ANDRITZ GROUP: Results for the first quarter of 2020

ANDRITZ GROUP: Results for the first quarter of 2020

30.04.2020, 8576 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Quarterly Report

Graz - April 30, 2020. International technology group ANDRITZ saw mixed business development overall in the first quarter of 2020. While order intake at over 1.8 billion euros was higher than in the previous year's reference period, the operating result (EBITA) fell despite a slight increase in sales.

The key financial figures developed as follows:

* At 1,852.9 million euros (MEUR), order intake reached a favorable level and was 11.7% higher than the figure for the previous year's reference period (Q1 2019: 1,658.1 MEUR). This is largely attributable to the Pulp & Paper business area, which succeeded in booking a large order for a new pulp mill in South America during the reporting period. Order intake also increased in the Metals business area due to favorable development in the Metals Forming (Schuler) sector. Order intake declined in the Hydro business area, which faced continuing difficult market conditions.

* Order backlog as of March 31, 2020, amounted to 7,924.6 MEUR and has thus increased compared to the end of 2019 (December 31, 2019: 7,777.6 MEUR).

* Sales at 1,510.2 MEUR increased by 1.4% and were slightly higher than the previous year's reference period (Q1 2019: 1,489.2 MEUR). This is attributable to the Pulp & Paper business area, which was able to increase sales substantially compared to the previous year and thus overcompensated the decline in sales in the other business areas.

* Despite the small increase in sales, EBITA fell significantly compared to the previous year and amounted to 70.1 MEUR (-15.3% versus Q1 2019: 82.8 MEUR). As a result, the Group's profitability (EBITA margin) decreased to 4.6% (Q1 2019: 5.6%). While earnings in the Pulp & Paper business area increased compared to the previous year's reference period and profitability remained at an unchanged favorable level, EBITA declined considerably in the Metals and Hydro business areas. The Metals business area faced very difficult market conditions, both in Metals Forming and Metals Processing, during the reporting period. Metals Forming (Schuler), in particular, saw a significant decline in earnings as a result of the crisis in the international automotive industry and the related underutilization of capacities there. The reduction in capacity initiated in Germany at the end of last year will not be effective until the second half of 2020, with more impact to come in 2021.

* Due to lower planned depreciation of intangible assets, the EBIT increased slightly to 53.8 MEUR (Q1 2019: 52.9 MEUR).

* The financial result decreased to -9.5 MEUR (Q1 2019: -6.4 MEUR), mainly due to the valuation of securities and accounts in foreign currencies (FX) in the other financial result as of the reporting date.

* As a result, net income (without non-controlling interests) declined to 31.5 MEUR (Q1 2019: 33.6 MEUR).

* The gross liquid funds amounted to 1,543.1 MEUR at the end of March 2020. In addition, the ANDRITZ GROUP has surety lines totaling 5,902 MEUR at its disposal, of which around 2,977 MEUR are utilized. Thus, the ANDRITZ GROUP has a solid liquidity position.

OUTLOOK FOR 2020: GUIDANCE REMAINS SUSPENDED In view of the continuing difficult general economic conditions globally due to the Covid-19 pandemic and the lack of visibility concerning its further development, it is still not possible from today's perspective to provide reliable information on the expected development of the ANDRITZ GROUP's sales and earnings in 2020.

In reaction to the negative economic impact of the coronavirus crisis, ANDRITZ has launched immediate adjustment measures focusing on achieving cost savings in the short term and optimizing cost structures in the medium term.

Wolfgang Leitner, President and CEO of ANDRITZ AG: "Project visibility in the markets we serve is currently still very low. We are monitoring the situation closely and will take further steps in line with developments to keep the financial impact as low as possible and safeguard ANDRITZ's ability to compete."

KEY FINANCIAL FIGURES AT A GLANCE

_____________________________________________________________________________ |_________________________________________|Unit|Q1_2020|Q1_2019|+/-___|2019___| |Sales____________________________________|MEUR|1,510.2|1,489.2|+1.4%_|6,673.9| |-_Pulp_&_Paper___________________________|MEUR|713.3__|602.7__|+18.4%|2,869.5| |-_Metals_________________________________|MEUR|355.2__|387.8__|-8.4%_|1,636.9| |-_Hydro__________________________________|MEUR|298.2__|338.5__|-11.9%|1,470.7| |-_Separation_____________________________|MEUR|143.5__|160.2__|-10.4%|696.8__| |Order_intake_____________________________|MEUR|1,852.9|1,658.1|+11.7%|7,282.0| |-_Pulp_&_Paper___________________________|MEUR|1,078.2|806.9__|+33.6%|3,632.5| |-_Metals_________________________________|MEUR|361.5__|348.1__|+3.8%_|1,582.2| |-_Hydro__________________________________|MEUR|245.5__|313.9__|-21.8%|1,350.2| |-_Separation_____________________________|MEUR|167.7__|189.2__|-11.4%|717.1__| |Order_backlog_(as_of_end_of_period)______|MEUR|7,924.6|7,260.9|+9.1%_|7,777.6| |EBITDA___________________________________|MEUR|112.6__|126.5__|-11.0%|537.6__| |EBITDA_margin____________________________|%___|7.5____|8.5____|-_____|8.1____| |EBITA____________________________________|MEUR|70.1___|82.8___|-15.3%|343.2__| |EBITA_margin_____________________________|%___|4.6____|5.6____|-_____|5.1____| |Earnings_Before_Interest_and_Taxes_(EBIT)|MEUR|53.8___|52.9___|+1.7%_|237.9__| |Financial_result_________________________|MEUR|-9.5___|-6.4___|-48.4%|-57.0__| |Earnings_Before_Taxes_(EBT)______________|MEUR|44.3___|46.5___|-4.7%_|180.9__| |Net income |MEUR|31.5 |33.6 |-6.3% |127.8 | |(without_non-controlling_interests)______|____|_______|_______|______|_______| |Cash flow from |MEUR|56.9 |56.0 |+1.6% |821.6 | |operating_activities_____________________|____|_______|_______|______|_______| |Capital_expenditure______________________|MEUR|29.9___|25.4___|+17.7%|157.1__| |Employees (as of end of period; without |- |28,411 |29,398 |-3.4% |29,513 | |apprentices)_____________________________|____|_______|_______|______|_______|

All figures according to IFRS. Due to the utilization of automatic calculation programs, differences can arise in the addition of rounded totals and percentages. MEUR = million euros. EUR = euros.

- End -

PRESS RELEASE AVAILABLE FOR DOWNLOAD This press release is available for download at andritz.com/news.

ANDRITZ GROUP International technology group ANDRITZ offers a broad portfolio of innovative plants, equipment, systems and services for the pulp and paper industry, the hydropower sector, the metals processing and forming industry, solid/liquid separation in the municipal and industrial sectors, as well as animal feed and biomass pelleting. The global product and service portfolio is rounded off with plants for power generation, recycling, the production of nonwovens and panelboard, as well as automation and digital solutions offered under the brand name of Metris. The publicly listed group today has around 28,400 employees and more than 280 locations in over 40 countries.

ANNUAL AND FINANCIAL REPORTS Annual and Financial reports are available for download at the ANDRITZ web site andritz.com, and printed editions can be requested free of charge by e-mail to investors@andritz.com.

DISCLAIMER Certain statements contained in this press release constitute "forward-looking statements". These statements, which contain the words "believe," "intend," "expect," and words of a similar meaning, reflect the Executive Board's beliefs and expectations and are subject to risks and uncertainties that may cause actual results to differ materially. As a result, readers are cautioned not to place undue reliance on such forward-looking statements. The company disclaims any obligation to publicly announce the result of any revisions to the forward- looking statements made herein, except where it would be required to do so under applicable law.

end of announcement euro adhoc

issuer: Andritz AG Stattegger Straße 18 A-8045 Graz phone: +43 (0)316 6902-0 FAX: +43 (0)316 6902-415 mail: welcome@andritz.com WWW: www.andritz.com ISIN: AT0000730007 indexes: WBI, ATX stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2900/aom

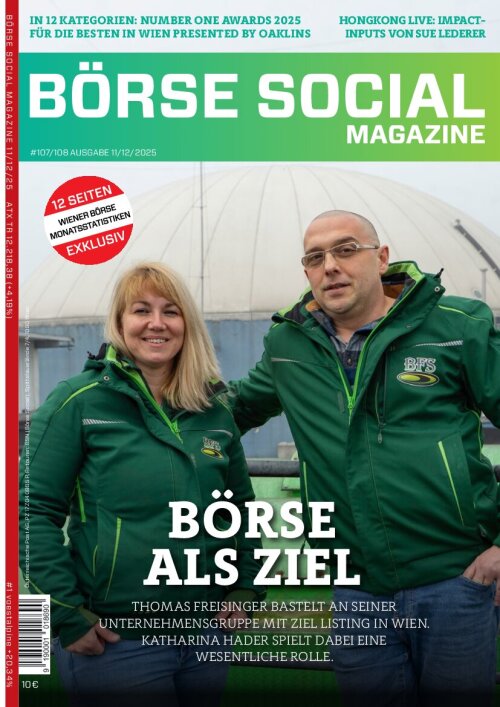

Private Investor Relations Podcast #23: Joachim Brunner zu IR quer über Kontinente, Sprachen, Aufsichten; als Bonus-Content 1x ATXPrime

Andritz

Uhrzeit: 18:38:41

Veränderung zu letztem SK: 0.24%

Letzter SK: 71.65 ( 0.42%)

Bildnachweis

Aktien auf dem Radar:Amag, Polytec Group, DO&CO, RHI Magnesita, Semperit, Austriacard Holdings AG, Rosgix, AT&S, Lenzing, voestalpine, BTV AG, Hutter & Schrantz Stahlbau, Pierer Mobility, Porr, SBO, VIG, Addiko Bank, Rosenbauer, BKS Bank Stamm, Oberbank AG Stamm, SW Umwelttechnik, Flughafen Wien, Österreichische Post, Verbund.

Random Partner

UBS

UBS bietet weltweit finanzielle Beratung und Lösungen für private, institutionelle und Firmenkunden als auch für private Kundinnen und Kunden in der Schweiz. UBS mit dem Hauptsitz in Zürich hat eine weltweite Präsenz in allen wichtigen Finanzmärkten.

>> Besuchen Sie 61 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wie Polytec Group, Pierer Mobility, BTV AG, Wolfo...

- Wie VIG, Porr, Lenzing, DO&CO, OMV und Wienerberg...

- Reploid: Vorstand Alain Parent übernimmt neue Fun...

- Österreich-Depots: Das Amag-Thema macht Freude (D...

- Börsegeschichte 15.1.: Extremes zu EVN (Börse Ges...

- Nachlese: Joe Brunner, Christian-Hendrik Knappe (...

Featured Partner Video

Private Investor Relations Podcast #22: Christian Schreckeis holt mit seinem OeBFA-Team einen internationalen IR-Award nach Österreich

Christian Schreckeis ist Abteilungsleiter Emissions- und Portfoliomanagement, Investor Relations & Bundeshaushalt bei der Österreichischen Bundesfinanzierungsagentur (OeBFA). Mit seinem Team hat er...

Books josefchladek.com

What if Jeff were a Butterfly?

2025

Void

Stahlrohrmöbel (Catalogue 1934)

1934

Selbstverlag

Das Neue Haus

1941

Verlag Dr. H. Girsberger & Cie

Il senso della presenza

2025

Self published

Os Americanos (first Brazilian edition)

2017

Instituto Moreira Salles

Wassili und Hans Luckhardt

Wassili und Hans Luckhardt Claudia Andujar

Claudia Andujar Niko Havranek

Niko Havranek Elizabeth Alderliesten

Elizabeth Alderliesten