21st Austria weekly - Andritz, Agrana, Valneva (25/04/2022)

01.05.2022, 3620 Zeichen

Andritz: International technology group Andritz has received an order from Papierfabriek Doetinchem, Netherlands, to upgrade the wet sections of its PM1 and PM3 special paper machines. The start-ups are scheduled for 2022. The aim of the investment is to improve the paper quality and provide the basis for a possible capacity increase. Andritz will deliver ModuScreen HB dilution headbox screens, PrimeFlow AT headboxes with PrimeProfiler F dilution control, and pumps for both machines.

Andritz: weekly performance:

Agrana: Following the conclusion of internal impairment tests, fruit, starch and sugar group Agrana generated earnings before interest and tax (EBIT) in its 2021|22 financial year (1 March 2021 to 28 February 2022) in an amount of Euro 24.7 mn (prior year: Euro 78.7 mn). The extraordinary items related to the Ukraine war (largely non-cash expenses related to asset and goodwill impairments) therefore ultimately amounted to a negative Euro 72.4 mn. Earnings per share declined to a negative Euro 0.20 (prior year: Euro 0.96). Consolidated revenue amounted to Euro 2,901.5 mn (prior year: Euro 2,547.0 mn). Despite all of the challenges faced, Agrana has made a sound start to the 2022|23 financial year and forecasts a very significant improvement in EBIT in the first quarter of 2022|23. A very considerable increase in EBIT is also anticipated for the full year 2022|23. In consolidated revenues a significant increase is forecast. The above statements are based on assumptions that the war in Ukraine is temporary and remains regional in its scope, that physical supplies of energy and other commodities are maintained, and that procurement and distribution markets can in part return to normal during the 2022|23 financial year. AGRANA also anticipates that the sharp price rises, particularly those related to the commodities and energy markets, can be passed on by means of new customer contracts.

Agrana: weekly performance:

Valneva: Austrian/French Valneva, a specialty vaccine company, today provided an update on the rolling review process of its inactivated, COVID-19 vaccine candidate, VLA2001, with the Committee for Medicinal Products for Human Use (“CHMP”) of the European Medicines Agency (“EMA”). Following last week’s meeting, the CHMP provided another List of Questions (“LoQ”). This LoQ includes requests for additional data and for further justification of a Conditional Marketing Authorization. Valneva will respond to these requests in the coming days. If the CHMP accepts the submissions, the Company would expect a Conditional Marketing Authorization this quarter. Valneva continues to believe that its inactivated vaccine meets the conditions for a Conditional Marketing Authorization, including a positive benefit-risk profile. The Company remains focused on achieving a Conditional Marketing Authorization for VLA2001 in Europe after it was granted Conditional Marketing Authorization by the Medicines and Healthcare products Regulatory Agency (“MHRA”) of the United Kingdom (“UK”) two weeks ago. Thomas Lingelbach, Chief Executive Officer of Valneva, commented, “We are disappointed that the EMA has not considered our submissions sufficient to date. We remain fully committed and dedicated to working jointly with the regulators towards a product approval. VLA2001 is the only inactivated COVID-19 vaccine candidate in Europe, and we continue to receive messages every day from people who are looking for a more traditional vaccine approach”.

Valneva: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (25/04/2022)

Wiener Börse Party #1099: Wiener Börse zum Februar-Verfall fester, aber mit kleiner Enttäuschung, positive Spannungsmomente bei der Porr

Bildnachweis

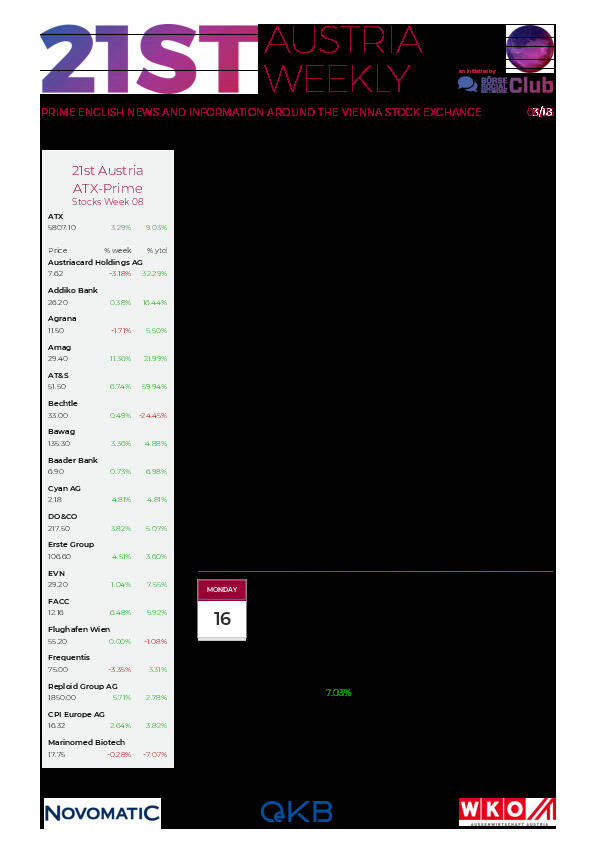

Aktien auf dem Radar:Kapsch TrafficCom, Strabag, Agrana, Bajaj Mobility AG, Addiko Bank, Austriacard Holdings AG, Amag, Rosgix, DO&CO, Porr, FACC, BKS Bank Stamm, Oberbank AG Stamm, Reploid Group AG, Josef Manner & Comp. AG, UBM, CA Immo, EuroTeleSites AG, EVN, Flughafen Wien, CPI Europe AG, OMV, Österreichische Post, Telekom Austria, Verbund, Fresenius Medical Care, Allianz, HeidelbergCement, Deutsche Post, Scout24, Bayer.

Random Partner

EXAA Abwicklungsstelle für Energieprodukte AG

Die EXAA Abwicklungsstelle für Energieprodukte AG ist die führende österreichische Energiebörse mit einer breiten heimischen sowie internationalen Kundenbasis und einem länderübergreifenden Produktportfolio. Die Energiebörse versteht sich als Partner für alle Akteure am europäischen Energiemarkt und erschließt kontinuierlich neue Geschäftsfelder, um weiter nachhaltig zu wachsen.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten