21st Austria weekly - Valneva (31/10/2019)

03.11.2019, 2111 Zeichen

Valneva: Austrian/French biotech company Valneva recorded total revenues in the first nine months of 2019 of Euro 81.4 mn (Euro 92.1 mn excluding the GSK SAA termination effect) compared to Euro 78.3 mn in the first nine months of 2018. A net negative effect of Euro 10.7 mn was included in Valneva’s collaboration and licensing revenues to reflect both the current and future payment obligations related to the termination of the SAA. Product sales revenues in the first nine months of 2019 increased to Euro 86.4 mn from Euro 71.1 mn in the first nine months of 2018, representing year-over-year growth of 22%. Valneva realized an operating loss of Euro 3.2 mn (operating profit of Euro 7.5 mn excluding the GSK SAA termination effect) in the first nine months of 2019 compared to an operating profit of Euro 0.9 mn in the same period of 2018. EBITDA in the first nine months of 2019 was Euro 3.0 mn (Euro 13.7 mn excluding the GSK SAA termination effect), compared to an EBITDA of Euro 6.1 mn in the first nine months of 2018. In the first nine months of 2019, Valneva generated a net loss amounting to Euro 2.4 mn (net profit of Euro 8.3 mn excluding the GSK SAA termination effect) compared to a net loss of Euro 3.3 mn in the first nine months of 2018. The company raised its product sales guidance and now projects product sales revenues of Euro 125 mn to Euro 130 mn representing year on year growth exceeding 20%. Previously, Valneva expected product sales revenue of between Euro 115 mn to Euro 125 mn. David Lawrence, Valneva’s Chief Financial Officer, commented, “The continued growth of IXIARO® and DUKORAL® sales, together with disciplined cost management, has enabled us to report strong results during the first nine months of the year. As a result, we feel confident about our full-year outlook and raise our product sales guidance. The recent completion of patient recruitment for our Lyme Phase 2 studies underscores the continuing execution on our key R&D value drivers.”

Valneva: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (31/10/2019)

Private Investor Relations Podcast #24: Veronika Rief in der Philosophie-Viertelstunde über Nachhaltigkeitsberichterstattung im Finanzwesen

Bildnachweis

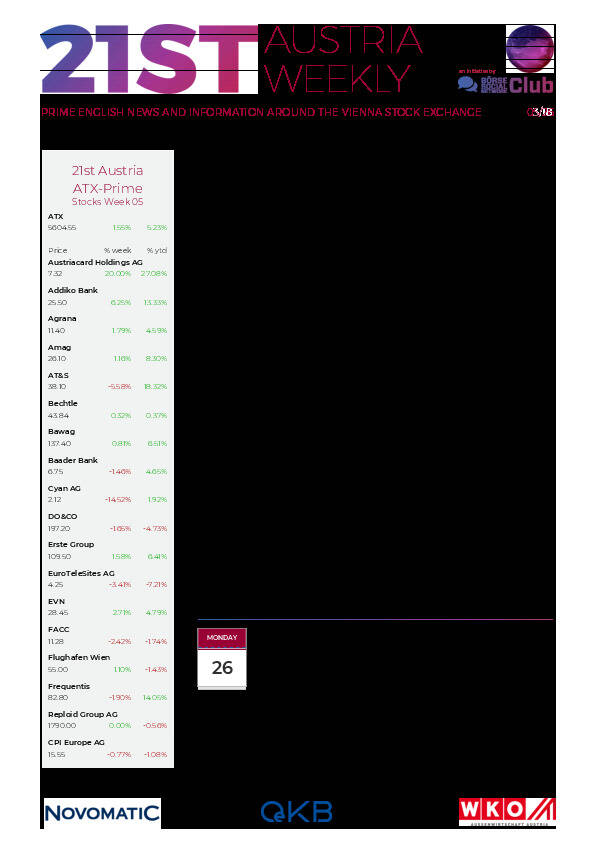

Aktien auf dem Radar:AT&S, OMV, Lenzing, Amag, EuroTeleSites AG, Zumtobel, Österreichische Post, DO&CO, Josef Manner & Comp. AG, Rath AG, RBI, Semperit, Warimpex, Telekom Austria, BKS Bank Stamm, Oberbank AG Stamm, Austriacard Holdings AG, Agrana, CA Immo, EVN, Flughafen Wien, Frequentis, CPI Europe AG, Verbund.

Random Partner

CPI Europe AG

Die CPI Europe AG ist ein börsenotierter gewerblicher Immobilienkonzern, der seine Aktivitäten auf die Segmente Einzelhandel und Büro in sieben Kernmärkten in Europa (Österreich, Deutschland, Tschechien, Slowakei, Ungarn, Rumänien und Polen) fokussiert. Zum Kerngeschäft zählen die Bewirtschaftung und die Entwicklung von Immobilien.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten