21st Austria weekly - Amag, AT&S, OMV, Bawag (28/10/2021)

31.10.2021, 4258 Zeichen

Amag: The Amag group, premium supplier of high-quality aluminium cast and flat rolled products for highly varied industries such as the aircraft, automotive, sports equipment, lighting, mechanical engineering, construction and packaging industries, achieved new highs in revenue and earnings in the first nine months of 2021. The main reasons were a stable production performance, increasing shipment volumes and an attractive aluminium price. Revenue reached a new high of Euro 923.8 mn in the first nine months of the reporting year (Q1-Q3/2020: Euro 673.2 mn). Net income after taxes rose more than fivefold year-on-year to reach Euro 57.0 mn as of the end of the first three quarters of 2021 (Q1-Q3/2020: Euro 11.1 mn). As Gerald Mayer, CEO of AMAG Austria Metall AG, commented: "The most important bottleneck is currently the availability of suitable specialist staff for production. At present we are looking for around 100 employees." Based on an improved forecast in the Metal Division as a consequence of the higher aluminium price, the Amag Management Board anticipates EBITDA in a range between Euro 175 and EUR 195 mn for the full 2021 financial year.

AT&S: AT&S, one of the globally leading manufacturers of high-end printed circuit boards and IC substrates, headquartered in Austria (Europe), today announced detailed project information on the company’s planned investment in a state-of-the-art factory for IC substrates at the Kulim Hi-Tech Park, Kedah. AT&S’ new campus for the production of IC substrates in Kulim Hi-Tech Park, Kedah, involves a proposed total investment for phase 1 of RM 8.5 billion (Euro 1.7 bn). The construction of the facility is going to start with an official groundbreaking ceremony on October 30, 2021, with commercial operations targeted to come on stream in 2024. “I want to thank the Malaysian government as well as the MIDA (the government’s principal promotion agency under the Ministry of International Trade and Industry) for the great support throughout the entire process, from the start of our location scouting until today,” says AT&S CEO Andreas Gerstenmayer. “Already today, Malaysia is an important hub for the chip supply chain. We are convinced that Malaysia can further strengthen its position as a technology country and will develop its position in the region as a high-tech manufacturing hub in Asia,” Gerstenmayer says.

OMV: OMV, the international integrated oil, gas and chemicals company headquartered in Vienna, Austria, has agreed to sell its 25% stake in the Wisting oil field to Lundin Energy AB, an experienced Nordic oil and gas company. The purchase price is USD 320 mn, payable upon completion. In addition, there is a contingent payment of up to USD 20 mn depending on final project CAPEX. The contingent payment will be triggered if a reduced CAPEX number relative to the current view is manifested in the Plan for Development and Operation. The economic effective date of the transaction will be January 1, 2021. The closing of the transaction is subject to approvals.

Bawag: Banking group Bawag released its results for the third quarter 2021, reporting a net profit of Euro 123 mn, Euro 1.38 earnings per share, and a RoTCE of 16.4%. For the first nine months of the year, BAWAG Group reported net profit of Euro 316 mn, Euro 3.55 earnings per share, and a RoTCE of 14.2%. "We started the first nine months of the year with a strong set of operating results delivering net profit of EUR 316 million, RoTCE of 14.2% and cost-income ratio of 39.9%. Although we’ve experienced rolling and partial lockdowns in our core markets during the first few months of 2021, we are seeing a normalization of economic activity and are therefore confident to meet our targets of a RoTCE ~15% and CIR ~40% for the full year. In September, we hosted our inaugural investor day, where we communicated our new targets and 4-year plan through 2025. We have positioned the franchise for responsible, sustainable, and profitable growth in the many years ahead. Our long-term value creation will benefit our customers, shareholders, team members, and local communities.” commented Chief Executive Officer Anas Abuzaakouk.

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (28/10/2021)

Wiener Börse Party #1110: ATX mehr als 2 Prozent tiefer, Verbund gesucht, Andritz vielversprechend und Gabler statt Babler

Bildnachweis

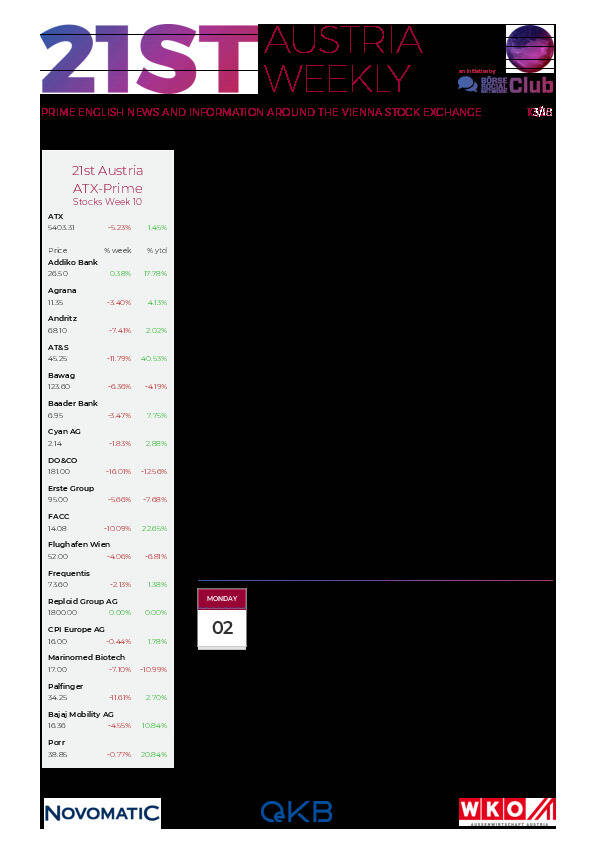

Aktien auf dem Radar:FACC, CPI Europe AG, RHI Magnesita, Austriacard Holdings AG, Agrana, Kapsch TrafficCom, OMV, Verbund, DO&CO, Palfinger, RBI, Strabag, Uniqa, VIG, Mayr-Melnhof, Lenzing, Erste Group, ATX, AT&S, ATX NTR, Bawag, Bajaj Mobility AG, Wienerberger, voestalpine, ATX TR, ATX Prime, Amag, Porr, Polytec Group, Rath AG, SBO.

Random Partner

Erste Asset Management

Die Erste Asset Management versteht sich als internationaler Vermögensverwalter und Asset Manager mit einer starken Position in Zentral- und Osteuropa. Hinter der Erste Asset Management steht die Finanzkraft der Erste Group Bank AG. Den Kunden wird ein breit gefächertes Spektrum an Investmentfonds und Vermögensverwaltungslösungen geboten.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten