21st Austria weekly - Kapsch TrafficCom, Uniqa Insurance, Semperit, Do&Co (19/11/2020)

22.11.2020, 4047 Zeichen

Kapsch TrafficCom: Kapsch announced, that the new all-electronic tolling (AET) system developed for the New York State Thruway Authority (NYSTA) is now fully operational and in revenue service. After intensive testing and final configuration, the new system went live on November 14, 2020. All road users now pay their vehicle tolls on NYSTA-operated roads via automatic electronic toll collection (ETC). The New York State Thruway Authority now operates a completely cashless AET system. Vehicles can pay tolls while traveling at highway speeds below the new high-volume Kapsch gantries, or are tolled at NYSTA-operated entry and exit points that also use the ETC method. Remaining toll plaza infrastructure will eventually be removed. Sensors and lasers automatically determine vehicle class, which define the toll rate applied to each vehicle. Charges are billed to the driver's E-ZPass account if they have a transponder, or by mail to the vehicle's registered owner using license plate information.

Kapsch TrafficCom: weekly performance:

Uniqa Insurance Group: With premiums written of Euro 4,091.2 mn and earnings before taxes of Euro 213.8 mn, Uniqa has followed the first half of the year by successfully closing the third quarter of 2020 – in the middle of the Covid-19 crisis. EBT of Euro 159 mn was generated in the three months from July to September alone, making this quarter one of the most successful in the company’s history. Underwriting result nearly doubled. It increased by 99.0 per cent to Euro 124.9 mn in the first three quarters – showing how strong UNIQA’s core insurance business is. This is despite Uniqa having to pay out over Euro 70 mn in additional insurance benefits from January to September for business interruptions and cancelled events due to Covid-19.

Uniqa: weekly performance:

Semperit: In the first three quarters of 2020, the Semperit Group, an internationally-oriented group that develops, produces, and sells in more than 100 countries highly specialised rubber products for the industrial and medical sector, recorded a slight increase of 0.8% to Euro 657.2 mn compared with the same period of the previous year. The corona pandemic again had opposite effects on the Semperit Group's Industrial and Medical Sectors: in the Industrial Sector, revenue declined by 13.4%, while the Medical Sector recorded an increase of 27.5%. EBITDA almost doubled in the first three quarters from Euro 60.4 mn in 2019 to Euro 118.5 million in 2020. This is particularly due to the good result of the Medical Sector, which is based on the exceptional economic boom caused by the corona pandemic on the one hand and on the successful restructuring and transformation measures on the other. Semperit Group's EBITDA for the full year will range between Euro 200.0 and 225.0 mn and thus significantly exceed the previous year's figure. According to the company, he fundamental strategic decision of 28 January 2020, to which Semperit will focus on the industrial rubber business in the future and separate from the medical business, is still valid, regardless of the developments recently observed in the wake of the corona crisis. However, in view of the extremely positive earnings contributions and the high margins that are currently resulting from the exceptional economic situation, the Semperit Group will probably continue the medical business at least until mid-2021.

Semperit: weekly performance:

Do&Co: In the first half of the business year 2020/2021, which was characterised by the impact of the Covid-19 pandemic, the Catering group Do & Co recorded revenue in the amount of Euro 111.35 mn, representing a decrease of -78.1% or Euro -396.49 mn compared to the same period in the previous year. For the first half of the business year 2020/2021, the groups result after income tax was Euro -37.3 mn, resulting in a decrease of Euro -59.34 mn for the same period of the previous year.

DO&CO: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (19/11/2020)

Wiener Börse Party #1089: ATX nach Rücksetzer wieder etwas erholt; Verbund und Bawag (auch nach Ende Rückkaufprogramm) gesucht

Bildnachweis

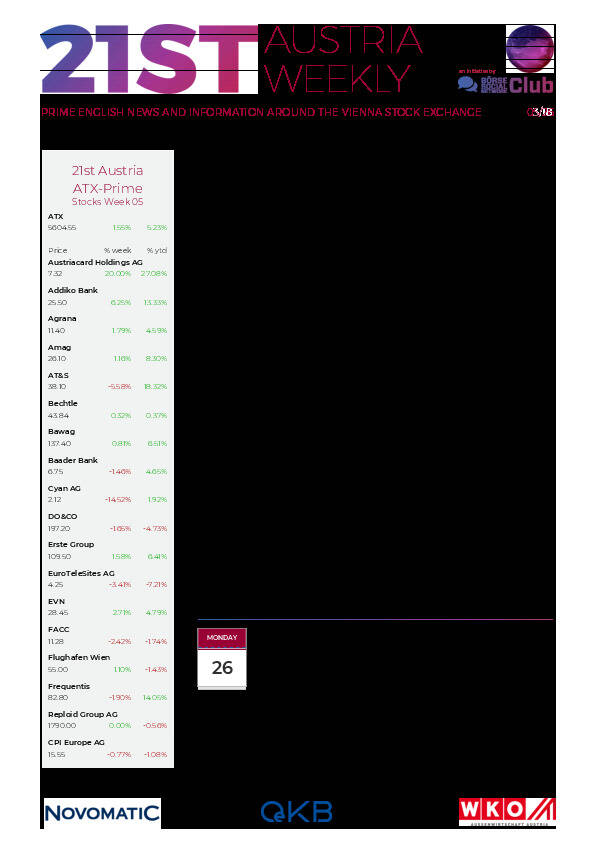

Aktien auf dem Radar:AT&S, Andritz, OMV, EuroTeleSites AG, Austriacard Holdings AG, Amag, Österreichische Post, Lenzing, CPI Europe AG, Telekom Austria, Semperit, Flughafen Wien, VIG, DO&CO, Gurktaler AG Stamm, Josef Manner & Comp. AG, Bajaj Mobility AG, Verbund, Warimpex, Addiko Bank, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Reploid Group AG, Marinomed Biotech, Agrana, CA Immo, EVN, Zumtobel, Dow Jones, Amazon.

Random Partner

Warimpex

Die Warimpex Finanz- und Beteiligungs AG ist eine Immobilienentwicklungs- und Investmentgesellschaft. Im Fokus der Geschäftsaktivitäten stehen der Betrieb und die Errichtung von Hotels in CEE. Darüber hinaus entwickelt Warimpex auch Bürohäuser und andere Immobilien.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten