21st Austria weekly - Agrana, Polytec, RBI (24/04/2025)

27.04.2025, 2664 Zeichen

Agrana: Following the conclusion of the audit of its consolidated financial statements, fruit, starch and sugar group AGRANA generated operating profit (EBIT) in its 2024|25 financial year (1 March 2024 to 28 February 2025) in an amount of € 40.5 million (prior year: € 151.0 million). Exceptional items amounted to € –36.4 million and the share of results of equity-accounted joint ventures ultimately amounted to € 0.5 million. Earnings per share declined to € –0.07 (prior year: € 1.04). Consolidated revenue amounted to € 3,514.0 million (prior year: € 3,786.9 million). The provisional plans for the 2025|26 financial year sufficiently accurate to allow the Management Board to make an initial forecast for the new financial year. For the 2025|26 financial year (1 March 2025 to 28 February 2026), AGRANA expects EBIT to be around the level of the prior year (0% to +1% or 0% to –1%). Consolidated revenue is expected to decline slightly (by more than –1% and by up to –5%).

Agrana: weekly performance:

Polytec: The POLYTEC GROUP's consolidated sales revenues amounted to EUR 677.8 million in the 2024 financial year, up 6.6% or EUR 41.8 million on the previous year (EUR 636.0 million). The GROUP's EBIT for the full financial year 2024 amounted to EUR 3.9 million, up EUR 10.6 million from the previous year's figure of minus EUR 6.7 million. The EBIT margin rose by 1.7 percentage points year-on-year, from minus 1.1% to 0.6%. From today's perspective, the management of POLYTEC Holding AG expects planned consolidated sales revenues in the range of EUR 650 million to EUR 700 million for the 2025 financial year and is targeting an EBIT margin of around 2% to 3%. The measures introduced in previous periods to increase operational efficiency are showing improvements and are expected to take full effect in the course of the year.

Polytec Group: weekly performance:

Raiffeisen Bank International AG (RBI): RBI announces that the Russian appeal court has confirmed the first-instance verdict in the legal proceedings initiated by Rasperia Trading Limited (“Rasperia”) against STRABAG SE, its Austrian core shareholders, and RBI’s wholly owned Russian subsidiary, AO Raiffeisenbank. AO Raiffeisenbank will appeal this verdict in the next instance in Russia. Furthermore, RBI Group is finalizing its claim against

Rasperia in Austria, which is expected to be filed in Q2/2025. The transfer ban on AO Raiffeisenbank shares, which was imposed as a measure to secure payment, is expected to be lifted upon the disbursement of the damages.

RBI: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (24/04/2025)

Wiener Börse Party #1110: ATX mehr als 2 Prozent tiefer, Verbund gesucht, Andritz vielversprechend und Gabler statt Babler

Bildnachweis

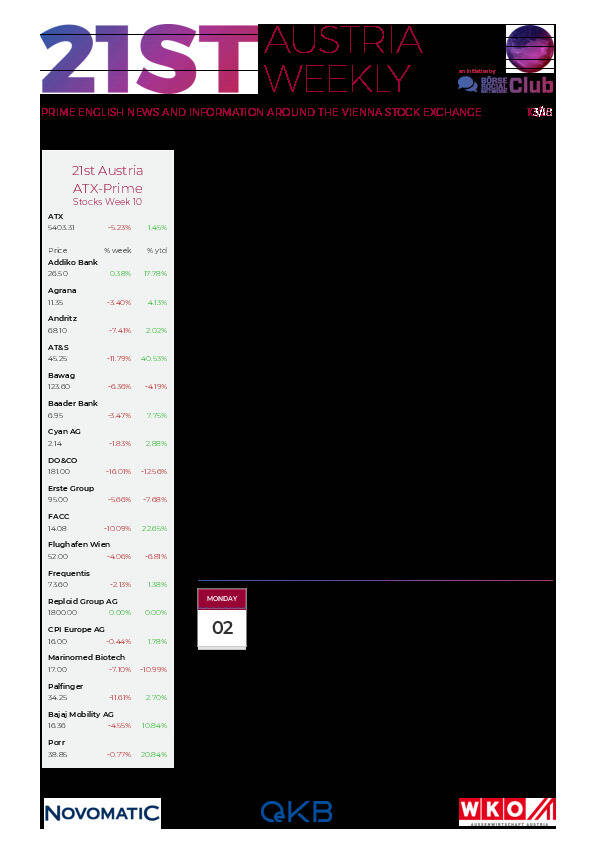

Aktien auf dem Radar:FACC, CPI Europe AG, RHI Magnesita, Austriacard Holdings AG, Agrana, Kapsch TrafficCom, OMV, Verbund, DO&CO, Palfinger, RBI, Strabag, Uniqa, VIG, Mayr-Melnhof, Lenzing, Erste Group, ATX, AT&S, ATX NTR, Bawag, Bajaj Mobility AG, Wienerberger, voestalpine, ATX TR, ATX Prime, Amag, Porr, Polytec Group, Rath AG, SBO.

Random Partner

VBV

Die VBV-Gruppe ist führend bei betrieblichen Vorsorgelösungen in Österreich. Sowohl im Bereich der Firmenpensionen als auch bei der Abfertigung NEU ist die VBV Marktführer. Neben der VBV-Pensionskasse und der VBV-Vorsorgekasse gehören auch Dienstleistungsunternehmen wie die VBV-Pensionsservice-Center, die VBV-Consult, die VBV-Asset Service und die Betriebliche Altersvorsorge-SoftWare Engineering zur VBV-Gruppe.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten