21st Austria weekly - Wienerberger, Addiko, Kapsch TrafficCom, Valneva, Strabag (11/08/2021)

15.08.2021, 4928 Zeichen

Wienerberger: Further to the Q2 Trading Statement issued on July 5, 2021, Wienerberger reports its final H1 2021 results, which are the Group's strongest mid-year results in its history. In the first half of 2021, the Group achieved record revenues of Euro 1,867.5 mn, up by approximately 14% from the previous year's value (H1 2020: Eueo 1,641.5 mn), despite moderate developments in the core markets and a slower return to pre-Covid levels. Wienerberger reported EBITDA LFL of Euro 308.4 mn, corresponding to a 21% increase year-on-year (2020: Euro 254.1 mn). Overall, the Group's performance surpassed the record values of the first half of 2019 by a significant margin (revenues H1 2019: Euro 1,736.4 mn, EBITDA Euro 295.7 mn). Heimo Scheuch, Chairman of the Managing Board of Wienerberger AG: "As our outstanding mid-year results achieved in all three Business Units show, we have emerged from the Covid-19 pandemic stronger than before. We have outperformed the success of our previous record year in 2019 and continued the positive trends of recent years." He adds: Based on our strong performance in the first half of 2021, we anticipate a positive second half of the year and therefore confirm the upward revision of our guidance for EBITDA LFL to Euro 620 to Euro 640 mn for 2021, up from Euro 600 to Euro 620 mn", explains CEO Heimo Scheuch.

Wienerberger: weekly performance:

Addiko: Addiko Group, a Consumer and SME specialist bank active across Central and South-Eastern Europe (CSEE), released its unaudited results for the first half of 2021 today, reporting a profit after tax of €6.1m. The result after tax of reflects lower credit loss expenses of Euro-10.2 mn or -0.3% Cost of Risk (1H20: Euro -29.2 mn). Despite the slowly improving macroeconomic environment, Addiko did not release the IFRS 9 post-model overlay provisions recognised during 2020. The operating result increased by 2.1% to Euro 28.1 mn (1H20: Euro 27.5 mn) reflecting the slow recovery in business activities. The result includes costs for management changes and regular bonus accruals, with the latter not having been included in the previous year. “The recovery is slower than anticipated because of local Covid-related restrictions, but we see an overall improvement in the macroeconomic environment and signs that business activities are starting to pick up,” said Herbert Juranek, CEO of Addiko Bank AG, “this means consumers are increasing spending, and SMEs are back in business. We have an ambitious plan and teamed up with our country CEOs to accelerate our transformation to become the leading specialist bank in our region.”

Addiko Bank: weekly performance:

Kapsch TrafficCom: Even though revenues of Euro 127 million were relatively low, traffic solution provider Kapsch TrafficCom was able to conclude the first quarter with a profit. Operating result (earnings before interest and taxes, EBIT) achieved Euro 7 mn (previous year: Euro -11 mn), while the earnings attributable to the shareholders were Euro 3 mn (previous year: Euro -10 mn). This corresponds to earnings per share of Euro 0.24 (previous year: Euro -0.77). Following a difficult phase, we have managed to ring in a visible turnaround. Looking back on the last two years, I am convinced that the main restructuring measures are already behind us and that we will finish the 2021/22 financial year with a profit again", says Georg Kapsch, CEO of Kapsch TrafficCom.

Kapsch TrafficCom: weekly performance:

Valneva: Valneva, a specialty vaccine company focused on the development and commercialization of prophylactic vaccines for infectious diseases with significant unmet medical need, today announced the initiation of a further Phase 3 trial (VLA2001-304) for its inactivated, adjuvanted COVID-19 vaccine candidate, VLA2001. VLA2001-304 aims to generate data in the elderly and is also designed to potentially enable variant-bridging through immune-comparability. Data from this study are expected to complement ongoing clinical trials and support additional regulatory submissions. VLA2001-304, which will be conducted in New Zealand, will recruit approximately 150 participants aged 56 years and older (Cohort 1) with the aim of generating additional safety and immunogenicity data in this age group following vaccination with VLA2001 (two doses 28 days apart).

Valneva: weekly performance:

Strabag: Construction group Strabag has been awarded the contract as consortium leader (89 %) for the modernisation of the 1.3 km long section of the railway between Děčín východ and Prostřední Žleb stations in Děčín in the north of the Czech Republic near the German border. The contract is worth around Euro 41.5 mn. Construction, to be carried out in a consortium with local partner DT Mostárna a.s., is scheduled to start in August.

Strabag: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (11/08/2021)

Börsepeople im Podcast S22/20: Johannes Linhart

Bildnachweis

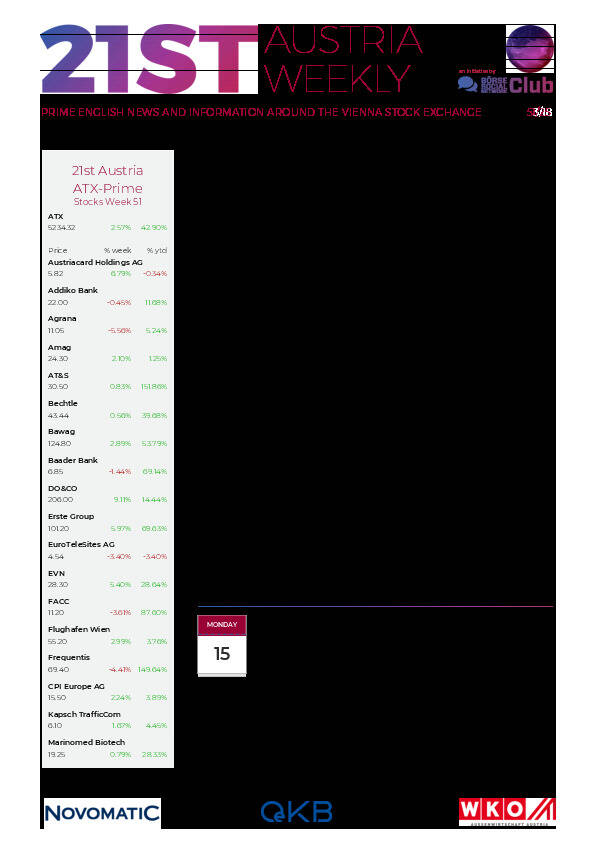

Aktien auf dem Radar:UBM, Agrana, Zumtobel, Addiko Bank, Austriacard Holdings AG, Palfinger, ATX, ATX Prime, ATX TR, ATX NTR, Bawag, Mayr-Melnhof, RBI, Wienerberger, Lenzing, Rosenbauer, Warimpex, CA Immo, FACC, Wolford, BKS Bank Stamm, Oberbank AG Stamm, VIG, Amag, AT&S, CPI Europe AG, Österreichische Post, voestalpine, Infineon, Merck KGaA, Fresenius Medical Care.

Random Partner

EY

Bei EY wird alles daran gesetzt, dass die Welt besser funktioniert. Dafür steht unser Anspruch „Building a better working world“. Mit unserem umfassenden Wissen und der Qualität unserer Dienstleistungen stärken wir weltweit das Vertrauen in die Kapitalmärkte und Volkswirtschaften.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten