21st Austria weekly - Strabag, S&T, Valneva (05/05/2022)

08.05.2022, 4567 Zeichen

Strabag: Effective 1 January 2023, the publicly listed construction technology group Strabag will be led by a new CEO, as Klemens Haselsteiner succeeds Thomas Birtel, who will be stepping down as CEO after ten years at the helm upon reaching the specified age limit. Haselsteiner has been on the Management Board since 2020, where he set up and established the Digitalisation, Corporate Development and Innovation portfolio. Before that, he had worked for the group in Russia and in Germany, where he held a leading position in the Stuttgart subdivision, first as commercial business unit manager and later as subdivision manager. “Assuming corporate responsibility is part of my DNA, so to speak. Our company has a long-term outlook, so we must not only think about today or tomorrow, but also about the day after tomorrow. My vision is to create a resilient, sustainable and innovative Strabag,” says Klemens Haselsteiner.

Strabag: weekly performance:

S&T: The technology group S&T AG recorded a strong order intake of Euro 435 mn (PY: Euro 404 mn) in the first quarter 2022. The quarter ended successfully with largely organic revenue growth of 12.1% to Euro 329.7 mn. EBITDA increased by 4.3% to Euro 29.4 mn in the same period, while earnings per share rose by 12.5% to 18 cents (PY: 16 cents). Just like the global chip crisis, S&T was not able to fully escape the economic consequences of the Ukraine war and the associated sanctions against Russia. S&T generates around 6% of its revenues with its subsidiaries in Russia, Ukraine, Belarus and Moldova. End of March, S&T AG decided to withdraw as far as possible from these countries, a process which will be largely completed by the end of 2022. The expected costs for this have already been accrued. Hannes Niederhauser, CEO of S&T AG: "The financial year 2022 will be a year of transformation for us. With project "Focus", i.e. the sale of our IT Service Division, we are realising one of the most important strategic projects of the last 10 years and are thus setting the course for the further development and profitable growth of the Group. The sale process is proceeding according to plan and is expected to be signed in Q3. Currently, we are facing many challenges, yet we are optimistic for the financial year 2022. In the financial year 2021, we received new orders of around Euro 1,750 mn, and in the first quarter of 2022, this positive trend has continued with Euro 435 min. Despite ongoing supply chain issues and the loss of sales in Russia, we continue to expect organic revenue growth of around 12% to Euro 1,500 mn in 2022. We will replace the sold IT service revenues with IoT revenues in a timely manner and plan to increase revenues to Euro 2,000 mn by 2025 with a significantly increased EBITDA margin of 13%."

S&T: weekly performance:

Valneva: Valneva, a specialty vaccine company, today reported its first quarter financial results ending March 31. Valneva’s total revenues were Euro 21.8 mn in the first quarter of 2022 compared to Euro 23.2 mn in the first quarter of 2021, a decrease of 5.9%. In the first quarter of 2022, Valneva generated a net loss of Euro 26.0 mn compared to a net loss of Euro 27.7 mn in the first quarter of 2021. Peter Bühler, Valneva’s Chief Financial Officer, commented, “Valneva continued to achieve significant milestones in the first quarter of the year with the first approval and first sales of our COVID-19 vaccine, successful completion of the pivotal Phase 3 trial of our chikungunya vaccine candidate and further positive Phase 2 results for our Lyme disease vaccine candidate. More recently, receiving conditional approval from the UK MHRA is a great recognition for our inactivated COVID-19 vaccine and we are now focused on making it available to additional people in geographical Europe and other regions of the world. The first quarter was also marked by tangible signs of a travel industry recovery which has already started to positively impact our travel vaccine sales. I would like to take this opportunity to thank our shareholders, partners and employees for their ongoing support and contribution.”. The Company confirms it still expects its total 2022 revenues to be within the range announced in February (Euro 430 mn to Euro 590 mn). Considering the uncertainties on the timing of product deliveries, the distribution of total revenues by revenue category may differ from the figures announced in February.

Valneva: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (05/05/2022)

Wiener Börse Party #1099: Wiener Börse zum Februar-Verfall fester, aber mit kleiner Enttäuschung, positive Spannungsmomente bei der Porr

Bildnachweis

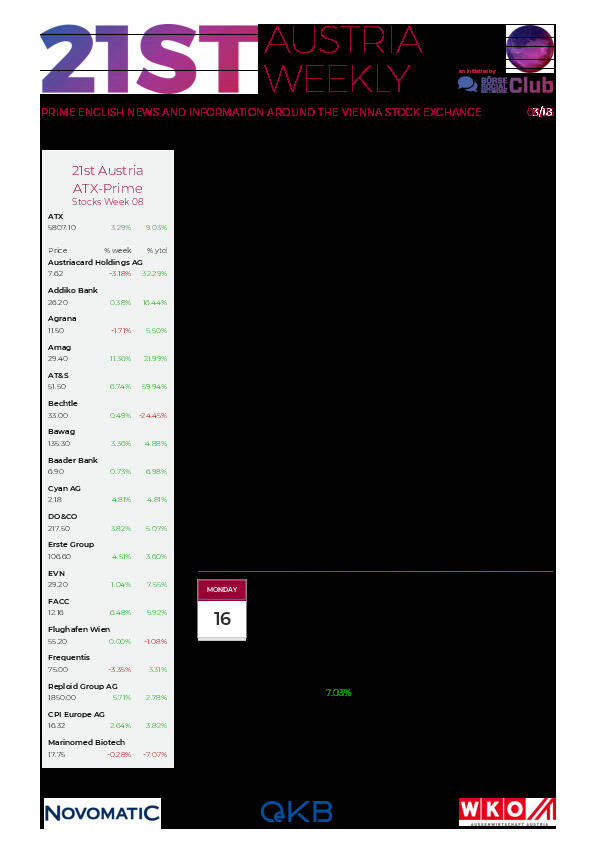

Aktien auf dem Radar:Kapsch TrafficCom, Strabag, Agrana, Bajaj Mobility AG, Addiko Bank, Austriacard Holdings AG, Amag, Rosgix, DO&CO, Porr, FACC, BKS Bank Stamm, Oberbank AG Stamm, Reploid Group AG, Josef Manner & Comp. AG, UBM, CA Immo, EuroTeleSites AG, EVN, Flughafen Wien, CPI Europe AG, OMV, Österreichische Post, Telekom Austria, Verbund, Fresenius Medical Care, Allianz, HeidelbergCement, Deutsche Post, Scout24, Bayer.

Random Partner

DenizBank AG

Die DenizBank AG wurde 1996 gegründet und ist eine österreichische Universalbank. Sie unterliegt dem österreichischen Bankwesengesetz und ist Mitglied bei der gesetzlichen einheitlichen Sicherungseinrichtung der Einlagensicherung AUSTRIA GmbH. Die DenizBank AG ist Teil der türkischen DenizBank Financial Services Group, die sich seit 2019 im Besitz der Emirates NBD Gruppe befindet.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten