21st Austria weekly - Andritz:, OMV, Amag, S Immo, Valneva (29/04/2021)

02.05.2021, 4202 Zeichen

Andritz: International technology group Andirzt has received an order from the EPC contractors McConnell Dowell and John Holland to supply the electro-mechanical equipment for the 250-MW Kidston pumped storage plant in North Queensland, Australia. Kidston will not only be Australia's first pumped storage plant for more than 40 years, but also one of the world's first to be co-located with a solar plant. The owner and developer of Kidston is Genex Power. Commissioning of the plant is expected in 2024. Further, Andritz showed solid business development in the first quarter of 2021 in spite of the overall unchanged and difficult economic environment. At over 1.7 bn euros, order intake reached a high level and the company's net income practically doubled despite a slight decline in revenue compared to the previous year's reference period. Revenue at Euro 1,493.2 mn was 1.1% lower than in the previous year's reference period. This is largely attributable to the Metals business area, where revenue declined due to the lower order intake in the past year. The earnings before interest and taxes (EBIT) increased to Euro 96.4 mn (Q1 2020: 53.8 mn), while the net income (without non-controlling interests) practically doubled compared to the previous year's reference period, reaching Euro 62.1 mn (Q1 2020: Euro 31.5 mn).

Andritz: weekly performance:

Amag: Aluminium producer Amag Group's revenue increased to Euro 251.2 mn in the current quarter due to solid shipment volumes and higher aluminium price (Q1 2020: Euro 246.4 mn). With a shipment volume of 98,500 tonnes in Q1 2021, the Amag Group was at a similar level compared to the same quarter of the previous year (Q1 2020: 99,600 tonnes), though 11,000 tonnes of primary aluminium were not recognised for the quarter as a result of the delayed departure of a transport ship. With depreciation and amortisation unchanged quarter-on-quarter at EUR -21.0 million, the Amag Group generated earnings before interest and taxes (EBIT) of Euro 9.3 mn (Q1 2020: Euro 15.5 mn). The net income after taxes was clearly positive again in the reporting quarter at Euro 5.1 mn after three quarters of short-time work (Q1 2020: Euro 11.5 mn).

Amag: weekly performance:

OMV: Austrian oil and gas company OMV reported Q1 figures. Consolidated sales revenues significantly increased by 35% to Euro 6,429 mn due to the additional revenues from the full consolidation of Borealis. The clean CCS Operating Result improved by 24% to Euro 870 mn.

OMV: weekly performance:

Valneva: Valneva SE, a specialty vaccine company focused on the development and commercialization of prophylactic vaccines for infectious diseases with significant unmet medical need, announced its intention to issue and sell, subject to market and other conditions, 7,082,762 of its ordinary shares in a global offering to specified categories of investors comprised of an initial public offering of American Depositary Shares, each representing two ordinary shares, in the United States and a concurrent private placement of ordinary shares in certain jurisdictions outside of the United States. The offering price per ADS in U.S. dollars and the corresponding offering price per ordinary share in euros, as well as the final number of ADSs and ordinary shares sold in the Global Offering, will be determined following a book building process commencing immediately.

Valneva: weekly performance:

S Immo: CEE real estate company S Immo AG is ramping up its development activities in CEE with a new office project in Budapest. An ensemble consisting of three state-of-the-art office buildings offering roughly 29,000 m² of usable space will be built on Vaci Ut, one of the most important office locations in the Hungarian capital. The most significant structure is an 11-storey building located directly on Vaci Ut. The company plans to obtain sustainability certification according to BREEAM and Well. Intense planning activities will be completed in 2021, and construction is scheduled to start in 2022. The project is expected to be completed in 2024.

S Immo: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (29/04/2021)

BörseGeschichte Podcast: Wolfgang Matejka vor 10 Jahren zum ATX-25er

Bildnachweis

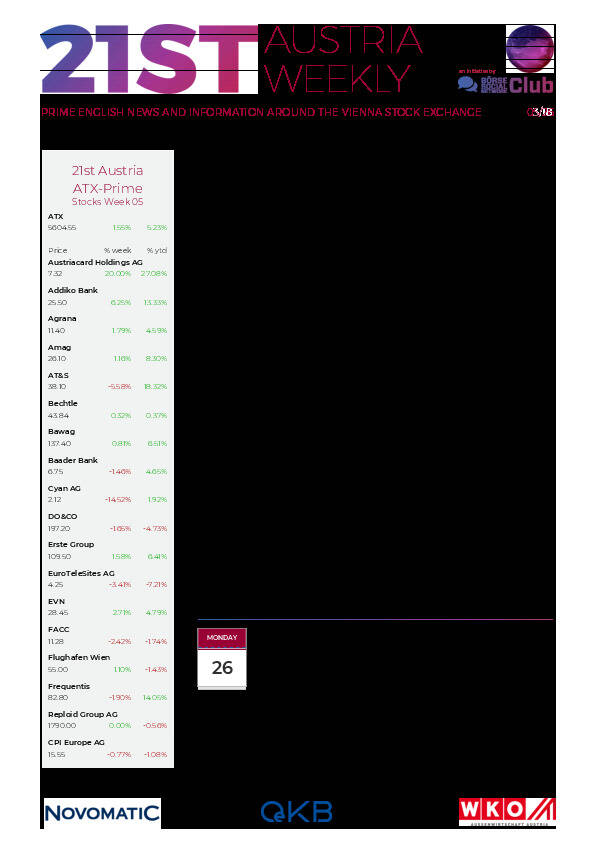

Aktien auf dem Radar:AT&S, Austriacard Holdings AG, OMV, Amag, Semperit, SBO, ATX, ATX Prime, ATX TR, ATX NTR, Palfinger, Wienerberger, Andritz, Mayr-Melnhof, Uniqa, Österreichische Post, DO&CO, Addiko Bank, Lenzing, Marinomed Biotech, Polytec Group, Stadlauer Malzfabrik AG, Telekom Austria, Wiener Privatbank, RHI Magnesita, BKS Bank Stamm, Oberbank AG Stamm, Agrana, CA Immo, EuroTeleSites AG, EVN.

Random Partner

Bechtle

Bechtle bietet Technologiekonzepte und umfassende IT-Lösungen für die digitale Transformation. Vom vollständigen IT-Arbeitsplatz über Datacenter und Multi-Cloud-Lösungen bis hin zu IT-Security und Künstliche Intelligenz entwickeln wir zukunftsfähige IT-Architekturen.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten