21st Austria weekly - EVN, Uniqa (24/08/2023)

27.08.2023, 1629 Zeichen

EVN: Revenue recorded by Austrian utility group EVN Group declined by 1.3% to EUR 2,904.1m in the first three quarters of 2022/23. The underlying factors included a decrease in revenue from South East Europe due to lower network and energy sales volumes as well as market price declines which followed the market distortions and sharp rise in the previous year. The international project business also reported a decrease in revenue. In contrast, revenue was increased by price effects for renewable electricity generation, valuation effects from hedges, higher sales prices at EVN Wärme and an increase in network tariffs. Group net result for the period equalled EUR 419.1m. That represents a year-on-year increase of 83.5%, which was influenced primarily by the high dividend payment of EUR 158.0m from Verbund AG.

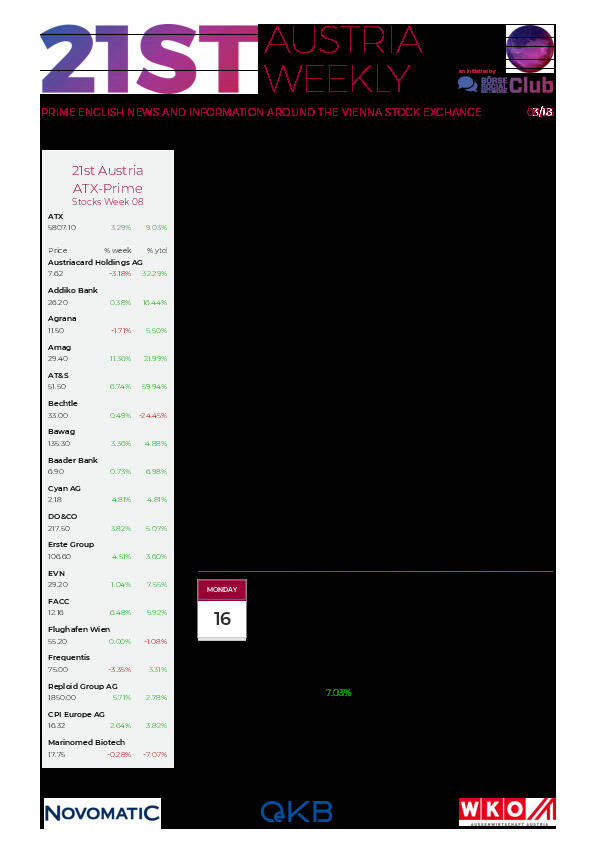

EVN: weekly performance:

Uniqa: The Uniqa Insurance Group AG is once again able to present strong figures for the first half of 2023, with premium growth of 7.9 per cent to €3.7 billion and a significant increase in earnings before taxes to €216 million. “The continuation in the very good operating performance both in Austria and especially in our international markets is the crucial factor. The financial result is also above expectations. Even though the moderate loss developments in the first half of 2023 played a role too, we do see that claims increased due to the severe weather in the summer months of July and August”, says Andreas Brandstetter, CEO UNIQA Insurance Group.

Uniqa: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (24/08/2023)

Wiener Börse Party #1099: Wiener Börse zum Februar-Verfall fester, aber mit kleiner Enttäuschung, positive Spannungsmomente bei der Porr

Bildnachweis

Aktien auf dem Radar:Kapsch TrafficCom, Strabag, Agrana, Bajaj Mobility AG, Addiko Bank, Austriacard Holdings AG, Amag, Rosgix, DO&CO, Porr, FACC, BKS Bank Stamm, Oberbank AG Stamm, Reploid Group AG, Josef Manner & Comp. AG, UBM, CA Immo, EuroTeleSites AG, EVN, Flughafen Wien, CPI Europe AG, OMV, Österreichische Post, Telekom Austria, Verbund, Fresenius Medical Care, Allianz, HeidelbergCement, Deutsche Post, Scout24, Bayer.

Random Partner

Societe Generale

Société Générale ist einer der weltweit größten Derivate-Emittenten und auch in Deutschland bereits seit 1989 konstant als Anbieter für Optionsscheine, Zertifikate und Aktienanleihen aktiv. Mit einer umfangreichen Auswahl an Basiswerten aller Anlageklassen (Aktien, Indizes, Rohstoffe, Währungen und Zinsen) überzeugt Société Générale und nimmt in Deutschland einen führenden Platz im Bereich der Hebelprodukte ein.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten