21st Austria weekly - Semperit, wienerberger (13/08/2025)

17.08.2025, 2240 Zeichen

Semperit: The Semperit Group's business performance in the first half of 2025 was marked by a persistently difficult market environment, with the second quarter seeing a significant improvement in earnings compared to the first quarter. The recovery in the order situation also continued. Revenue for the first half of the year amounted to EUR 320.5 million (–7.2%) and EBITDA to EUR 30.7 million (–35.2%). Operating EBITDA before project costs was EUR 32.9 million (–31.3%). “After a challenging start to the year, we gained momentum in the second quarter. An upturn in orders from March onwards underpins this trend. Both order intake in the first half of the year and the order backlog at the end of June are above the previous year’s levels,” says Semperit CEO Manfred Stanek. “We expect the recovery to continue in the second half of the year and will use this to further strengthen our market position in all business areas. Our focus will be on product innovations as well as further cost optimizations and efficiency improvements,” Stanek continued. The publicly listed Semperit AG Holding is an internationally oriented group of companies that develops, produces and sells high-quality elastomer products and applications.

Semperit: weekly performance:

wienerberger: wienerberger reports a solid performance in H1 2025, demonstrating its resilience and ability to adapt to challenging conditions in core end markets. Revenues amounted to €2.3 billion (H1 2024: €2.2 billion), while operating EBITDA reached €383 million (H1 2024: €400 million), reflecting the Group’s ability to maintain stable performance in a persistently volatile market environment. This underlines how wienerberger’s broad-based positioning across multiple end markets supports overall stability and contributed to growth in selected segments. The Group expects to prolong its solid performance into the rest of 2025 despite challenging conditions, and therefore re-confirms its previous operating EBITDA guidance of approximately €800 million for the full year 2025, in line with the guidance communicated earlier in the year.

Wienerberger: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (13/08/2025)

kapitalmarkt-stimme.at daily voice: Wie es über den Jahreswechsel mit unseren Podcasts weitergeht ...

Bildnachweis

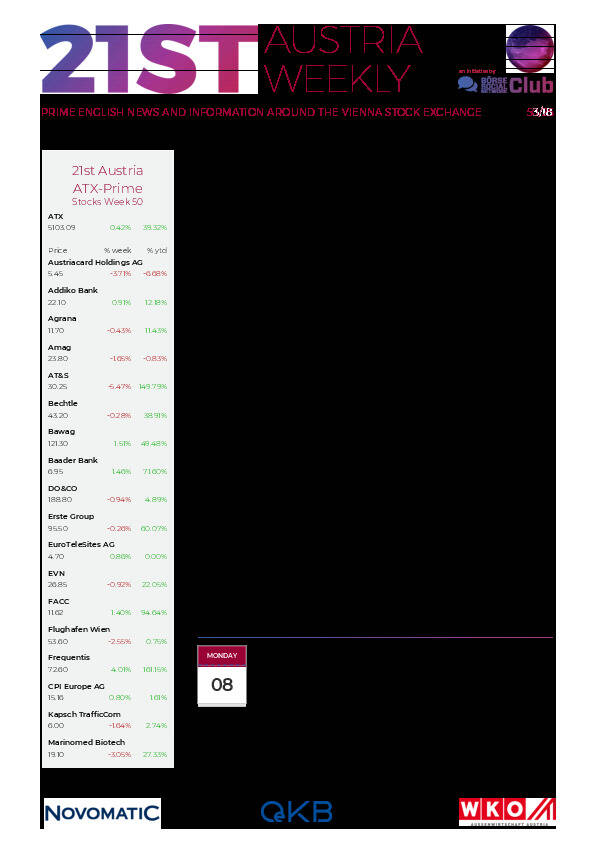

Aktien auf dem Radar:VIG, Amag, FACC, Pierer Mobility, EuroTeleSites AG, Addiko Bank, Frequentis, Rosgix, DO&CO, Frauenthal, Hutter & Schrantz Stahlbau, Hutter & Schrantz, Stadlauer Malzfabrik AG, Wolford, Oberbank AG Stamm, EVN, Flughafen Wien, CPI Europe AG, Kapsch TrafficCom, Österreichische Post, Semperit, Strabag.

Random Partner

BNP Paribas

BNP Paribas ist eine führende europäische Bank mit internationaler Reichweite. Sie ist mit mehr als 190.000 Mitarbeitern in 74 Ländern vertreten, davon über 146.000 in Europa. BNP Paribas ist in vielen Bereichen Marktführer oder besetzt Schlüsselpositionen am Markt und gehört weltweit zu den kapitalstärksten Banken.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten