP line will be upgraded and rebuilt to become a state-of-the-art P-RC APMP- (Pre-Conditioning Refiner Chemical Alkaline Peroxide Mechanical Pulp) system. The fiberline’s production capacity for mechanical pulp to make P&W paper grades will thus be increased from 100,000 to at least 300,000 admt/a, making it the largest in the world. Further, the company announced, that it increases earnings expectation for the full year 2021. The company now expects – from today’s perspective – a significant increase in the EBITA reported compared to the previous year and profitability (EBITA margin reported) of around 8% (EBITA margin reported in 2020: 5.9%). From today’s perspective, no substantial extraordinary effects are expected for 2021. Revenue for the full year 2021 is still expected to show a slight decline compared to the previous year.

Andritz: weekly performance:

Austrian Post: Austrian Post raised its forecasts fr 2021. The company aims to achieve an earnings improvement in the current financial year of at least 20% compared to the prior-year level (basis 2020 EBIT: 161 mn).

Österreichische Post: weekly performance:

Amag: Amag Austria Metall AG, supplier of primary aluminum and premium cast and rolled aluminum products, increases its earnings forecast for the current financial year mainly due to ongoing positive market trends in the primary aluminium area (Metal division). Considering the positive earnings development in the first half of 2021 and based on actual estimates for the second half year, the Amag management board expects an EBITDA between Euro 155 and 175 mn for the financial year 2021. The previous EBITDA range of Euro 125 to 140 mn, which was announced as part of the reporting on the first quarter of 2021, is therefore clearly outnumbered. With a revenue of Euro 595.1 mn in the first half of 2021 (H1/2020: Euro 463.8 mn) Amag reached an EBITDA of Euro 93.6 mn (H1/2020: Euro 59.3 mn).

Amag: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (19/07/2021)

BörseGeschichte Podcast: Wolfgang Matejka vor 10 Jahren zum ATX-25er

Bildnachweis

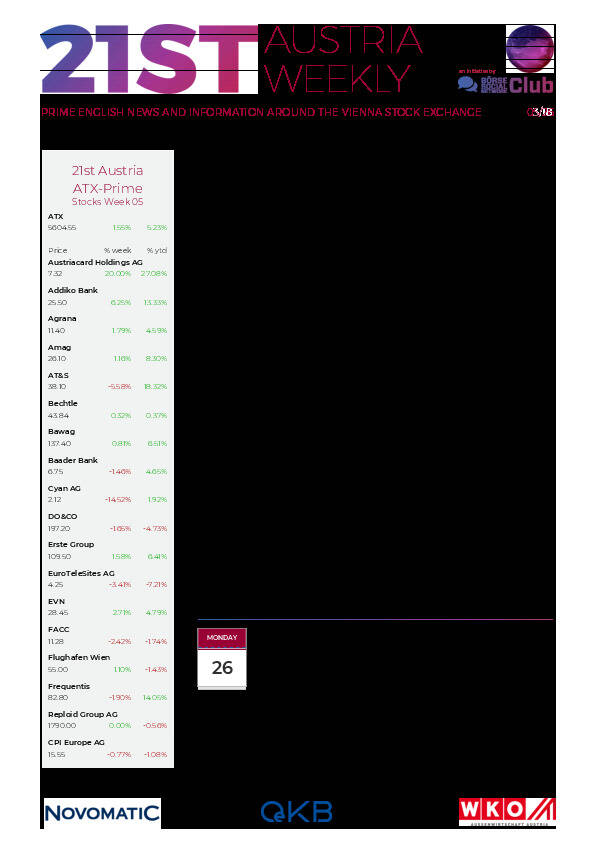

Aktien auf dem Radar:AT&S, Austriacard Holdings AG, OMV, Amag, Semperit, SBO, ATX, ATX Prime, ATX TR, ATX NTR, Palfinger, Wienerberger, Andritz, Mayr-Melnhof, Uniqa, Österreichische Post, DO&CO, Addiko Bank, Lenzing, Marinomed Biotech, Polytec Group, Stadlauer Malzfabrik AG, Telekom Austria, Wiener Privatbank, RHI Magnesita, BKS Bank Stamm, Oberbank AG Stamm, Agrana, CA Immo, EuroTeleSites AG, EVN.

Random Partner

Societe Generale

Société Générale ist einer der weltweit größten Derivate-Emittenten und auch in Deutschland bereits seit 1989 konstant als Anbieter für Optionsscheine, Zertifikate und Aktienanleihen aktiv. Mit einer umfangreichen Auswahl an Basiswerten aller Anlageklassen (Aktien, Indizes, Rohstoffe, Währungen und Zinsen) überzeugt Société Générale und nimmt in Deutschland einen führenden Platz im Bereich der Hebelprodukte ein.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten