21st Austria weekly - Lenzing, RBI (03/11/2021)

08.11.2021, 2700 Zeichen

>> Öffnen auf photaq.com Lenzing:The fibers company Lenzing Group reported a significant year-on-year improvement in revenue and earnings in the first nine months of 2021 thanks to the largely positive market environment. Growing optimism in the textile and apparel industry and the recovery in retail led to a substantial increase in demand and prices on the global fiber market, particularly at the start of the current financial year.Revenue rose by 32.9 percent to Euro 1.59 bn in the first nine months of 2021. This increase is attributable to a higher sales volume as well as higher viscose prices. Net profit for the period amounted to Euro 113.4 mn (compared to a net loss of minus 23.3 mn in the first nine months of 2020). "Lenzing has enjoyed a strong business performance to date in 2021. Demand for our wood-based, biodegradable specialty fibers under the Tencel(TM), Lenzing(TM) Ecovero(TM) and Veocel(TM) brands is growing very well", notes Thomas Obendrauf, Chief Financial Officer of the Lenzing Group. "We stay the course, and the largest investment program in our company's history is still running according to schedule. With the imminent commissioning of the lyocell plant in Thailand, we will reach a highly important milestone for both the company and our goal to make the textile and nonwovens industries more sustainable", Obendrauf comments.Lenzing: weekly performance: 2.69%Raiffeisen Bank International (RBI):After the pandemic-driven recession in the previous year, the current financial year is being marked by economic recovery. Consolidated profit increased by a substantial 76 per cent year-on-year to 1,055 mn. An expansion of business volumes allowed for net interest income, which had been impacted by key interest rate cuts and currency devaluations, to be largely stabilized. The recent rises in market interest rates in many group countries has already resulted in an increase in net interest income over the last quarter. Net fee and commission income has also regained its pre-pandemic level with an increase of 16 per cent. The increase in consolidated profit was also due to significantly lower loan loss provisions, which at Euro 152 mn were Euro 345 mn below the previous year’s period."We are very satisfied with the performance in the first nine months. We have significantly improved our consolidated profit compared to the prior-year period and successfully completed the acquisition of Czech Equa bank. The economic upturn in our markets gives us a tailwind, so we are optimistic about both the rest of the year and 2022," said Johann Strobl, CEO of RBI.RBI: weekly performance: 14.39%(From the 21st Austria weekly https://www.boerse-social.com/21staustria (03/11/2021)

Wiener Börse Party #1079: Kleine ATX-Korrektur am Ende einer weiteren Rekordwoche, Erste 2x über 100, Porr und AT&S vor den Vorhang

Bildnachweis

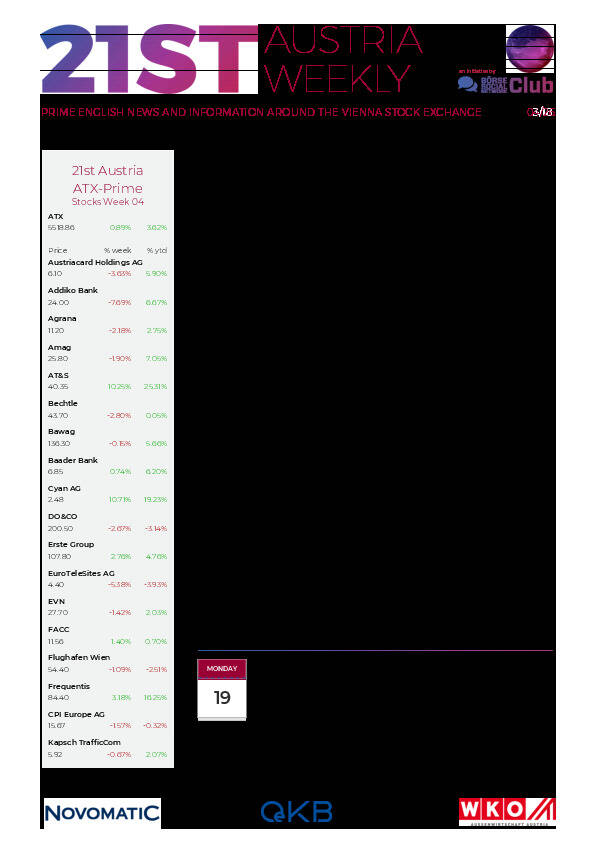

Aktien auf dem Radar:EuroTeleSites AG, RHI Magnesita, Flughafen Wien, Austriacard Holdings AG, Addiko Bank, Zumtobel, FACC, Pierer Mobility, Andritz, CA Immo, Lenzing, Mayr-Melnhof, OMV, UBM, SBO, Wiener Privatbank, Frequentis, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, Amag, EVN, CPI Europe AG, Österreichische Post, Telekom Austria, Verbund, adidas, Fresenius Medical Care, Volkswagen Vz., Siemens Energy, Hannover Rück.

Random Partner

Vontobel

Als internationales Investmenthaus mit Schweizer Wurzeln ist Vontobel auf die Bereiche Private Clients und Institutional Clients spezialisiert. Der Erfolg in diesen Bereichen gründet auf einer Kultur der Eigenverantwortung und dem Bestreben, die Erwartungen der Kundinnen und Kunden zu übertreffen.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten