21st Austria weekly - Agrana (10/10/2024)

13.10.2024, 1728 Zeichen

Agrana: In the first half of the 2024|25 financial year, AGRANA, the fruit, starch and sugar company, registered a significant year-on-year decrease of 49.0% in operating profit (EBIT) to € 56.6 million. The Group’s revenue eased by 5.0% to € 1,861.7 million (H1 prior year: € 1,959.5 million). The reduction in EBIT and revenue resulted from a decline in sales prices for sugar and lower margins on starch and saccharification products compared to the year before. The Fruit segment, on the other hand, delivered a very satisfactory performance, with EBIT significantly above that of the previous year. In the sugar market, the coming months will remain very challenging. Strong initial harvest forecasts in Europe, coupled with substantially risen imports from Ukraine, have in the past months led to elevated supply, which in combination with flat demand has significantly driven down sugar prices. “The currently very adverse market situation will have a negative impact on the earnings of the AGRANA Group for the 2024|25 financial year. Although our diversified business model acts as a buffer against economic swings, we continue to work at full speed on our Next Level strategy in order to reduce our exposure to market volatility and increase our baseline profitability. We have already initiated measures to this end, including a comprehensive cost reduction programme both at the holding company and segment level. In the volatile commodity markets where we operate, cost leadership is crucial. On this front we intend to fully leverage our existing potential,” says AGRANA CEO Stephan Büttner.

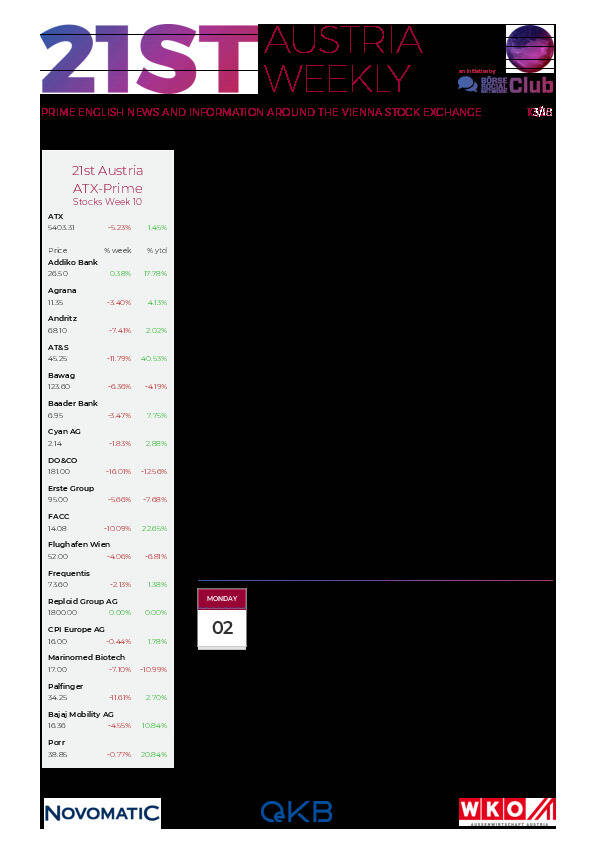

Agrana: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (10/10/2024)

D&D Research Rendezvous #20: Gunter Deuber sieht Europas Sonderkonjunktur nun at risk - intensiver Blick auf die Aktienmärkte

Bildnachweis

Aktien auf dem Radar:FACC, RHI Magnesita, Amag, Agrana, Austriacard Holdings AG, Kapsch TrafficCom, Wolford, UBM, AT&S, DO&CO, Rath AG, RBI, Verbund, Wienerberger, Warimpex, Zumtobel, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Flughafen Wien, CA Immo, EuroTeleSites AG, CPI Europe AG, Österreichische Post, Telekom Austria, Infineon, Deutsche Boerse, Fresenius Medical Care, SAP, Scout24, Continental.

Random Partner

Buwog

Die Buwog Group ist deutsch-österreichischer Komplettanbieter im Wohnimmobilienbereich. Insgesamt verfügt die Buwog Group über ein Portfolio mit rd. 51.000 Wohnungen. Mit einem Neubauvolumen von jährlich rund 700 Wohnungen im Großraum Wien ist die Buwog Group einer der aktivsten Wohnbauträger und Immobilienentwickler in Deutschland und Österreich.

>> Besuchen Sie 54 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten