21st Austria weekly - Wolftank, CA Immo, Immofinanz, VIG (30/11/2023)

03.12.2023, 3093 Zeichen

Wolftank: Wolftank Group, specializing in energy and environmental technologies, has obtained a major contract from Siram Veolia to design and build a hydrogen refueling infrastructure for a railway company near Lake Iseo in northern Italy, on a total tender base of EUR 19.5 mn. This significant order assigned by Siram Veolia marks another milestone in Wolftank Group’s growing portfolio in public transport refueling.

Wolftank-Adisa: weekly performance:

Immofinanz: Immofinanz Group recorded strong growth in both rental income and operating results in the first three quarters of 2023 due to acquisitions, the full consolidation of S Immo and successful asset management. Rental income rose by 79.4% year-on-year to EUR 389.2 million; the results of asset management, at EUR 323.7 million, were even 92.2% higher than in the previous year. The results of operations increased to EUR 209.1 million and sustainable FFO 1 from the standing investment business more than doubled to EUR 214.4 million. “The results show that we are in a resilient position and are operating successfully with our strategy. Despite the challenging market environment, we performed strongly with acquisitions, the full consolidation of S IMMO and our asset management and recorded significant growth in all operating key figures. We also continued to improve our financial basis, which puts us in a solid position for the future,” says Radka Doehring, member of the Immofinanz Executive Board.

Immofinanz: weekly performance:

CA Immo: CA Immo, the real estate company specializing in high-quality office space, can report a good operating performance for the first three quarters of 2023. The results show, among other things, a significant increase in rental income (+9%) and high income from the sale of non-strategic properties (sales result of €158m, FFO II +88%), which led to an increase in the operating result (EBITDA) of 129% compared to the previous year´s figure. In total, CA Immo generated a consolidated net profit of €61.1m, which was around 77% below the previous year's figure, primarily due to the non-cash-effective, market-related negative result from revaluation. High liquidity, a solid equity ratio of 47.9% and a balanced maturity profile of long-term liabilities ensure stability even in this uncertain market situation and increase the scope for active portfolio management.

CA Immo: weekly performance:

VIG: Vienna Insurance Group (VIG) generated a total premium volume of EUR 10,619 million over the first three quarters. This equates to an 11.4% increase year on year. A significant increase in premiums was achieved in all segments. The Group’s solvency ratio at the end of the third quarter of 2023 was 303.8% (including transitional measures) and thus increased further compared to 282% in the first half of 2023. VIG is confident that the Group will achieve profit before taxes at the upper end of the EUR 700–750 million range for 2023 as a whole.

VIG: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (30/11/2023)

SportWoche Podcast #106: Persönliches Fail-Fazit VCM und Staatsmeisterin Carola Bendl-Tschiedel über Rekordlerin Julia Mayer

Bildnachweis

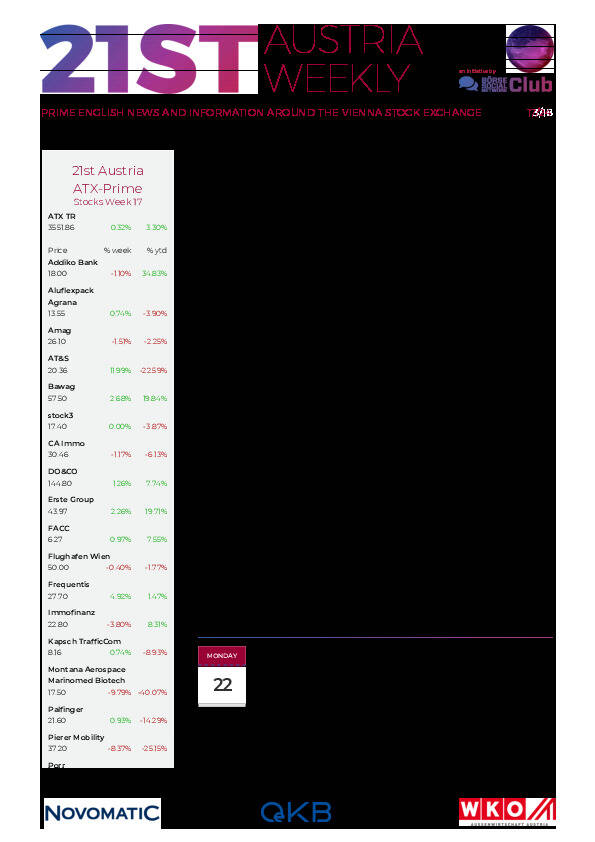

Aktien auf dem Radar:Immofinanz, Polytec Group, Marinomed Biotech, Flughafen Wien, Warimpex, Lenzing, AT&S, Strabag, Uniqa, Wienerberger, Pierer Mobility, ATX, ATX TR, VIG, Andritz, Erste Group, Semperit, Cleen Energy, Österreichische Post, Stadlauer Malzfabrik AG, Addiko Bank, Oberbank AG Stamm, Agrana, Amag, CA Immo, EVN, Kapsch TrafficCom, OMV, Telekom Austria, Siemens Energy, Intel.

Random Partner

FACC

Die FACC ist führend in der Entwicklung und Produktion von Komponenten und Systemen aus Composite-Materialien. Die FACC Leichtbaulösungen sorgen in Verkehrs-, Fracht-, Businessflugzeugen und Hubschraubern für Sicherheit und Gewichtsersparnis, aber auch Schallreduktion. Zu den Kunden zählen u.a. wichtige Flugzeug- und Triebwerkshersteller.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten