21st Austria weekly - Kontron, Verbund, Semperit (14/05/2025)

18.05.2025, 2517 Zeichen

Kontron: Kontron, a supplier of IoT technology, and congatec GmbH, a vendor of embedded and edge computing technology, today signed an agreement to cooperate in manufacturing COMs, whereby Kontron will manufacture the congatec COMs. Kontron’s subsidiary JUMPtec GmbH and congatec GmbH, a company fully owned by Deutsche Beteiligungs AG, are both developers of COMs for embedded computing (COMexpress, COM-HPC, SMARC, Q7). Both Kontron and congatec anticipate cost advantages and will be able to actively manage tariff developments, especially in the USA, due to the production facilities of Kontron in North America. Both companies are well known for the highest quality standards and a broad and innovative technology roadmap with powerful partnerships with Intel, AMD, Qualcomm, and NXP.

Kontron: weekly performance:

Verbund: Utility company VERBUND’s earnings for quarter 1/2025 saw a substantial year-on-year decline due to the extremely low water supply. EBITDA fell by 18.1% to €723.9m compared with the same period of the previous year and the Group result was down 21.6% to €396.7m. Despite significantly higher generation from thermal power, VERBUND’s own generation in quarter 1/2025 was 21.3% lower than the previous year's figure. The higher average sales prices achieved had a positive effect on earnings. The sales price achieved for own generation from hydropower rose by €8.7/MWh to €126.8/MWh.

Verbund: weekly performance:

Semperit: The Semperit Group’s business performance in the first quarter of 2025 was characterized by a persistently difficult market environment. Order activities remained subdued in most areas, with customers postponing projects due to increased uncertainty. This had a negative impact particularly on the conveyor belt business (Belting). Revenue amounted to EUR 151.7 million (–13.8%) and EBITDA to EUR 11.1 million (–51.6%). Operating EBITDA (before project costs) was EUR 11.9 million. “The first few months of 2025 were not only marked by a persistently difficult market environment, as expected, but also brought greater uncertainty with the tariff conflict initiated by the US. This led to further delays in our customers’ investment decisions and cautious ordering activity,” says Semperit CEO Manfred Stanek, Semperit is an internationally oriented group of companies that develops, produces and sells high-quality elastomer products.

Semperit: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (14/05/2025)

Silvesterparty Wiener Börse feat. Wolfgang Matejka & Gunter Deuber: Wer den Wiener Markt 2025 wachgeküsst hat (und sehr viel mehr)

Bildnachweis

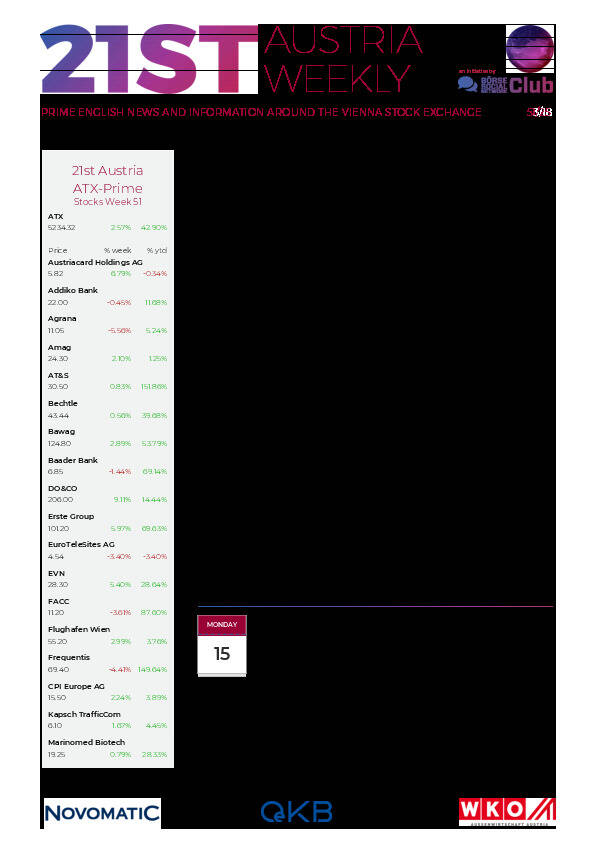

Aktien auf dem Radar:UBM, Agrana, Zumtobel, Addiko Bank, Austriacard Holdings AG, Palfinger, ATX, ATX Prime, ATX TR, ATX NTR, Bawag, Mayr-Melnhof, RBI, Wienerberger, Lenzing, Rosenbauer, Warimpex, CA Immo, FACC, Wolford, BKS Bank Stamm, Oberbank AG Stamm, VIG, Amag, AT&S, CPI Europe AG, Österreichische Post, voestalpine, Infineon, Merck KGaA, Fresenius Medical Care.

Random Partner

BNP Paribas

BNP Paribas ist eine führende europäische Bank mit internationaler Reichweite. Sie ist mit mehr als 190.000 Mitarbeitern in 74 Ländern vertreten, davon über 146.000 in Europa. BNP Paribas ist in vielen Bereichen Marktführer oder besetzt Schlüsselpositionen am Markt und gehört weltweit zu den kapitalstärksten Banken.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten