21st Austria weekly - Agrana, Mayr-Melnhof (13/10/2022)

16.10.2022, 1749 Zeichen

Agrana: Agrana, the international fruit, starch and sugar group, generated revenue of Euro 1,792.3 mn in the first half of the 2022|23 financial year, a significant increase of 25.8% year-on-year (H1 prior year: Euro 1,424.4 mn). The earnings measure “operating profit before exceptional items and results of equity-accounted joint ventures” grew to Euro 86.5 mn in a very challenging environment (H1 prior year: Euro 41.0 mn). The Group’s loss for the period was Euro 17.0 mn (H1 prior year: profit for the period of Euro 27.1 mn).However, a required impairment test at 31 August 2022 resulted in the recognition of impairment on assets and goodwill in the Fruit segment. This write-down of Euro 91.2 mn – an exceptional item attributable to the Ukraine war and to steeply rising capital costs – is not a cash expense, but testifies to the extremely volatile and uncertain economic conditions. “With a strong operating performance in our entire production chain and rigorous cost management throughout the Group, we were able to supply our customers worldwide reliably at all times and achieve good operating profit before exceptional items. All segments helped drive these results,” emphasises CEO Markus Mühleisen.

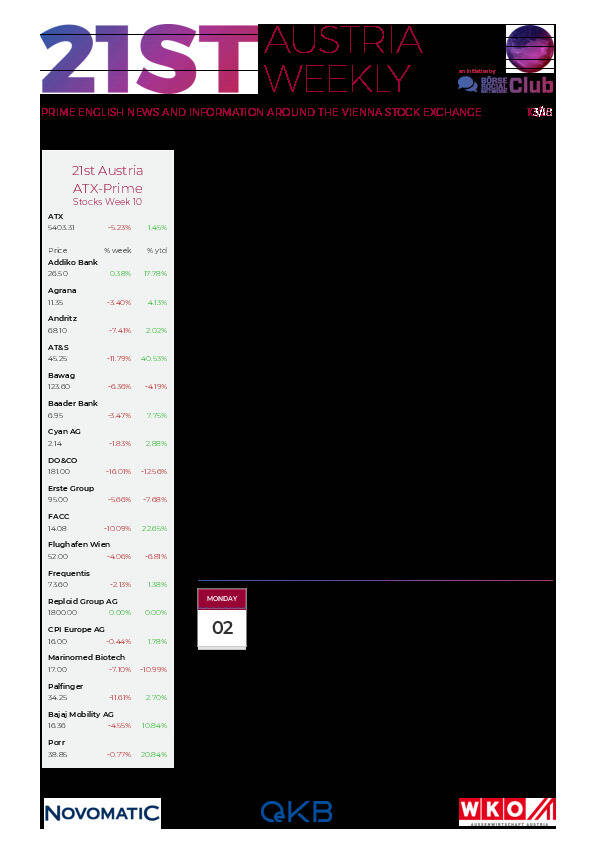

Agrana: weekly performance:

Mayr-Melnhof: Andreas Blaschke will resign from his mandate to the Management Board at the end of October 2022 after 21 years on the Board and 31 years of service to the MM Group. On the Management Board of Mayr-Melnhof Karton AG, Andreas was responsible for the MM Packaging division. CEO Peter Oswald will take on the responsibilities of Andreas Blaschke on the Board.

Mayr-Melnhof: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (13/10/2022)

Wiener Börse Party #1110: ATX mehr als 2 Prozent tiefer, Verbund gesucht, Andritz vielversprechend und Gabler statt Babler

Bildnachweis

Aktien auf dem Radar:FACC, CPI Europe AG, RHI Magnesita, Austriacard Holdings AG, Agrana, Kapsch TrafficCom, OMV, Verbund, DO&CO, Palfinger, RBI, Strabag, Uniqa, VIG, Mayr-Melnhof, Lenzing, Erste Group, ATX, AT&S, ATX NTR, Bawag, Bajaj Mobility AG, Wienerberger, voestalpine, ATX TR, ATX Prime, Amag, Porr, Polytec Group, Rath AG, SBO.

Random Partner

Kontron

Der Technologiekonzern Kontron AG – ehemals S&T AG – ist mit mehr als 6.000 Mitarbeitern und Niederlassungen in 32 Ländern weltweit präsent. Das im SDAX® an der Deutschen Börse gelistete Unternehmen ist einer der führenden Anbieter von IoT (Internet of Things) Technologien. In diesen Bereichen konzentriert sich Kontron auf die Entwicklung sicherer und vernetzter Lösungen durch ein kombiniertes Portfolio aus Hardware, Software und Services.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten