21st Austria weekly - DO & CO, Strabag, Rosenbauer, Wolford, Andritz (17/02/2023)

19.02.2023, 3407 Zeichen

DO & CO: Austrian catering group DO & CO said its nine-month sales more than doubled to 1.04 billion euros, compared with 495 million in the same period a year earlier. According to the company, the current business year is by far the strongest in terms of revenue in the Company’s history. The recovery from the impacts of the COVID-19 pandemic that started in the previous business year has continued in the first three quarters of the business year 2022/2023. DO & CO has benefited from an increase in demand across the three divisions airline catering, international event catering and restaurants, lounges & Hotels. For the first three quarters of the business year 2022/2023, the Group achieved a profit after income tax of 26.72 million euros, an increase of 9.39 million on the same period of the previous year. The management is confident that it can keep winning tenders of all sizes to successfully continue on its growth path.

DO&CO: weekly performance:

Strabag: Strabag, the publicly listed European technology group for construction services, nnounced its first figures for the 2022 financial year and an outlook for 2023. The group recorded a 10% increase in its output volume to € 17,735.47 million in the 2022 financial year, surpassing the previous record set in 2019. Despite rising construction costs and the accelerated interest rate turnaround, the order backlog as at 31 December 2022 increased by 6% year-on-year to € 23,738.84 million. The Management Board expects to be able to maintain the output volume at a high level in 2023 despite the challenging environment; specifically, the forecast is for € 17.9 billion. In terms of EBIT margin a normalisation is expected for both 2022 and 2023, in line with the long-term strategic goal of generating at least 4% on a sustainable basis from 2022. “While the interest rate turnaround is having a negative impact on the construction business – even more so than material and energy prices – we are coming out of an unusual zero interest rate policy phase and a related boom in construction; the development of the construction industry can thus be described as a normalisation rather than a crisis. For 2023, we do not expect any major setbacks for the Strabag Group, although we are already noticing a shift towards more public-sector projects in our order backlog,” CEO Klemens Haselsteiner commented.

Strabag: weekly performance:

Wolford: Bodywear group Wolford achieved sales in the amount of 126.6 million euros in 2022. This corresponds to an increase of +16% compared to the previous fiscal year 2021. The sales increase was achieved in all channels. On the earnings side, the outlook given at the half-year is confirmed, according to which there will be no improvement in operating profit (EBIT) for the full year.

Wolford: weekly performance:

Andritz: Visy Paper will install a FibreFlow Drum pulping system for its recycled paper mill in Coolaroo, Victoria, Australia. Andritz will deliver a FibreFlow Drum pulper with a maximum feed capacity of 1,400 t/d, various fiber cleaning equipment, and a spray water treatment system for the production of various board grades. “The drum pulper is the first of its kind in Australia,” says Jean Yves Nouaze, Executive General Manager Pulp & Paper, Visy.

Andritz: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (17/02/2023)

Wiener Börse Party #642: ATX rauf, Beobachtungsliste-Blick, morgen Kinder-Roadshow AT&S in Wien, Weinen mit der Gen Z

Bildnachweis

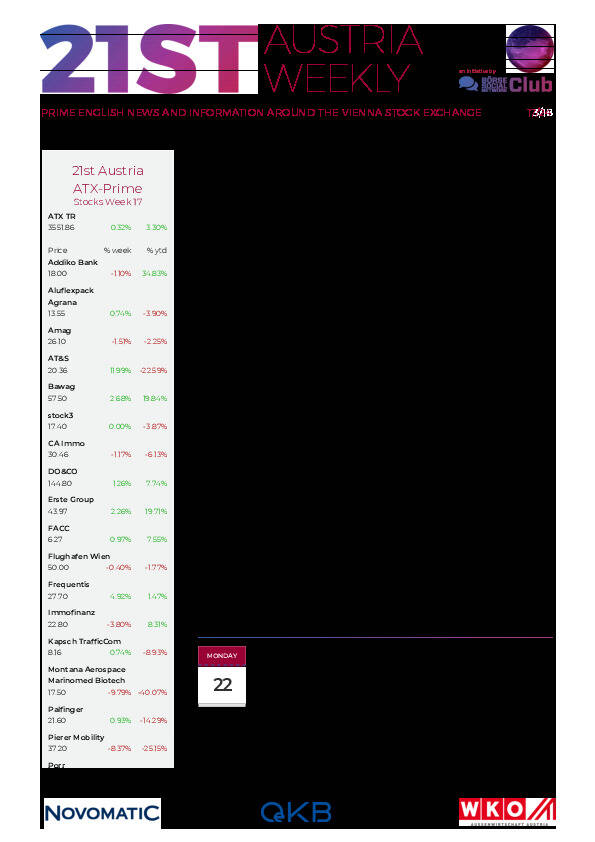

Aktien auf dem Radar:Polytec Group, Palfinger, Immofinanz, Warimpex, Flughafen Wien, Austriacard Holdings AG, Rosgix, Verbund, RBI, Porr, Frequentis, Addiko Bank, AT&S, Cleen Energy, Gurktaler AG Stamm, SBO, SW Umwelttechnik, Oberbank AG Stamm, Marinomed Biotech, Agrana, Amag, CA Immo, Erste Group, EVN, FACC, Kapsch TrafficCom, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG.

Random Partner

Baader Bank

Die Baader Bank ist eine der führenden familiengeführten Investmentbanken im deutschsprachigen Raum. Die beiden Säulen des Baader Bank Geschäftsmodells sind Market Making und Investment Banking. Als Spezialist an den Börsenplätzen Deutschland, Österreich und der Schweiz handelt die Baader Bank über 800.000 Finanzinstrumente.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten