21st Austria weekly - Lenzing, RBI, Kontron, voestalpine (03/11/2023)

05.11.2023, 4290 Zeichen

Lenzing: The anticipated recovery in markets relevant for the Lenzing Group, a leading global supplier of specialty fibers for the textile and nonwovens industries, has to date failed to materialize. Revenue in the first three quarters of 2023 decreased by 5.3 percent year-on-year to EUR 1.87 bn. This reduction was primarily due to lower fiber revenues, while pulp revenues were up. The net result after tax amounted to minus EUR 96.7 mn (compared with EUR 74.9 mn in the first three quarters of 2022), while earnings per share amounted to minus EUR 4.90 (compared with EUR 2.16 in the first three quarters of 2022). Building on this, the Managing Board is currently implementing a comprehensive performance program with the overriding objective of significantly enhanced long-term resilience to crises and greater agility in the face of market changes. In addition to the positive effects on sales, the Managing Board expects annual cost savings of more than EUR 100 mn, of which approx. 50 percent will be effective from the coming financial year.

Lenzing: weekly performance:

RBI: Raiffeisen Bank International (RBI) achieved a consolidated profit of 2.114 billion euros in the first three quarters of 2023. Core revenues (net interest income as well as net fee and commission income) without the Russian and Belarussian business rose by 20 per cent year-on-year. "We are very satisfied with the first three quarters. The good earnings development persisted in the third quarter. At the same time, the reduction of our Russian business continues to make good progress," said RBI CEO Johann Strobl. In the reporting period, impairment losses on financial assets were significantly lower at 251 million euros than in the comparable period of 721 million euros. Impairment losses in Eastern Europe continued to dominate due to the ongoing Russian war of aggression in Ukraine. Risk costs in Eastern Europe totaled 225 million euros compared to 569 million euros in the previous-year period. 147 million euros (previous-year period: 299 million euros) related to Russia and 74 million euros (previous-year period: 247 million euros) to Ukraine.

RBI: weekly performance:

Kontron: In the first nine months, revenue of Iot company Kontron increased by a total of 14.0% to EUR 860.9 million compared to the same period of the previous year (1-9M 2022: EUR 755.0 million). The gross margin improved from 36.2% in the same period to 39.6% in the first nine months of 2023. EBITDA jumped by 39.9% to EUR 95.9 million (1-9M 2022: EUR 68.5 million), which corresponds to an EBITDA margin of 11.1%. Consolidated net income attributable to Kontron shareholders from continuing operations for the first nine months of 2023 amounted to EUR 52.8 million compared to EUR 24.3 million in the same period of 2022. Earnings per share (undiluted, including discontinued operations) increased significantly to 86 cents in the past nine-month period (1-9M 2022: 51 cents). Hannes Niederhauser, CEO of Kontron AG: “The strategic realignment of the new Kontron with its own technologies is a resounding success. Despite fears of recession, we recorded continuous growth in order intake in Q3 2023, which increased the order backlog to EUR 1,655 million. That is EUR 195 million more than at the beginning of the year. This means that all planned revenues and growth for 2024 are essentially already covered. With our new high security operating system KOS and solutions in the area of artificial intelligence (AI), growth will accelerate even further. Based on this very positive development, we are raising our outlook for net income for 2023 for the second time from EUR >66 million to EUR >72 million. This represents an increase of more than 30% compared to the previous year.”

Kontron: weekly performance:

voestalpine: The Supervisory Board of voestalpine AG appointed Gerald Mayer (currently CEO of AMAG) to its Management Board. He will take over as CFO from April 1, 2024. His term of office is three years, as with all initial appointments. Gerald Mayer replaces Robert Ottel who has not extended his mandate and will leave voestalpine AG at the end of March 2024.

voestalpine: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (03/11/2023)

Wiener Börse Party #1102: ATX deutlich erholt, heute FACC-Day an der Wiener Börse, spannende News bei cyan, Aufschlag Erich Hampel

Bildnachweis

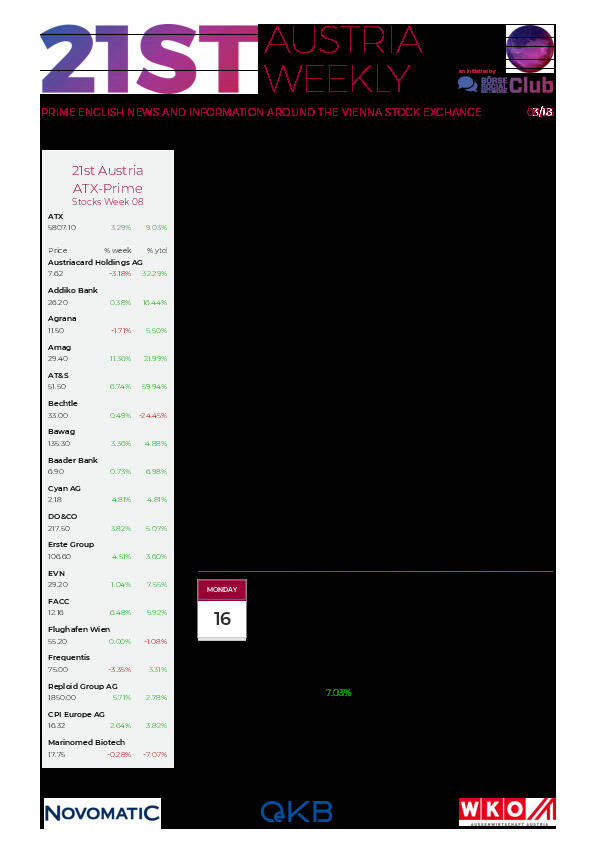

Aktien auf dem Radar:FACC, Amag, Strabag, Austriacard Holdings AG, Polytec Group, Flughafen Wien, Rosgix, EuroTeleSites AG, Wienerberger, Telekom Austria, AT&S, Hutter & Schrantz Stahlbau, SBO, RHI Magnesita, BKS Bank Stamm, Oberbank AG Stamm, Athos Immobilien, CA Immo, EVN, CPI Europe AG, OMV, Bajaj Mobility AG, Österreichische Post, UBM, Verbund.

Random Partner

Deutsche Börse

Als internationale Börsenorganisation und innovativer Marktinfrastrukturanbieter sorgt die Deutsche Börse Group für faire, transparente, verlässliche und stabile Kapitalmärkte. Mit ihren Produkten, Dienstleistungen und Technologien schafft sie Sicherheit und Effizienz für eine zukunftsfähige Wirtschaft.

>> Besuchen Sie 53 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten