21st Austria weekly - VIG, Austriacard (19/05/2025)

25.05.2025, 1514 Zeichen

Vienna Insurance Group (VIG): Following the invitation of the Government of the Republic of Moldova, Vienna Insurance Group (VIG) has submitted a bid for the acquisition of 80% of the shares of MOLDASIG S.A. (Moldasig). The transaction aims at increasing stability and excellence in the field of risk protection. With a market share of around 14 percent, Moldasig, based in Chișinău, is one of Moldova’s leading non-life insurance companies. The company offers the full range of non-life insurance products to both individual and corporate clients.This transaction follows a multi-stage bidding process, initiated by the Moldovan state taking over 80 percent of the company's shares.

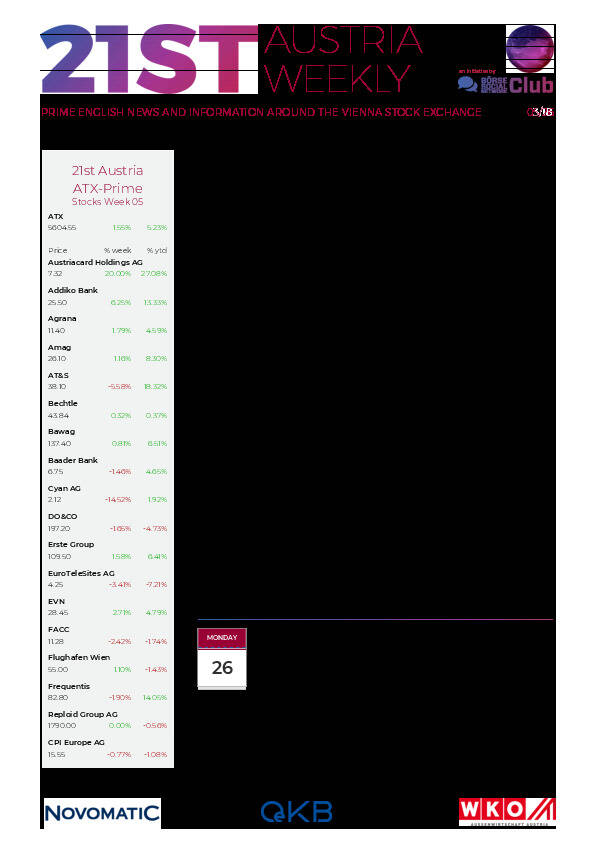

VIG: weekly performance:

Austriacard Holdings: AUSTRIACARD HOLDINGS AG announces its first-quarter results for 2025. The company reports progress in client solutions, robust growth in Western Europe, the Nordics, and the Americas, and a normalization of the card payment business in Türkiye. Group revenues decreased by 10% to €82.6 million in Q1 2025 (Q1 2024: €91.8 million) driven by a reduction in the Turkish payment card market, mainly due to the normalisation of customer owned banking card stock levels. Adjusted EBITDA decreased by 18.9% to €11.2 million, following the decrease in the top line and the reduction of gross profit. Net profit decreased by 50.5% to €2.6 million.

Austriacard Holdings AG: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (19/05/2025)

Private Investor Relations Podcast #24: Veronika Rief in der Philosophie-Viertelstunde über Nachhaltigkeitsberichterstattung im Finanzwesen

Bildnachweis

Aktien auf dem Radar:AT&S, Austriacard Holdings AG, OMV, Amag, Semperit, SBO, ATX, ATX Prime, ATX TR, ATX NTR, Palfinger, Wienerberger, Andritz, Mayr-Melnhof, Uniqa, Österreichische Post, DO&CO, Addiko Bank, Lenzing, Marinomed Biotech, Polytec Group, Stadlauer Malzfabrik AG, Telekom Austria, Wiener Privatbank, RHI Magnesita, BKS Bank Stamm, Oberbank AG Stamm, Agrana, CA Immo, EuroTeleSites AG, EVN.

Random Partner

Erste Group

Gegründet 1819 als die „Erste österreichische Spar-Casse“, ging die Erste Group 1997 mit der Strategie, ihr Retailgeschäft in die Wachstumsmärkte Zentral- und Osteuropas (CEE) auszuweiten, an die Wiener Börse. Durch zahlreiche Übernahmen und organisches Wachstum hat sich die Erste Group zu einem der größten Finanzdienstleister im östlichen Teil der EU entwickelt.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten