21st Austria weekly - CA Immo, (18/09/2018)

18.09.2018, 1755 Zeichen

CA Immo: Austrian real estate company CA Immo is issuing a corporate bond with a volume of Euro 150 m and a term of 7.5 years. The coupon for the fixed-rate bond is 1.875%, with a denomination of Euro 1,000. From 20 to 25 September 2018, private investors in Austria may subscribe to the bond through Austrian banks (the right to premature closing of the subscription is reserved). The bond will trade on the Second Regulated Market of the Vienna Stock Exchange. The international rating agency Moody’s Investors Service Ltd. has assigned an investment grade rating of Baa2 to the bond. CFO Hans Volkert Volckens commented: “With this transaction, we use the positive market sentiment to face future changes in the interest rate and market environment. Net proceeds will in particular be used for further growth and the optimization of debt and other general corporate purposes.” The net proceeds are largely earmarked for the financing and refinancing of properties including the Group’s latest as well as future acquisitions and future development projects. Aside from a further reduction in average borrowing costs, the transaction will serve to improve the maturity profile of financial liabilities while raising the quota of hedged financial liabilities. Moreover, the pool of unencumbered assets – a key factor in the company’s investment grade rating – will expand, thereby substantiating the rating of CA Immo (Moody’s Baa2 with stable outlook). The financing profile of the Group will thus become more robust. Raiffeisen Bank International AG and UniCredit Bank Austria AG were mandated as Joint-Lead Managers and Bookrunners.

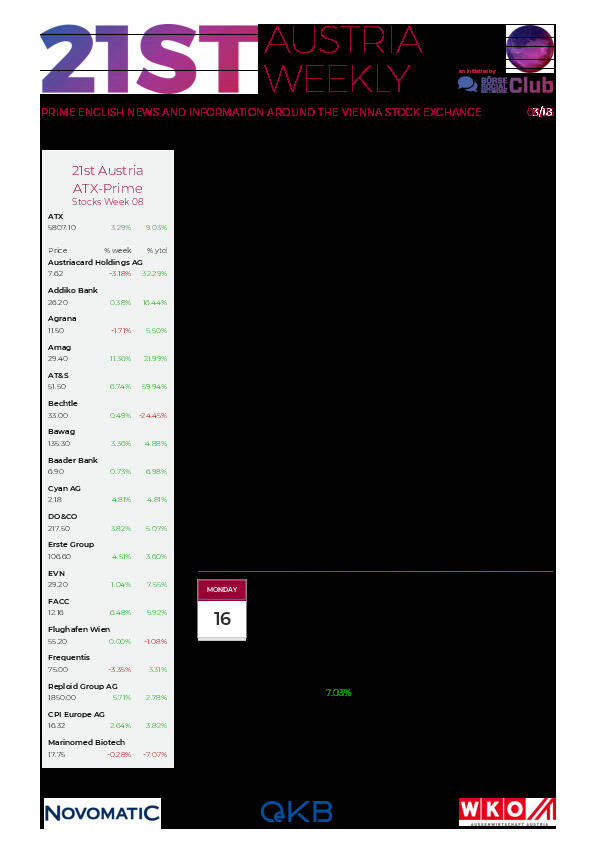

CA Immo: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (18/09/2018)

Wiener Börse Party #1102: ATX deutlich erholt, heute FACC-Day an der Wiener Börse, spannende News bei cyan, Aufschlag Erich Hampel

Bildnachweis

Aktien auf dem Radar:FACC, Amag, Strabag, Austriacard Holdings AG, Polytec Group, Flughafen Wien, Rosgix, EuroTeleSites AG, Wienerberger, Telekom Austria, AT&S, Hutter & Schrantz Stahlbau, SBO, RHI Magnesita, BKS Bank Stamm, Oberbank AG Stamm, Athos Immobilien, CA Immo, EVN, CPI Europe AG, OMV, Bajaj Mobility AG, Österreichische Post, UBM, Verbund.

Random Partner

EY

Bei EY wird alles daran gesetzt, dass die Welt besser funktioniert. Dafür steht unser Anspruch „Building a better working world“. Mit unserem umfassenden Wissen und der Qualität unserer Dienstleistungen stärken wir weltweit das Vertrauen in die Kapitalmärkte und Volkswirtschaften.

>> Besuchen Sie 53 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten