21st Austria weekly - Polytec, DO & CO (14/08/2025)

17.08.2025, 2083 Zeichen

Polytec: The POLYTEC GROUP's consolidated sales revenue in the first half of 2025 amounted to EUR 357.6 million, up 2.3% on the same period of the previous year (H1 2024: EUR 349.6 million). The increase is mainly due to higher tooling and other engineering sales revenues. Earnings before interest and taxes (EBIT) rose from EUR 3.5 million in the first half of 2024 to EUR 5.6 million in the first half of 2025. The EBIT margin increased by 0.6 percentage points from 1.0% to 1.6% compared to the same period of the previous year. Consolidated earnings after tax for the first half of 2025 amounted to EUR 1.4 million (H1 2024: minus EUR 2.7 million). This corresponds to earnings per share of EUR 0.06 (H1 2024: minus EUR 0.11). From today's perspective, the management of POLYTEC Holding AG expects planned consolidated sales revenues in the range of EUR 650 million to EUR 700 million for the 2025 financial year and is targeting an EBIT margin of around 2% to 3%.

Polytec Group: weekly performance:

DO & CO: Catering Company DO & CO has benefited from increased demand across all divisions. With revenues of € 611.68m (PY: € 551.47m), DO & CO is reporting the strongest first quarter in terms of revenue in the Company’s history and is on course for further success. Consolidated earnings before interest and tax (EBIT) of the DO & CO Group amounted to € 52.46m, € 15.90m higher than in the previous year. The EBIT margin was 8.6 % (PY: 6.6 %). Compared to the first quarter of the business year 2024/2025 the net result increased by 44.1 % to € 26.79m (PY: € 18.60m). As one of the few providers in the field of high-end hospitality and gourmet catering, DO & CO is significantly benefitting from these developments. Therefore, this financial year will see a particular focus on innovation and employee training and development. Management believes that this clear strategy will provide the ideal conditions for continued strong growth in the future.

DO&CO: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (14/08/2025)

Wiener Börse Party #1057: ATX weiter leicht nach oben und wieder die Versicherer VIG und Uniqa vorne, Opening Bell Adela von der Post

Bildnachweis

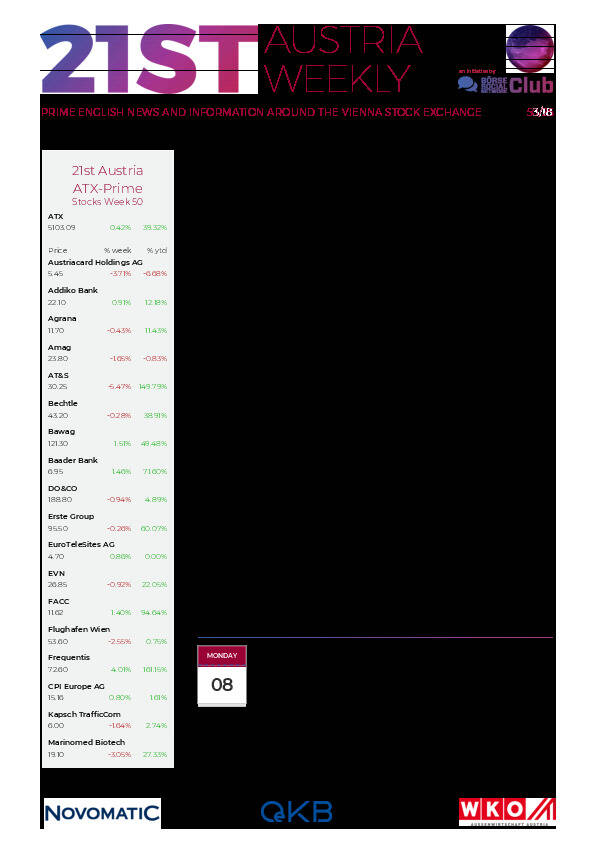

Aktien auf dem Radar:VIG, Austriacard Holdings AG, Amag, Pierer Mobility, EuroTeleSites AG, Addiko Bank, CPI Europe AG, Wienerberger, Zumtobel, BKS Bank Stamm, Oberbank AG Stamm, Kapsch TrafficCom, AT&S, EVN, Flughafen Wien, Österreichische Post, Semperit, Henkel, Münchener Rück, Fresenius Medical Care, E.ON , RWE, Zalando, Rheinmetall, Scout24, RHI Magnesita, FACC, RBI.

Random Partner

EXAA Abwicklungsstelle für Energieprodukte AG

Die EXAA Abwicklungsstelle für Energieprodukte AG ist die führende österreichische Energiebörse mit einer breiten heimischen sowie internationalen Kundenbasis und einem länderübergreifenden Produktportfolio. Die Energiebörse versteht sich als Partner für alle Akteure am europäischen Energiemarkt und erschließt kontinuierlich neue Geschäftsfelder, um weiter nachhaltig zu wachsen.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten