21st Austria weekly - Palfinger, Rosenbauer, S Immo, RHI Magnesita (21/04/2023)

23.04.2023, 2520 Zeichen

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (21/04/2023)

Börsepeople im Podcast S23/25: Peter Thier

Bildnachweis

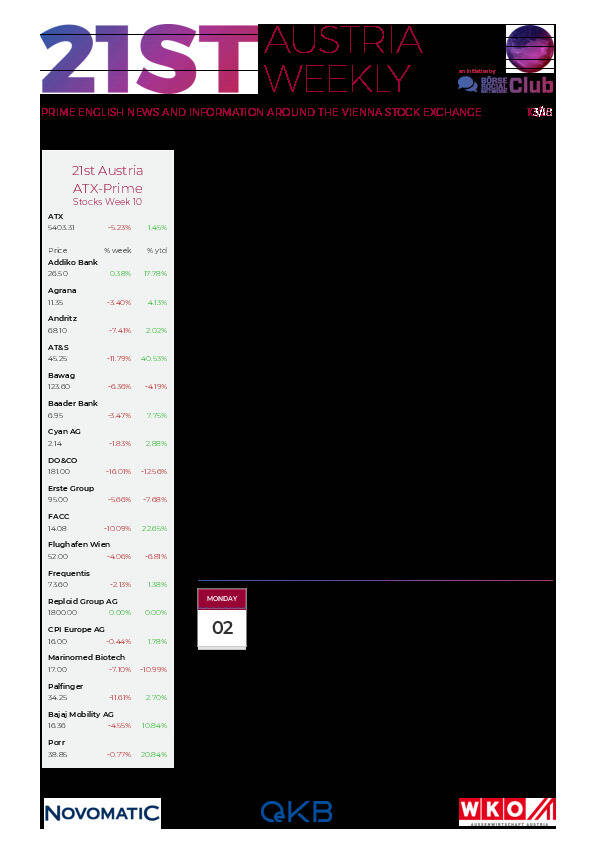

Aktien auf dem Radar:FACC, CPI Europe AG, Wienerberger, Agrana, Austriacard Holdings AG, EuroTeleSites AG, SBO, Semperit, AT&S, DO&CO, Erste Group, Frequentis, Linz Textil Holding, Mayr-Melnhof, Palfinger, Porr, Polytec Group, RBI, Uniqa, VIG, voestalpine, Wiener Privatbank, BKS Bank Stamm, Oberbank AG Stamm, Kapsch TrafficCom, Verbund, Amag, CA Immo, EVN, Flughafen Wien, Österreichische Post.

Random Partner

Societe Generale

Société Générale ist einer der weltweit größten Derivate-Emittenten und auch in Deutschland bereits seit 1989 konstant als Anbieter für Optionsscheine, Zertifikate und Aktienanleihen aktiv. Mit einer umfangreichen Auswahl an Basiswerten aller Anlageklassen (Aktien, Indizes, Rohstoffe, Währungen und Zinsen) überzeugt Société Générale und nimmt in Deutschland einen führenden Platz im Bereich der Hebelprodukte ein.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten