21st Austria weekly - voestalpine, SBO (07/06/2023)

11.06.2023, 1624 Zeichen

voestalpine: Steel group voestalpine posted record revenue and results in many earnings categories in the business year ended. Revenue rose by a further 22.1%, to EUR 18.2 billion. The operating result (EBITDA) grew by 11.1% to EUR 2.5 billion. Profit before tax was EUR 1.5 billion (previous year: EUR 1.4 billion), profit after tax fell by 11.4% to EUR 1.2 billion. The comparative figure of EUR 1.3 billion for the previous year included a positive valuation of EUR 257 million resulting from the sale of the HBI plant in Texas (USA). Subject to approval by the Annual General Meeting of voestalpine AG on July 5, 2023, a dividend of EUR 1.50 per share (last year 1,2 Euro) will be paid to the company’s shareholders.

voestalpine: weekly performance:

SBO: The Supervisory Board of Schoeller-Bleckmann Oilfield Equipment AG (SBO), listed on the ATX of the Vienna Stock Exchange, has passed a resolution on the company's designated Executive Board team as of 1 January 2024. At the beginning of the year, CEO Gerald Grohmann had announced after 22 years in the position that he would not renew his contract that runs until the end of the year. As of January 2024, Klaus Mader, currently Chief Financial Officer (CFO) of SBO, will assume the position of Chief Executive Officer (CEO) and CFO in combination. Campbell MacPherson, currently head of SBO's Advanced Manufacturing & Services (AMS) division, will be promoted to the Executive Board and become Chief Operating Officer (COO) of the company.

SBO: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (07/06/2023)

Wiener Börse Party #1080: ATX nahe Rekorden, Warimpex-Day bzw. vor spannendem Bookbuildung bei Asta Energy

Bildnachweis

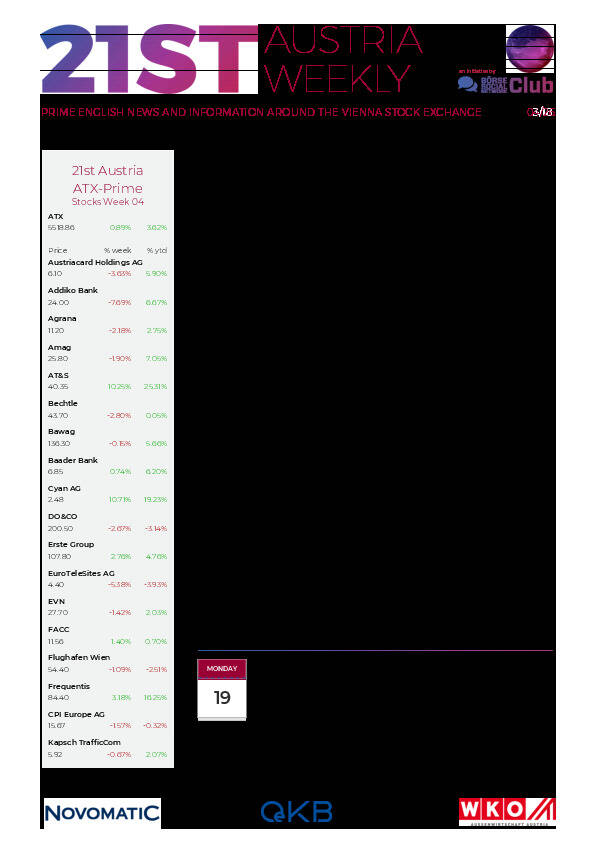

Aktien auf dem Radar:EuroTeleSites AG, Porr, RHI Magnesita, Austriacard Holdings AG, Zumtobel, Addiko Bank, FACC, Andritz, CA Immo, Lenzing, Polytec Group, Amag, Pierer Mobility, BKS Bank Stamm, Oberbank AG Stamm, Josef Manner & Comp. AG, EVN, CPI Europe AG, OMV, Österreichische Post, Telekom Austria, Verbund.

Random Partner

Bechtle

Bechtle bietet Technologiekonzepte und umfassende IT-Lösungen für die digitale Transformation. Vom vollständigen IT-Arbeitsplatz über Datacenter und Multi-Cloud-Lösungen bis hin zu IT-Security und Künstliche Intelligenz entwickeln wir zukunftsfähige IT-Architekturen.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten