ANDRITZ GROUP: Results for Q3 / Q1-Q3 2019

06.11.2019, 9420 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Quarterly Report

Graz - NOVEMBER 6, 2019. International technology Group ANDRITZ achieved a considerable increase both in order intake and in sales in the third quarter of 2019 compared to the figures for the previous year's reference period. The order backlog reached a new record high. As expected, earnings (EBITA) were significantly below the level of the previous year's reference period due to the measures announced at the end of July for restructuring of the Metals Forming sector. Excluding this extraordinary effect, profitability (EBITA margin) remained at the same solid level as in the previous year's reference period.

The Group's financial key figures:

* In the third quarter of 2019, order intake at 2,093.9 MEUR was 42.6% higher than the figure for the previous year's reference period (Q3 2018: 1,468.7 MEUR), thus continuing the favorable development of the preceding quarters (Q1 2019: 1,658.1 MEUR; Q2 2019: 2,047.1 MEUR). This is attributable predominantly to the Pulp & Paper business area, which was able to more than double its order intake compared to the previous year due to a large-scale order to deliver pulp production technologies. Order intake in the other business areas was approximately the same as or just below the level of the previous year's reference period, thus reflecting the moderate general economic situation. As a result, order intake in the first three quarters of 2019 developed very favorably, rising to 5,799.1 MEUR (+22.4% compared to Q1-Q3 2018: 4,738.0 MEUR).

* The order backlog as of September 30, 2019 amounted to 8,120.7 MEUR, thus reaching its highest level in the company's history (+14.6% compared to the end of 2018: 7,084.3 MEUR).

* Sales rose significantly by 17.6% to 1,690.2 MEUR (Q3 2018: 1,437.7 MEUR) in the third quarter of 2019. The Pulp & Paper business area made a substantial contribution towards this, recording a significant increase in sales due to the favorable development of order intake in the preceding quarters. Sales in the first three quarters of 2019, at 4,752.6 MEUR, were also considerably higher than the previous year's reference figure (+13.1% versus Q1-Q3 2018: 4,200.8 MEUR).

* As expected, the EBITA for the third quarter, at 6.4 MEUR, was significantly lower than the figure for the previous year's reference period (85.9 MEUR). This is due to restructuring measures in the Metals Forming (Schuler) sector resulting from the weak international automotive market as well as measures for smaller capacity adjustments in the other business areas. Excluding these extraordinary effects of around 95 MEUR, the EBITA in the third quarter was 101.7 MEUR, and profitability (EBITA margin) at 6.0% reached the same level as in the previous year's reference period (Q3 2018: 6.0%). The EBITA in the first three quarters of 2019 amounted to 183.9 MEUR (-27.1% compared to Q1-Q3 2018: 252.2 MEUR).

* As also announced at the end of July 2019, impairment of goodwill was made in the amount of approximately 25 MEUR during the reporting quarter.

* The net income (without non-controlling interests) fell to -31.0 MEUR (Q3 2018: 56.4 MEUR) in the third quarter of 2019 due to the extraordinary measures, goodwill impairment and the significantly lower financial result in the third quarter of 2019. In the first three quarters of 2019, the net income (without non-controlling interests) amounted to 46.5 MEUR (Q1-Q3 2018: 157.0 MEUR).

OUTLOOK Regarding expectations for the 2019 business year as a whole, ANDRITZ confirms its guidance and expects a significant increase in sales compared to the previous year. In terms of profitability, ANDRITZ expects an unchanged operative EBITA margin before extraordinary effects of approximately 6.9% (EBITA margin 2018 before extraordinary effects: 6.9%).

Wolfgang Leitner, President and CEO of ANDRITZ AG. "In view of the weak global economy, the record order backlog of more than 8.1 billion euros provides a good basis for sales development in the coming year. Our main goals for 2020 are to process the high order backlog on schedule although it is distributed very unevenly over the business areas, implement the adjustment measures announced in the Metals Forming sector, and further optimize our cost structures in order to enhance our competitiveness."

KEY FINANCIAL FIGURES AT A GLANCE

Unit Q1-Q3 2019 Q1-Q3 2018 +/- Q3 Q3 +/- 2018 2019 2018 Sales MEUR 4,752.6 4,200.8 +13.1% 1,690.2 1,437.7 +17.6% 6,031.5 - Hydro MEUR 1,026.8 1,085.8 -5.4% 351.2 361.5 -2.8% 1,517.5 - Pulp & MEUR 2,060.9 1,523.2 +35.3% 750.6 513.7 +46.1% 2,233.2 Paper - Metals MEUR 1,181.4 1,142.7 +3.4% 422.7 400.3 +5.6% 1,635.1 - Separation MEUR 483.5 449.1 +7.7% 165.7 162.2 +2.2% 645.7 Order intake MEUR 5,799.1 4,738.0 +22.4% 2,093.9 1,468.7 +42.6% 6,646.2 - Hydro MEUR 944.8 1,056.2 -10.5% 343.0 303.1 +13.2% 1,445.8 - Pulp & MEUR 3,089.0 1,726.4 +78.9% 1,163.3 545.5 +113.3% 2,571.9 Paper - Metals MEUR 1,238.8 1,403.3 -11.7% 429.0 456.6 -6.0% 1,931.8 - Separation MEUR 526.5 552.1 -4.6% 158.6 163.5 -3.0% 696.7 Order backlog (as of end of MEUR 8,120.7 6,882.8 +18.0% 8,120.7 6,882.8 +18.0% 7,084.3 period) EBITDA MEUR 329.9 321.2 +2.7% 67.2 109.5 -38.6% 498.0 EBITDA margin % 6.9 7.6 - 4.0 7.6 - 8.3 EBITA MEUR 183.9 252.2 -27.1% 6.4 85.9 -92.5% 394.3 EBITA margin % 3.9 6.0 - 0.4 6.0 - 6.5 Earnings Before MEUR 93.8 229.3 -59.1% -35.1 76.4 -145.9% 321.6 Interest and Taxes (EBIT) Financial MEUR -35.7 -5.8 -515.5% -14.9 4.2 -454.8% -17.4 result Earnings Before Taxes MEUR 58.1 223.5 -74.0% -50.0 80.6 -162.0% 304.2 (EBT) Net income (without non- MEUR 46.5 157.0 -70.4% -31.0 56.4 -155.0% 222.0 controlling interests) Cash flow from MEUR 439.2 -85.0 +616.7% 167.3 16.2 +932.7% 7.8 operating activities Capital MEUR 96.9 69.3 +39.8% 34.9 22.1 +57.9% 137.0 expenditure Employees (as of end of period; - 29,690 26,397 +12.5% 29,690 26,397 +12.5% 29,096 without apprentices)

All figures according to IFRS. Due to the utilization of automatic calculation programs, differences can arise in the addition of rounded totals and percentages. MEUR = million euros. EUR = euros.

- End -

ANDRITZ GROUP ANDRITZ is an international technology group providing plants, systems, equipment, and services for various industries. The company is one of the technology and global market leaders in the hydropower business, the pulp and paper industry, the metal working and steel industries, and in solid/liquid separation in the municipal and industrial segments. Other important fields of business are animal feed and biomass pelleting, as well as automation, where ANDRITZ offers a wide range of innovative products and services in the IIoT (Industrial Internet of Things) sector under the brand name of Metris. In addition, the company is active in power generation (steam boiler plants, biomass power plants, recovery boilers, and gasification plants) and environmental technology (flue gas and exhaust gas cleaning plants) and offers equipment for the production of nonwovens, dissolving pulp, and panelboard, as well as recycling plants.

ANDRITZ stands for passion, partnership, perspectives and versatility - core values to which the company is committed. The listed Group is headquartered in Graz, Austria. With almost 170 years of experience, 29,700 employees, and more than 280 locations in over 40 countries worldwide, ANDRITZ is a reliable and competent partner and helps its customers to achieve their corporate and sustainability goals.

Annual and financial reports Annual and Financial reports are available for download at the ANDRITZ web site andritz.com [http://www.andritz.com/], and printed editions can be requested free of charge by e-mail to investors@andritz.com [investors@andritz.com].

Disclaimer Certain statements contained in this press release constitute "forward-looking statements". These statements, which contain the words "believe," "intend," "expect," and words of a similar meaning, reflect the Executive Board's beliefs and expectations and are subject to risks and uncertainties that may cause actual results to differ materially. As a result, readers are cautioned not to place undue reliance on such forward-looking statements. The company disclaims any obligation to publicly announce the result of any revisions to the forward- looking statements made herein, except where it would be required to do so under applicable law.

end of announcement euro adhoc

issuer: Andritz AG Stattegger Straße 18 A-8045 Graz phone: +43 (0)316 6902-0 FAX: +43 (0)316 6902-415 mail: welcome@andritz.com WWW: www.andritz.com ISIN: AT0000730007 indexes: WBI, ATX stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2900/aom

D&D Research Rendezvous #19: Gunter Deuber reiht den holprigen, aber guten, Jahresstart 2026 an den Börsen ein und bringt viel Ausblick

Andritz

Uhrzeit: 13:04:54

Veränderung zu letztem SK: 1.20%

Letzter SK: 70.70 ( -6.85%)

Bildnachweis

Aktien auf dem Radar:AT&S, Andritz, OMV, EuroTeleSites AG, Austriacard Holdings AG, Amag, Österreichische Post, Lenzing, CPI Europe AG, Telekom Austria, Semperit, Flughafen Wien, VIG, DO&CO, Gurktaler AG Stamm, Josef Manner & Comp. AG, Bajaj Mobility AG, Verbund, Warimpex, Addiko Bank, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Reploid Group AG, Marinomed Biotech, Agrana, CA Immo, EVN, Zumtobel, Dow Jones, Amazon.

Random Partner

AT&S

Austria Technologie & Systemtechnik AG (AT&S) ist europäischer Marktführer und weltweit einer der führenden Hersteller von Leiterplatten und IC-Substraten. Mit 9.526 Mitarbeitern entwickelt und produziert AT&S an sechs Produktionsstandorten in Österreich, Indien, China und Korea und ist mit einem Vertriebsnetzwerk in Europa, Asien und Nordamerika präsent. (Stand 06/17)

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- 21st Austria weekly - (07/02/2026)

- Palfinger und voestalpine vs. RHI und Andritz – k...

- Zurich Insurance und Allianz vs. VIG und Uniqa – ...

- BT Group und Deutsche Telekom vs. Drillisch und T...

- Salzgitter und voestalpine vs. ThyssenKrupp und A...

- Puma und Callaway Golf vs. World Wrestling Entert...

Featured Partner Video

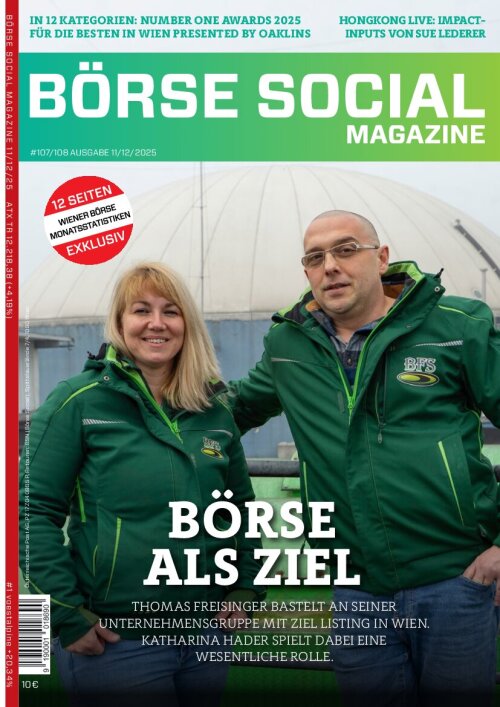

Börsepeople im Podcast S23/09: Helmut Anninger

Helmut Anninger ist Managing Partner bei Oaklins Austria, unserem Partner bei den Number One Awards. Helmut kommt aus einer Unternehmerfamilie und startete bei der KPMG Alpentreuhand, nach einer Ze...

Books josefchladek.com

Schtetl Zürich

2001

Offizin Verlag

Köpfe des Alltags

1931

Hermann Reckendorf

ABC Diary

2025

Self published

Ludwig Kozma

Ludwig Kozma Anna Fabricius

Anna Fabricius Sasha & Cami Stone

Sasha & Cami Stone Man Ray

Man Ray Livio Piatti

Livio Piatti Jeff Mermelstein

Jeff Mermelstein Michael Rathmayr

Michael Rathmayr