21st Austria weekly - Verbund, Andritz, Amag, ams Osram, Marinomed (27/07/2023)

30.07.2023, 4640 Zeichen

Verbund: Austrian utility Verbund saw an improvement in the results posted for quarters 1–2/2023. The reported Group result rose by 57.5% to €1,287.2m. Generation from the annual storage power plants rose by 6.2% in quarters 1–2/2023 compared with the prior-year reporting period. Generation from hydropower plants thus increased by 947 GWh to 15,054 GWh. The sharp rise in wholesale electricity prices on the futures markets that were relevant for the reporting period gave earnings a considerable boost. Conversely, spot market prices fell in quarters 1–2/2023. The average sales prices obtained for VERBUND’s own generation from hydropower rose by €69.6/MWh to €182.1/MWh. Higher generation from photovoltaic installations and wind power plants, especially from the plants put into operation in Spain, also had a positive effect, as did the higher earnings contribution from Gas Connect Austria GmbH in the Grid segment. This stood in contrast to the reduction in earnings caused by a significant decrease in thermal generation and the negative earnings contribution from the Sales segment attributable to high procurement costs, among other factors. The taxation of the windfall revenues of inframarginal power generators in Austria from December 2022 onwards and corresponding windfall profits in Romania had a negative impact of around €172m on the Group’s result.

Verbund: weekly performance:

Andritz: International technology group Andritz significantly increased revenue and earnings in the first half of 2023 compared to the first six months of the previous year despite the cooling global economy. The order intake of the Group amounted to 4,712.5 MEUR in the first half of 2023 and was thus practically at the high level of the previous year’s reference period (-1.2% versus H1 2022 4,767.6 MEUR). The order backlog as of June 30, 2023 amounted to 10,569.0 MEUR and increased by 5.9% compared to the end of 2022 (9,976.5 MEUR). Revenue of the Andritz in the first half of 2023 amounted to 4,109.0 MEUR and increased by 23.9% compared to the previous year’s reference period (first half of 2022: 3,317.0 MEUR). In the first half of 2023, the net income (without non-controlling interests) amounted to 226.8 MEUR (H1 2022: 167.2 MEUR).

Andritz: weekly performance:

ams-Osram: ams OSRAM presents a strategic re-alignment of the group. The company is re-focusing its semiconductor portfolio on its profitable core in differentiated, intelligent sensor and emitter components. The non-core and lower performing portfolio with revenues of around EUR 300 to 400 million - including amongst others - passive Optical Components, will be exited.

AMS: weekly performance:

Amag: AMAG Group, an Austrian premium supplier of high-quality aluminium cast and flat, generated revenue of EUR 796.4 million in the first half of 2023 (H1/2022: EUR 904.3 million). This was due particularly to the 23.6 % lower aluminum price and lower shipment volumes of 221,200 tonnes (H1/2022: 225,100 tonnes). At EUR 117.8 million, the second highest half-year earnings in AMAG’s history were achieved, following record EBITDA (earnings before interest, taxes, depreciation and amortisation) in the previous year (H1/2022: EUR 156.5 million), despite lower shipment volumes. Net income after taxes amounted to EUR 51.0 million in the reporting period, compared with EUR 78.4 million in the first half of 2022.

Amag: weekly performance:

Marinomed: Marinomed Biotech announced the market approval of a Carragelose nasal spray in Mexico. In 2021, Marinomed disclosed a licence agreement with the Latin American based specialty pharmaceutical company M8 pharmaceuticals (formerly moksha8) for the distribution of Carragelose nasal sprays in Mexican and Brazilian markets. M8 is responsible for pursuing the local market authorization and marketing of the product in the region. The approval for the Carragelose nasal spray has now been granted in Mexico, which clears the way for a market launch. The launch of the Carragelose nasal spray, which will be available under the trade name Barlo®, is envisaged for the next season. With a population of over 130 million, Mexico is Latin America’s second largest OTC and Rx market. The Mexican consumer healthcare market is forecasted to keep growing at an annual rate of up to 10%, reaching five billion USD by 2035. With a share of 32%, cough, cold and allergy is the leading Mexican OTC segment and represents a significant sales potential for Carragelose products.

Marinomed Biotech: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (27/07/2023)

BörseGeschichte Podcast: Wolfgang Matejka vor 10 Jahren zum ATX-25er

Bildnachweis

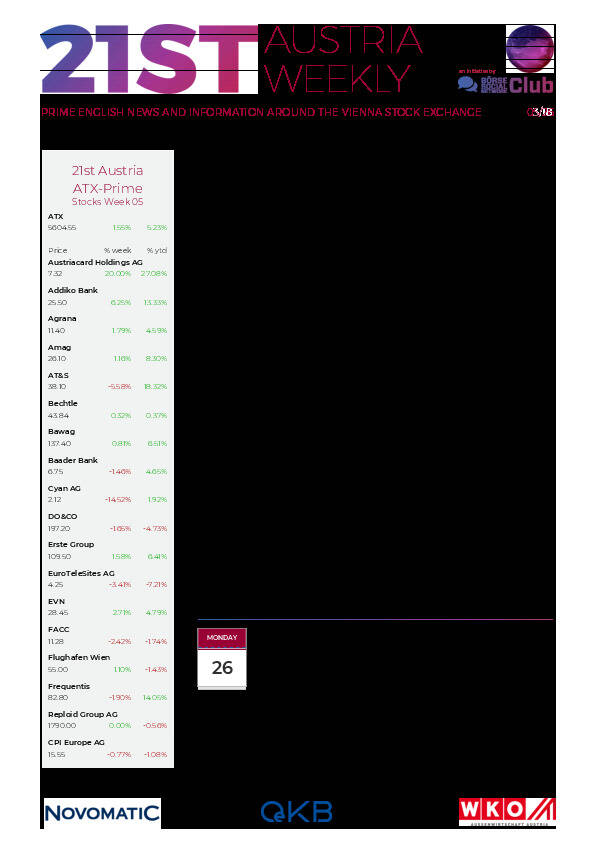

Aktien auf dem Radar:Austriacard Holdings AG, AT&S, Addiko Bank, Amag, SBO, Rosenbauer, RBI, ATX, ATX Prime, ATX TR, voestalpine, Porr, Bajaj Mobility AG, ATX NTR, Erste Group, VIG, Palfinger, DO&CO, Rosgix, Stadlauer Malzfabrik AG, Wiener Privatbank, Polytec Group, Frequentis, RHI Magnesita, BKS Bank Stamm, Oberbank AG Stamm, Flughafen Wien, CA Immo, EuroTeleSites AG, EVN, CPI Europe AG.

Random Partner

Wiener Börse

Als zentrale Infrastrukturanbieterin der Region öffnet die Wiener Börse AG Tore zu den globalen Finanzmärkten. Sie vereint die Börsenplätze Wien und Prag. Mit modernster Technik und kundenorientierten Services leistet die Wiener Börse als privatwirtschaftliches, gewinnorientiertes Unternehmen einen bedeutenden Beitrag für einen international wettbewerbsfähigen Kapitalmarkt.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten