21st Austria weekly - Valneva, voestalpine, FACC (10/11/2021)

14.11.2021, 3543 Zeichen

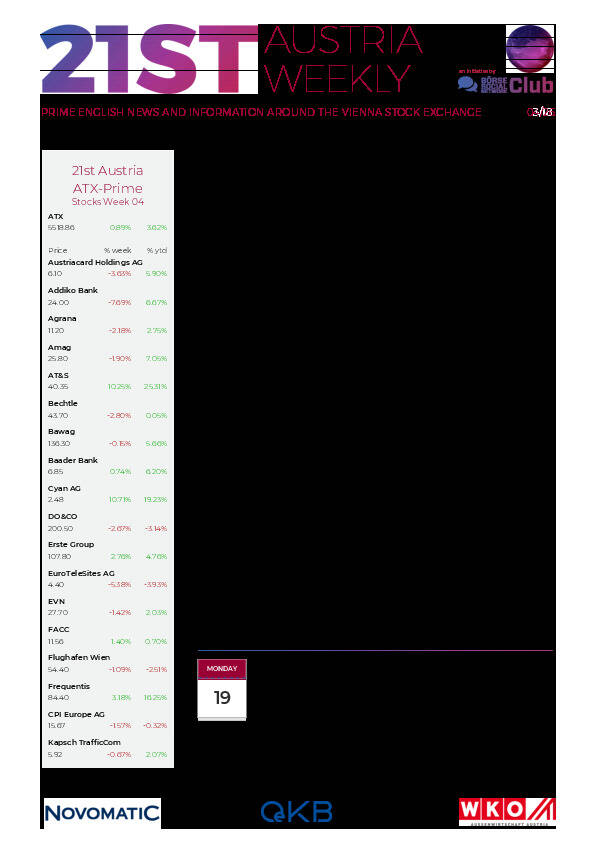

Valneva: weekly performance:

voestalpine: The key performance indicators (KPIs) of steel company voestalpine for the first half of the business year 2021/22 show strong year-over-year growth. Compared with the first half of the previous business year, revenue rose by 37.8% to Euro 7 bn. EBITDA surged year over year by 165.8% to Euro 1 bn. After Euro -215 mn in the first half of 2020/21, EBIT soared to Euro 651 mn in the first half of 2021/22. Profit before tax for the reporting period jumped to Euro 611 mn (H1 2020/21: Euro -268 mn), and profit after tax to Euro 486 mn (H1 2020/21: -276 mn). "We were able to deliver strong revenue and earnings increases in the business year's first half thanks to very solid demand for voestalpine's products in all markets and product segments that are material to us, our focus on efficiency-boosting measures, and the excellent commitment of our employees," says Herbert Eibensteiner, Chairman of the Management Board of voestalpine AG.

voestalpine: weekly performance:

FACC: Revenues of Aerospace company FACC AG in the first nine months of 2021 amount to Euro 358.3 mn (comparative period 2020: Euro 398.5 mn). Reported earnings before interest and taxes (EBIT) for the first nine months of 2021 stood at Euro 2.9 mn (comparative period 2020: Euro -53.0 mn). "The aviation market is increasingly recovering. We have achieved the targeted operational turnaround. To this end, we benefited above all from our flexibility for new market conditions, our consistent cost reduction and efficiency improvement program, and the exemplary commitment of our FACC crew," reports Robert Machtlinger, CEO of FACC AG. "A number of important major projects that we have been able to secure in recent weeks increase FACC's market share in its core business."

FACC: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (10/11/2021)

Wiener Börse Party #1079: Kleine ATX-Korrektur am Ende einer weiteren Rekordwoche, Erste 2x über 100, Porr und AT&S vor den Vorhang

Bildnachweis

Aktien auf dem Radar:EuroTeleSites AG, RHI Magnesita, Flughafen Wien, Austriacard Holdings AG, Addiko Bank, Zumtobel, FACC, Pierer Mobility, Andritz, CA Immo, Lenzing, Mayr-Melnhof, OMV, UBM, SBO, Wiener Privatbank, Frequentis, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, Amag, EVN, CPI Europe AG, Österreichische Post, Telekom Austria, Verbund, adidas, Fresenius Medical Care, Volkswagen Vz., Siemens Energy, Hannover Rück.

Random Partner

wikifolio

wikifolio ging 2012 online und ist heute Europas führende Online-Plattform mit Handelsstrategien für alle Anleger, die Wert auf smarte Geldanlage legen. wikifolio Trader, darunter auch Vollzeitinvestoren, erfolgreiche Unternehmer, Experten bestimmter Branchen, Vermögensverwalter oder Finanzredaktionen, teilen ihre Handelsideen in Musterportfolios, den wikifolios.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten