21st Austria weekly - ams Osram, Andritz, RBI (20/09/2023)

24.09.2023, 2204 Zeichen

ams Osram: ams Osram, a global leader in intelligent sensors and emitters, received notice of substantial public funding by the German federal government (i.e. the Federal Ministry for Economic Affairs and Climate Action) and the Free State of Bavaria. The funding is intended to boost the further development of semiconductor technology. The envisaged IPCEI funding (Important Project of Common European Interest) will support ams Osram in making its own investments in the research and development of innovative optoelectronic components at its Regensburg location. Subject to the final notice of grants, the company expects to receive more than EUR 300 million in public funding over the next five years.

ams-Osram: weekly performance:

Andritz: The Salzgitter Group has selected Austiran headquartered technology group Andritz to supply one of Europe's largest green hydrogen plants for the SALCOS® program, which aims to achieve virtually CO[2]-free (green) steel production. Andritz will build a 100 MW electrolysis plant at the Salzgitter Flachstahl GmbH site on an EPC basis, incorporating pressurized alkaline electrolyzer technology from HydrogenPro. Starting in 2026, the plant will produce around 9,000 tons of green hydrogen per year, which will be used to produce green steel. This will mark the start of the industrial utilization of hydrogen under the SALCOS® program.

Andritz: weekly performance:

RBI: Raiffeisen Bank International AG (RBI) has securitized a loan portfolio worth € 1.85 billion. The portfolio consists of corporate loans mainly in Germany, Slovakia and Austria. In this synthetic securitization, the portfolio was split into a senior, a mezzanine and a junior risk position. The credit risk of the mezzanine tranche was assumed by an international institutional investor. RBI retains the credit risk of the junior and senior tranches. Thanks to this securitization structure, the transaction has no impact on customer relations. At group level, the transaction will strengthen the common equity tier 1 ratio by approximately 11 basis points.

RBI: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (20/09/2023)

BörseGeschichte Podcast: Stefan Maxian vor 10 Jahren zum ATX-25er

Bildnachweis

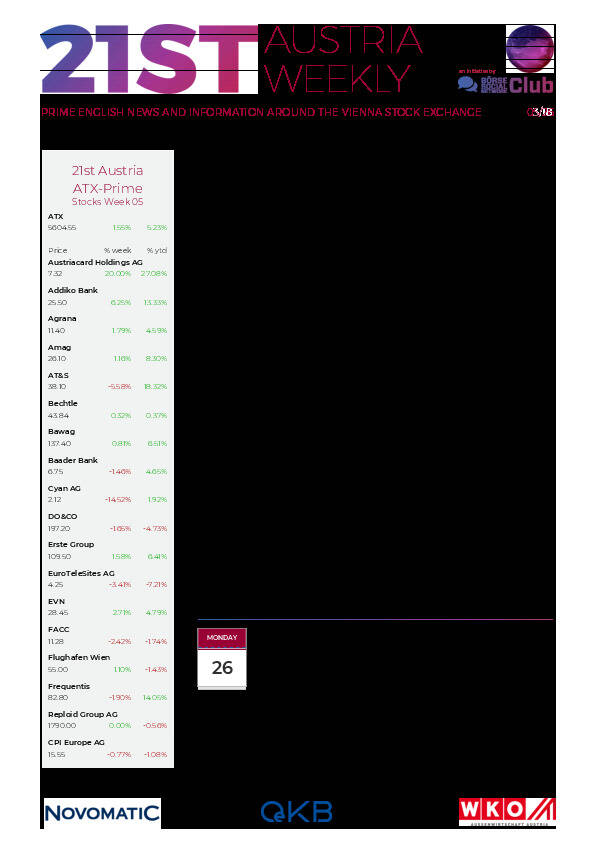

Aktien auf dem Radar:AT&S, Austriacard Holdings AG, OMV, Amag, Semperit, SBO, ATX, ATX Prime, ATX TR, ATX NTR, Palfinger, Wienerberger, Andritz, Mayr-Melnhof, Uniqa, Österreichische Post, DO&CO, Addiko Bank, Lenzing, Marinomed Biotech, Polytec Group, Stadlauer Malzfabrik AG, Telekom Austria, Wiener Privatbank, RHI Magnesita, BKS Bank Stamm, Oberbank AG Stamm, Agrana, CA Immo, EuroTeleSites AG, EVN.

Random Partner

Schwabe, Ley & Greiner (SLG)

Das Unternehmen SLG wurde 1988 gegründet und ist spezialisiert auf die Beratung im Bereich Finanz- und Treasury-Management.

Wir sind Marktführer im gesamten deutschsprachigen Raum und verfügen über einen soliden Partnerkreis. Diesen haben wir zur Stärkung des Unternehmens kontinuierlich erweitert.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten