21st Austria weekly - Marinomed, UBM (11/04/2024)

14.04.2024, 1947 Zeichen

Marinomed: Marinomed Biotech AG announced the expansion of its Carragelose product portfolio with new launches in Austria and Mexico, paving the way for targeting new indications and access to key markets. A new nasal spray formulation for the treatment of the symptoms of hay fever caused by grass pollen allergy has been launched by Marinomed’s Austrian distribution partner Sigmapharm under the brand name COLDAMARIS Allergie. Offering both symptom prevention and relief of allergic symptoms such as dryness in the nasal cavity, runny or blocked nose, itching and sneezing, this market entry perfectly coincides with the peak of this year’s allergy season. The launch of the allergen-blocking nasal spray also represents an important landmark in the expansion of the established Carragelose portfolio from blocking viruses to allergic indications, providing year-round revenue generation beyond the typical cold season.

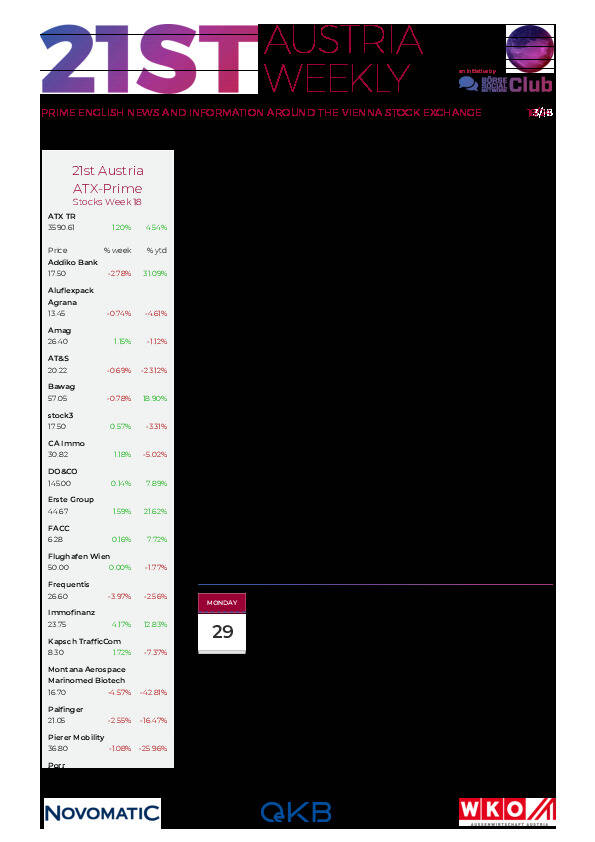

Marinomed Biotech: weekly performance:

UBM: UBM Development AG closed the 2023 financial year with negative earnings before tax of €39.4m. The loss resulted, above all, from revaluations of approximately €70m to projects and properties during the past year as well as the still difficult transaction market. “2023 will undoubtedly go down as an “annus horribilis“ in the history of the real estate market. In spite of this adverse operating climate, UBM has demonstrated its resilience and relative strength“ indicated Thomas G. Winkler, CEO of UBM Development AG. As of 31 December 2023, UBM held cash and cash equivalents of €151.5m and had an equity ratio of 30.3%. The outstanding €91.05m from the UBM bond 2018-2023 was repaid in full from internal cash reserves during the fourth quarter of 2023. It is also important to highlight that no other bond repayments will be due until November 2025.

UBM: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (11/04/2024)

Wiener Börse Party #646: ATX TR virtuell erneut auf High, Warimpex-Chance und Feiertagsmashup mit dem Live-Blick Börsenradio2go

Bildnachweis

Aktien auf dem Radar:Österreichische Post, Palfinger, RHI Magnesita, Flughafen Wien, EuroTeleSites AG, Rosenbauer, Wienerberger, Andritz, VIG, Strabag, SBO, Porr, Addiko Bank, Lenzing, Pierer Mobility, Verbund, voestalpine, Wolford, Wiener Privatbank, SW Umwelttechnik, Oberbank AG Stamm, Agrana, Amag, CA Immo, Erste Group, EVN, FACC, Immofinanz, Kapsch TrafficCom, OMV, Telekom Austria.

Random Partner

VIG

Die Vienna Insurance Group (VIG) ist mit rund 50 Konzerngesellschaften und mehr als 25.000 Mitarbeitern in 30 Ländern aktiv. Bereits seit 1994 notiert die VIG an der Wiener Börse und zählt heute zu den Top-Unternehmen im Segment “prime market“ und weist eine attraktive Dividendenpolitik auf.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten