21st Austria weekly - Strabag, OMV (21/09/2020)

27.09.2020, 3035 Zeichen

Strabag: The Austrian construction group Strabag has been awarded the contract by ÖBB-Infrastruktur AG for the rehabilitation and modernisation of the Karawanks Railway Tunnel. The 8 km long tube, which was built over 100 years ago, is currently on a two-track layout. To comply with modern safety standards and thereby extend the service life by a further 30 years, the tunnel is being rationalised to single track only. The contract value amounts to Euro 68.4 mn. Work is scheduled to last one year, including a nearly seven-month period of full closure. Futher the company announced, that MKAO Rasperia Trading Limited, Russian Federation, on 14 September 2020 informed and presented credible documentation that as of 4 September 2020 no Specially Designated National (SDN) holds a 50 % or greater interest in it. It is therefore no longer viewed as a so-called blocked entity under the US sanctions regime. Strabag will therefore pay to Rasperia the net dividends withheld to date for the 2017 and 2018 financial years, totalling Euro 53,722,500.00, against reciprocal and simultaneous transfer of the “value rights” (Wertrechte).

Strabag: weekly performance:

OMV: OMV, the integrated, international oil and gas company headquartered in Vienna, has reduced its Brent oil price planning assumptions. The long-term Brent oil price assumptions are now reduced to USD 60/bbl real, compared to USD 75/bbl applied before. For 2021, the company expects a continued macroeconomic impact of the COVID-19 pandemic and confirms its oil price forecast of USD 50/bbl. The oil price expectations for 2022 and 2023 are reduced to now USD 60/bbl from USD 70/bbl and USD 75/bbl, respectively. For the years 2024 to 2029, we assume a Brent oil price of USD 65/bbl (before USD 75/bbl), which is expected to gradually decline to USD 60/bbl until 2035. From 2035 onwards, we use a Brent oil price of USD 60/bbl. All assumptions for the years 2025 onwards are based on 2025 real terms. The updated price planning assumptions are expected to result in non-cash net impairments of around Euro 600 mn post-tax in the third quarter results, net of minor impairment reversals. The impairments in Upstream are approximately equally ascribed to tangible assets and write-offs of exploration intangibles.

“The revised oil price planning assumptions reflect our believe that the pace of transition to a lower carbon world will accelerate. Our strategy is clear: We will reposition our portfolio towards products, which are also essential in a widely decarbonized world. With this strategy, we are building on OMV’s proven concept of integration and make our company less vulnerable to the long-term oil price development. The recently announced acquisition of a controlling interest in Borealis, which extends OMV’s value chain towards high-value chemical products, is an important milestone for this ambition”, said Reinhard Florey, CFO of OMV.

OMV: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (21/09/2020)

Börsepeople im Podcast S23/20: Michael Hofbauer

Bildnachweis

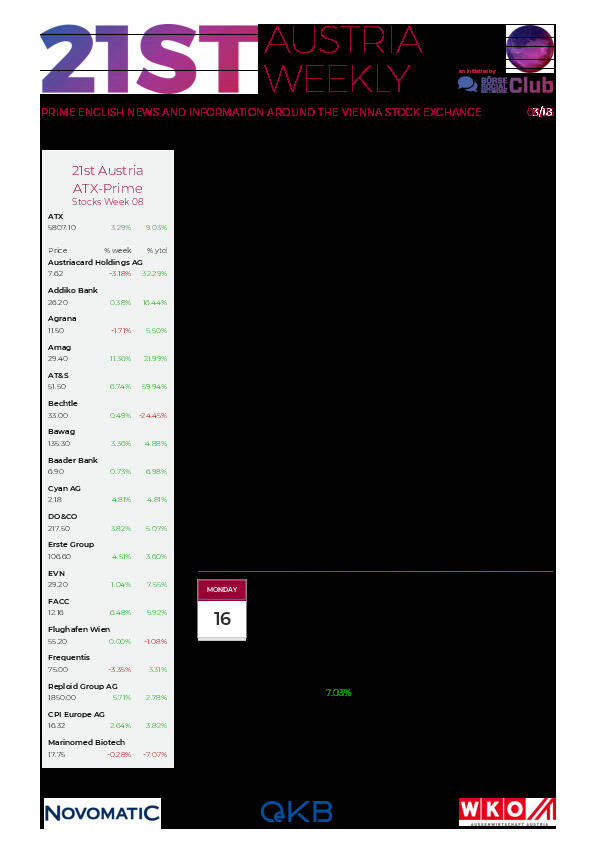

Aktien auf dem Radar:FACC, Amag, RHI Magnesita, Austriacard Holdings AG, Polytec Group, Kapsch TrafficCom, Rosgix, EuroTeleSites AG, Andritz, DO&CO, Mayr-Melnhof, Wienerberger, Telekom Austria, Frequentis, Marinomed Biotech, Rath AG, Wolford, BKS Bank Stamm, Oberbank AG Stamm, CA Immo, EVN, Flughafen Wien, CPI Europe AG, OMV, Bajaj Mobility AG, Österreichische Post, UBM, Verbund, Vonovia SE, Fresenius Medical Care, E.ON .

Random Partner

wienerberger

wienerberger ist einer der führenden Anbieter von innovativen, ökologischen Lösungen für die gesamte Gebäudehülle in den Bereichen Neubau und Renovierung sowie für Infrastruktur im Wasser- und Energiemanagement.

>> Besuchen Sie 53 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten